- In this week’s The Decentralised newsletter, we dig into why Aave’s GHO stablecoin is still trading below $1.

- We also look into Tether’s decision to up sticks from one of its OG blockchains, Omni.

A version of this story appeared in our The Decentralised newsletter. If you want to read this or our other newsletters before your friends do, don’t hesitate to sign up.

Hey everyone, Tim here.

Welcome back to another edition of The Decentralised, recapping the past week’s DeFi buzz and previewing our watchlist for the upcoming week.

First up, Aleks Gilbert investigated why Aave’s GHO stablecoin has been unable to hold its targeted dollar peg since launching in July. Researchers Aleks spoke with attributed the discount to insufficient demand for the stablecoin and the absence of a redemption mechanism, which would allow holders to exchange GHO for $1 in crypto.

This redemption mechanism is essential for similar stablecoins — such as Maker’s DAI — to maintain their dollar pegs. While Aave Companies, the firm behind the Aave protocol, is working on introducing its own so-called GHO Stability Mechanism to allow holders to swap GHO for $1 worth of other stablecoins, such an update is likely still months away.

In the meantime, holders will have to get used to the fact that GHO isn’t as stable as they initially thought — it currently trades at around $0.97.

Check out Aleks’ full story with quotes from Aave DAO delegates here.

Staying on the theme of stablecoins, Osato Avan-Nomayo reported on Tether’s decision last week to discontinue its USDT stablecoin on the Omni, Kusama, and Bitcoin Cash SLP networks.

According to Tether, users weren’t using these networks enough to make maintaining a presence viable. But, as Osato pointed out, Omni, a meta-layer built on top of Bitcoin all the way back in 2013, was one of the first places blockchain users could trade USDT, so discontinuing the stablecoin there feels like the end of an era.

If you’ve got USDT on one of the discontinued networks, don’t worry — holders have a year to move their funds to centralised exchanges or other supported networks.

Read Osato’s full article and learn more about Tether’s long history here.

In addition to Tether, Osato also explored a new update for Unibot, currently the biggest Telegram bot on the market. Telegram bots help simplify interactions with decentralised exchanges by letting users make transactions via the popular messaging service. Bots like Unibot optimize the on-chain trading experience by defending against MEV bots and helping users copy successful traders.

However, these optimizations potentially come at a cost: more security risk. To use bots like Unibot, users must store their private keys — password-like codes which allow access to crypto wallets — directly on Telegram, something which critics say poses a serious security risk.

In an effort to bolster security, Unibot introduced Unibot Cloud — a new programme that shifts users’ private keys off Telegram and delivers them as self-destructing messages only the user can decipher.

Find out what security experts think about Unibot Cloud, and whether it really does improve security, by reading Osato’s full piece here.

Data of the week

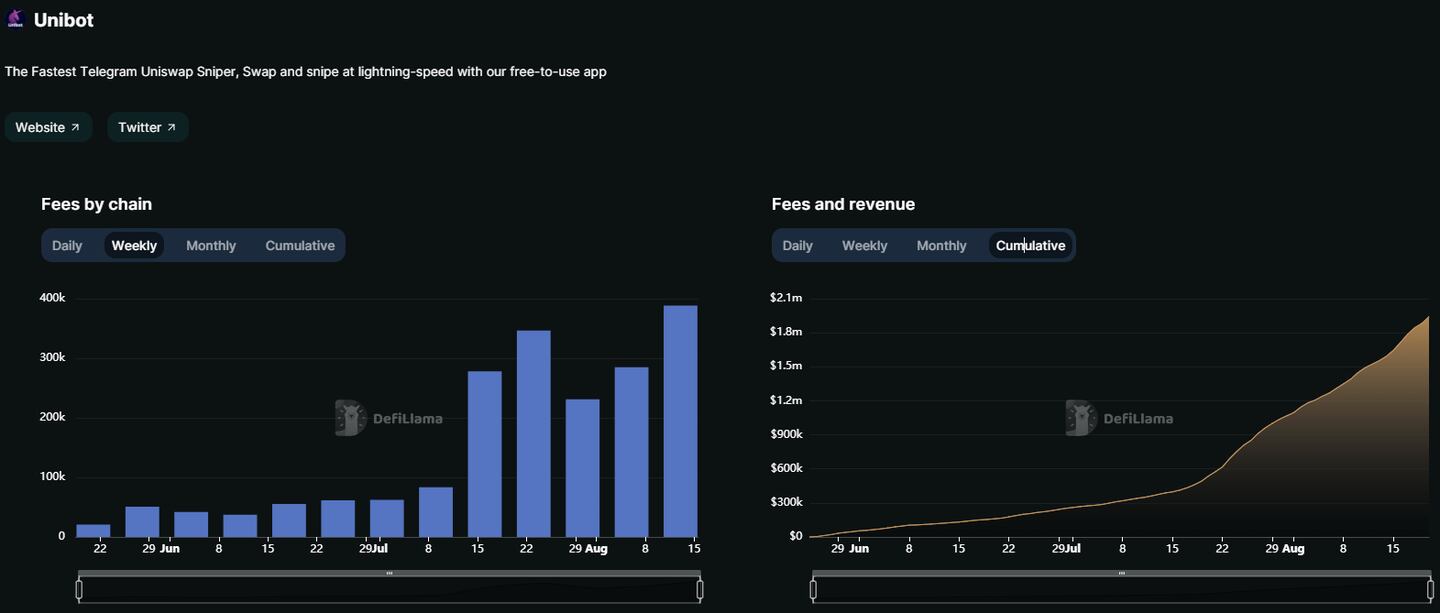

Telegram trading bots are big business. Over the past seven days, Unibot registered its all-time highest weekly fees charged to users, bringing in over $388,000.

Since its June launch, Unibot has generated almost $2 million in combined fees and revenue. And according to data from CoinGecko, the entire Telegram bot market is currently valued at over $242 million.

This week in DeFi governance

PROPOSAL: Rune Christensen wants to walk back Maker’s Enhanced Dai Savings Rate

After advocating for upping the Dai Savings Rate to 8% at the start of the month, Maker co-founder Rune Christensen is back with another proposal, this time to lower the DSR from 8% to 5%. Christensen cites the “rapid success” of the 8% rate in drawing in capital, but now wants to lower the rate and make some minor modifications so the DSR is more sustainable in the long term.

PROPOSAL: Rocket Pool wants to rejig staking rewards

Valdorff from Rocket Pool’s Incentive Management Committee has proposed rebalancing the second-biggest staking protocol’s token emissions. The proposed changes aim to grow the rETH supply by incentivising more minipools.

PROPOSAL: Wintermute offers Yearn Finance a deal

Market maker Wintermute is offering to use 3 million CRV tokens to buy Yearn’s yCRV, supply liquidity, and then stake that position through Yearn. In return, Wintermute is asking for a loan of 350 YFI tokens to use in its market making services.

Tweet of the week

Pseudotheos captures how overwhelming being plugged into crypto social media can be with a meme referencing the classic Japanese anime Neon Genesis Evangelion. Over at DL News, we’re more interested in the fourth Bitcoin halving than the fourth impact. IYKYK ;)

— pseudo 🇺🇦 (@pseudotheos) August 17, 2023

What we’re watching for next week

Friend Tech starting to pickup steam with people outside crypto twitter

— moon (@MoonOverlord) August 20, 2023

Pro gaming + OF + an NBA player among the top priced creators now pic.twitter.com/y6ZRBl6zgq

Friend.tech is the new hot thing on Crypto Twitter. It’s a DeFi protocol built on Coinbase’s Base layer 2 that lets Twitter/X personalities issue token shares in themselves.

Despite starting out as a crypto-centric platform, Friend.tech has also started attracting personalities from outside the space. However, it’s worth noting that social tokens like these are nothing new — BitClout tried this before but it, and its successor, diamond, are now widely regarded as dead.

We’re watching to see if Friend.tech is just another flash in the pan or something more.

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out to him with tips at tim@dlnews.com.

Disclosure: Tim holds over $1,000 worth of Ether, Swell staked Ether, Redacted Cartel, and GMX. He also holds an insignificant amount in NFTs.