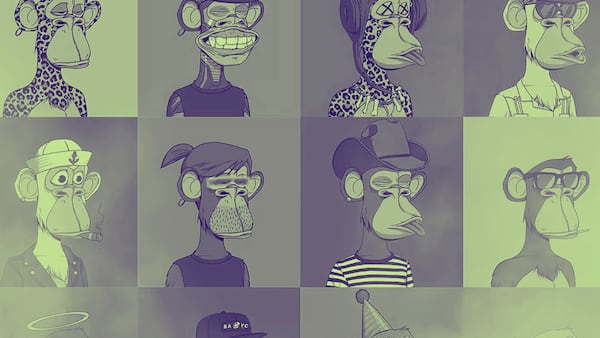

- Bored Ape Yacht Club NFTs are down 90% from their all-time highs.

- BAYC derivative collections have also suffered similar drawdowns.

The price of Bored Ape Yacht Club NFTs has slipped back to levels last seen at the dawn of the web3 boom three years ago.

Pieces of the NFT collection now trade hands for less than 10 ETH — around $33,000 — for the first time since August 2021.

That’s a 90% decline from their all-time high of $350,000 in May 2022.

The fall comes amid a devastating rout of the popular NFTs that rode a wave of market mania in 2021 and 2022.

Launched in April 2021, Bored Ape Yacht Club is a set of 10,000 Ethereum NFTs depicting cartoon ape characters. They were initially sold for 0.08 Ether each, or around $150.

By August that year, Bored Apes had climbed to 9.5 Ether each, or $20,000.

The collection’s creator, Yuga Labs, expanded the franchise with two derivative collections, Mutant Ape Yacht Club and Bored Ape Kennel Club.

These collections have also suffered and are down 95% and 97% from their all-time highs respectively.

No demand

At its May 2022 peak, the Bored Ape franchise looked invincible.

Yuga Labs had just conducted its Otherside NFT mint, selling 55,000 so-called land NFTs for its planned metaverse for $561 million, the biggest NFT sale ever.

But in the months that followed Yuga Labs floundered.

Development for Otherside chugged along, but the once-feverish appetite for the metaverse disappeared.

In 2023, Yuga Labs released Dookey Dash — an endless runner style game much like Temple Run — but only for NFT holders. While this kept Bored Ape fans temporarily engaged it wasn’t enough.

At the same time, NFT marketplace Blur greased the wheels on NFT trading by offering token incentives to traders. Many Bored Ape fans blamed Blur for falling NFT prices because the token rewards incentivised traders to sell their NFTs at a loss.

Even as the crypto market rallied in 2024 on the back of spot Bitcoin exchange-traded fund approvals, most NFTs — Bored Apes included — failed to regain their lost ground.

In April, Yuga Labs CEO Greg Solano announced a round of layoffs, telling staff at the company that the Bored Apes Yacht Club collection had “lost its way” and was struggling under “labyrinthine corporate processes.”

An NFT bear market

Bored Ape Yacht Club’s poor performance is part of a broader NFT bear market.

At the height of the NFT bull market, Bitwise, an asset manager, launched a Blue-Chip NFT Index Fund that included Bored Apes, CryptoPunks, as well as several other high-value NFTs.

The fund has registered a 74% loss since its inception in December 2021.

Despite this, there are pockets of strength within the NFT market.

Milady Maker, a popular NFT collection launched in August 2021, trades close to its all-time high.

Tim Craig is a DeFi Correspondent at DL News. Got a tip? Email him at tim@dlnews.com.