- Demand for Grayscale Investments' Chainlink Trust has pushed its premium to an all-time high.

- There are several reasons why its difficult for traders to arbitrage the price gap.

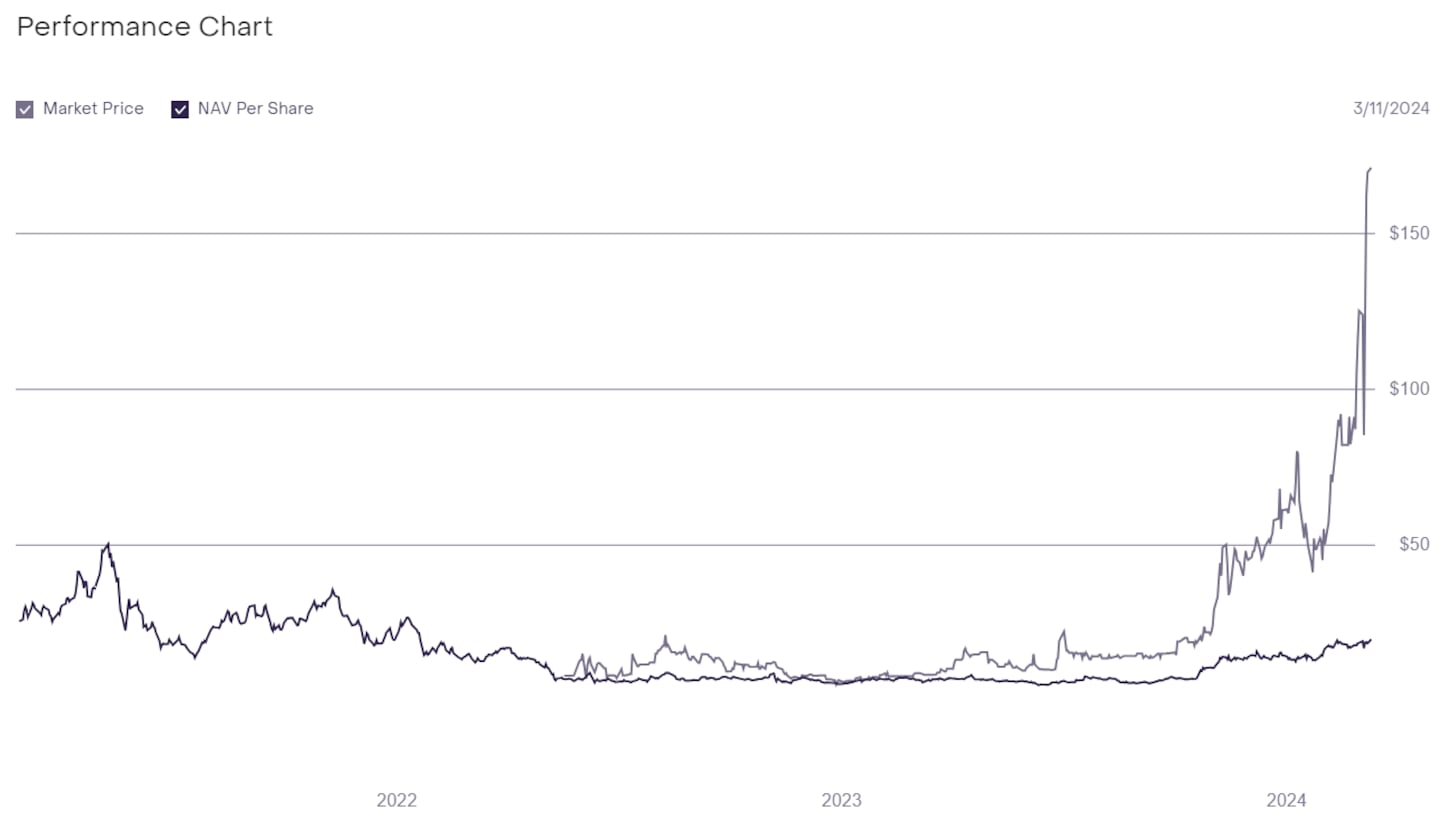

Shares of Grayscale Investments’ Chainlink Trust are trading at their highest premium ever amid an institutional crypto land grab fueled by the approval of 11 Bitcoin spot exchange-traded funds in January.

On March 11, shares of the Chainlink Trust, which each represent a little over 0.92 of a LINK token, traded at a market price of $170.99. That’s a more than 700% premium based on LINK’s $20.54 price on crypto exchanges.

Chainlink Trust launched in May 2022 and has historically traded at a premium over the LINK token. Institutional investors, who often cannot hold cryptocurrency directly because of regulatory constraints, can buy products like the Chainlink Trust to gain exposure to crypto assets beyond Bitcoin.

But quirks in how Grayscale’s trust products work have made big price discrepancies common. Grayscale’s Solana Trust, which lets investors gain exposure to the SOL token, recently traded at a 39% premium over the spot price of SOL.

Chainlink is a decentralised oracle network built on the Ethereum blockchain. It lets DeFi protocols access offchain data, such as the prices of different crypto assets. The LINK token serves as currency to pay Chainlink network operators for retrieving and preparing offchain data and performing computations.

The Chainlink Trust holds $8.4 million worth of LINK and charges 2.50% management fee annually.

Trading, redemption and arbitrage

Grayscale’s trust products cannot be created and redeemed for their underlying assets the way exchange-traded funds can.

This means that excess surplus or demand for trust shares can cause them to trade much higher or lower than the assets they represent, as there is no immediate way to try to take advantage of, or arbitrage, the price difference.

In December 2022, Grayscale’s Bitcoin Trust traded at a 48% discount to spot Bitcoin as the crypto industry reeled from the collapse of the FTX exchange.

Additionally, those who lock up tokens to create shares in Grayscale’s trusts are prevented from immediately selling their new shares on the market, further contributing to price premiums.

In the case of the Chainlink Trust, those who create new shares must wait 12 months before they can sell them.

Investors can arbitrage the price difference by creating new shares and waiting 12 months to sell them at the elevated price.

Doing so is risky, however, because there’s no guarantee of what the price will be in 12 months.

An ETF conversion?

The other way the price gap can be eliminated is by converting the trust to an ETF, allowing redemption of trust shares for their underlying assets.

In January, Grayscale’s application to convert its Bitcoin trust to a spot Bitcoin ETF was approved along with 10 other spot Bitcoin ETFs.

For other crypto assets that Grayscale has created trust products for, an ETF conversion looks much less likely.

Bloomberg Intelligence analysts Eric Balchunas and James Seyffart recently revised their approval odds for an Ethereum ETF from 70% down to 35%.

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out with tips at tim@dlnews.com.