- AI-linked crypto projects are on a tear.

- But who are the winners from investors’ $750 million splurge in 2024?

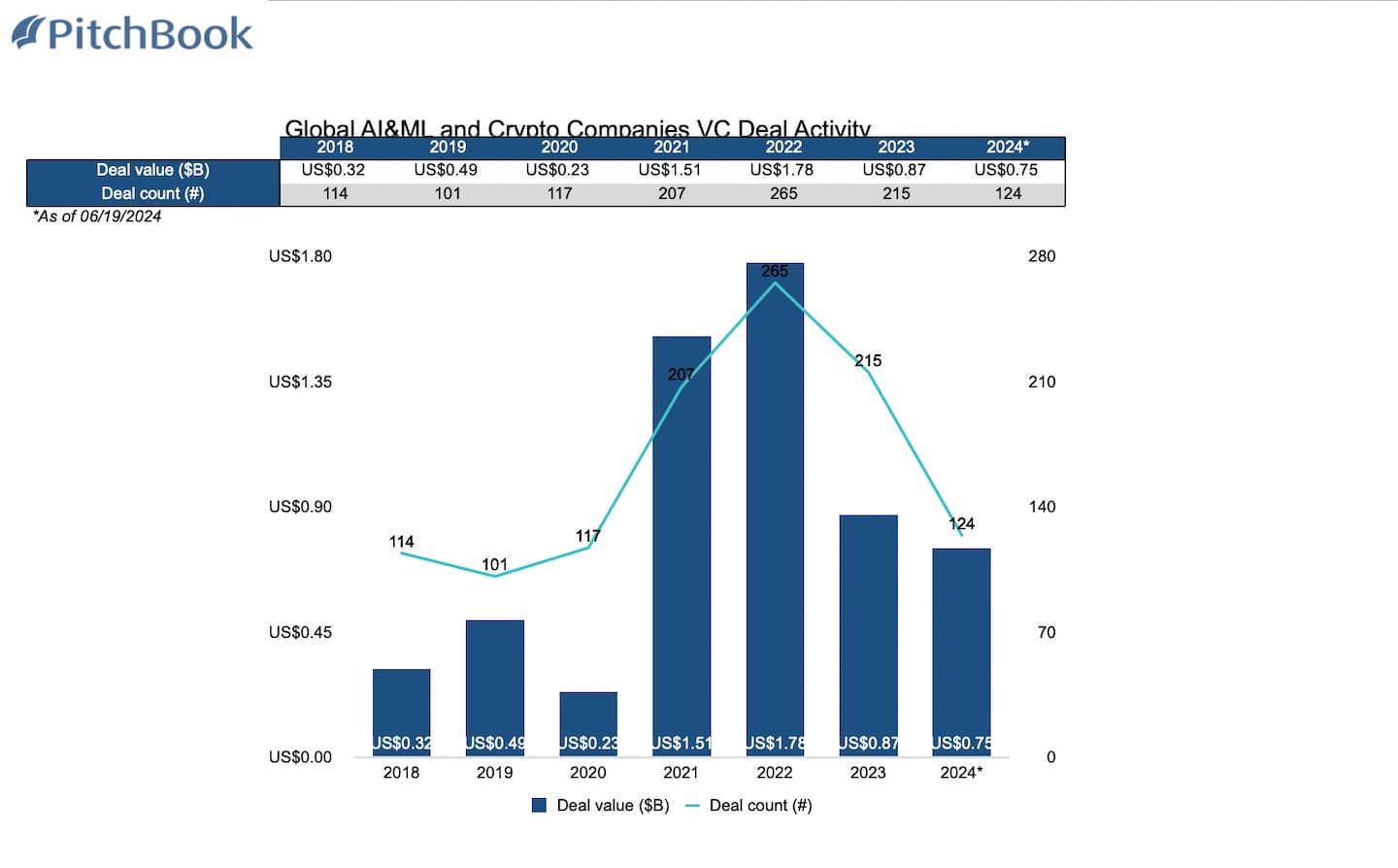

Investors poured $750 million into artificial intelligence-linked crypto projects this year, according to PitchBook.

While that’s still some ways to the $1.78 billion injected into the industry in 2022, investors say the sector is rebounding.

“There will be a tonne of AI and crypto opportunities,” said Cosmo Jiang, portfolio manager at hedge fund Pantera Capital, which will invest north of $200 million into the intersection of AI and blockchain until 2030.

The buzz around AI and crypto is palpable and for good reason: Researchers estimate that the combo will add $20 trillion to the global economy by 2030.

AI-linked stocks like chipmaker Nvidia are on a tear, enabling the total value of AI tokens to catapult to $27.6 billion.

At the same time, market watchers expect raises and acquisitions in the overall crypto industryto grow this year.

Investments are a great litmus test for where investors expect the market to go next.

Here are the biggest AI-crypto winners.

Exohood Labs

Raised: $112 million

Description: Developer of an AI-based blockchain

Investors: Livsquare Capital

Auradine

Raised: $80 million

Description: Developer of a web infrastructure platform intended to offer a broad range of infrastructure across hardware, software, and AI.

Investors: Celesta Capital, Marathon Digital Holdings, Maverick Capital, Mayfield Fund, MVP Ventures, StepStone Group, and Top Tier Capital Partners.

Zama

Raised: $73 million

Description: Developer of an open-source framework designed to help companies protect their users’ privacy.

Investors: Anatoly Yakovenko, Blockchange Ventures, Gavin Wood, Juan Batiz-Benet, Metaplanet Holdings, Multicoin Capital, Protocol Labs, Stake Capital, and VSquared Ventures.

TradeAlgo

Raised: $41.77 million

Description: Operator of a market research platform designed to help investors with trading education, technology, and tools.

Investors: N/A.

Passes

Raised: $40 million

Description: Developer of a content creation platform designed to enhance the creator experience and increase their revenue.

Investors: Abstract Ventures, Alexandra Botez, BOND Capital (San Francisco), CapitalX, Crossbeam Venture Partners, Emma Grede, Jens Grede, Michael Ovitz, and Ramtin Naimi.

Eric Johansson is DL News’ News Editor. Got a tip? Email at eric@dlnews.com.