A new decentralised exchange on Coinbase’s buzzy blockchain Base has attracted over $170 million worth of user deposits days after launch, outpacing DeFi favourites Compound and Uniswap.

The decentralised exchange, called Aerodrome Finance, says it aims to become “Base’s central liquidity hub.” It’s a fork — a copy of existing code, often with minor changes — of Velodrome, the top decentralised exchange on the Optimism blockchain.

But while Velodrome took months to reach the $170 million worth of deposits it has today, Aerodrome achieved the same feat in three days.

After launching on August 28, Aerodrome was slow to take off, attracting less than $5 million worth of liquidity in its first two days. However, over the past 24 hours deposits have surged to over $170 million.

Like other decentralised exchanges such as Uniswap, Aerodrome is permissionless, allowing anyone to create a liquidity pool — a smart contract of locked tokens for trading.

Aerodrome’s creators are pushing the exchange as a public good with the potential to become a valuable piece of blockchain infrastructure. Public goods in crypto refer to projects that strive to benefit the ecosystems they depend on, are accessible to everyone, and do not diminish when used by other people.

The hope is Aerodrome will attract enough liquidity to secure itself as the top decentralised exchange on Base, and become a place for users to easily trade between tokens at low cost.

But success is not guaranteed.

Solidly, the decentralised exchange on which Velodrome and Aerodrome is originally based, received harsh criticism upon launch after bugs in its code and problems with its token rewards system drove users and liquidity providers away.

Aerodrome says it has fixed Solidly’s pitfalls. And so far, it appears to be working.

Aerodrome’s success has pushed deposits to DeFi protocols on Base to over $330 million. Base is now the tenth-biggest blockchain and third-biggest Ethereum layer 2 behind Arbitrum and Optimism, according to DefiLlama data.

Liquidity flywheel

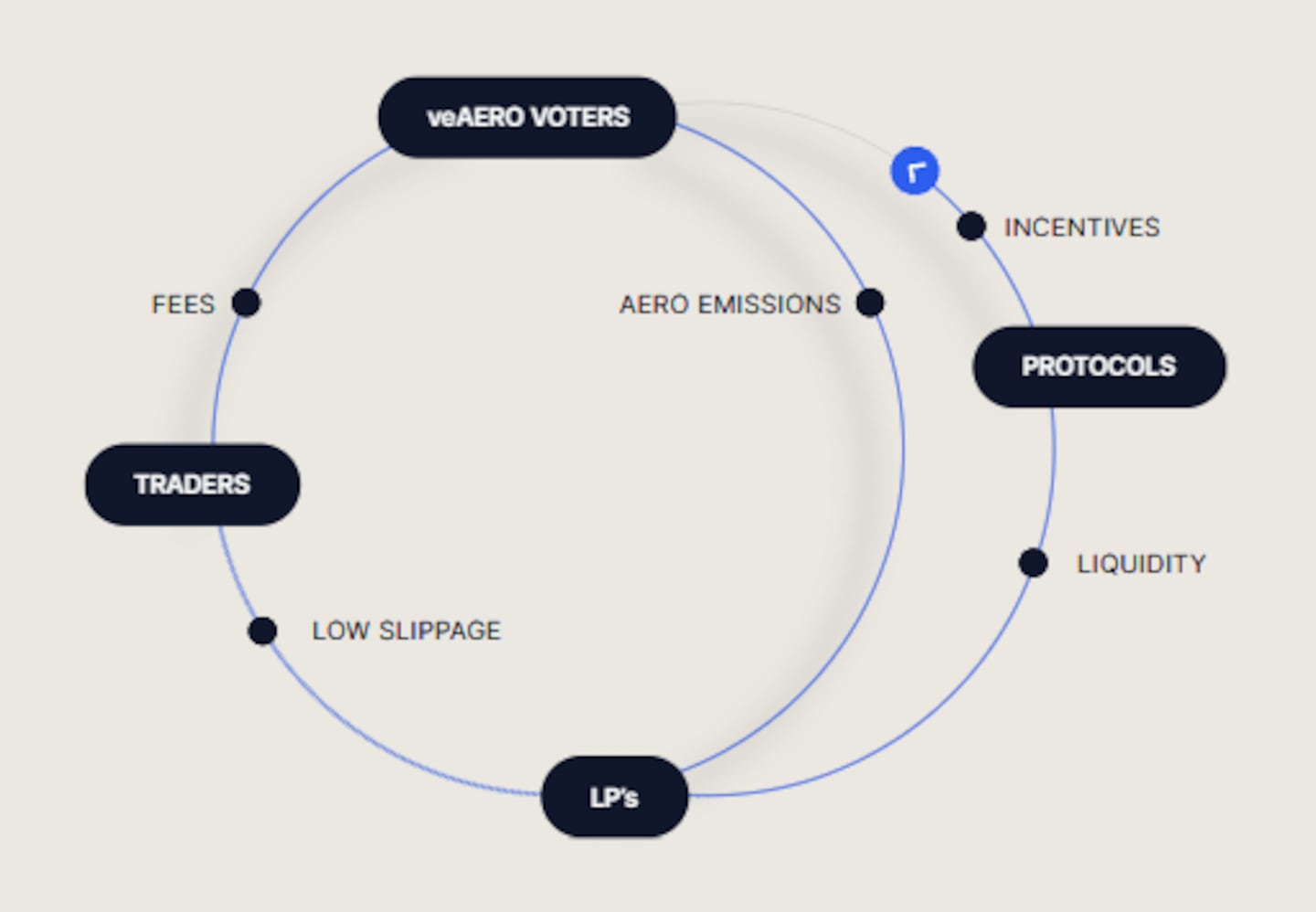

Successful exchanges need to attract liquidity so users can get better prices when swapping tokens. Aerodrome, like Velodrome and Solidly before it, uses popular DeFi mechanics pioneered by Curve Finance and OlympusDAO — veTokens and rebasing, respectively — to attract and maintain liquidity.

The protocol rewards liquidity providers with AERO token rewards, which are distributed to liquidity pools each week. These liquidity providers must also stake their deposited liquidity to receive the token rewards.

AERO holders can lock their tokens to vote on the distribution of rewards to the protocol’s liquidity pools. The longer a holder locks their tokens, the more voting power they receive, with a maximum lock period of four years.

Aerodrome also uses a rebasing mechanic first used by DeFi protocol OlympusDAO. Instead of distributing the lion’s share of AERO token rewards to those providing the most liquidity, those who lock up their tokens receive rewards proportional to their locked tokens.

That mechanism ensures that those who lock their AERO tokens always maintain the same proportion of all tokens in existence, i.e., their holdings do not get diluted by newly minted reward tokens.

This complex set of rules aims to create a liquidity flywheel — a mechanism that, once started, should continue to attract and maintain liquidity through carefully thought out incentives and the application of game theory principles.

The liquidity flywheel encourages liquidity providers to deposit liquidity to Aerodrome, and keep tokens locked in the protocol so they can receive the most token rewards.

Another win for Base

Aerodrome is not the first viral hit on Base to attract lots of outside capital.

Before the blockchain officially launched, memecoin traders piled over $40 million of capital to Base after an unknown individual launched a memecoin under the ticker $BALD. The $BALD creator later removed liquidity for the token, pulling the plug on the madness.

READ NOW: Why ruling in obscure Uniswap case is latest blow to Gary Gensler’s clampdown on cryptocurrencies

Then in August, Friend.tech, a platform that lets X, formerly Twitter, users issue and trade token shares in themselves, quickly rose to become the top protocol on Base. At its peak, Friend.tech users accounted for the majority of transactions on the blockchain and generated over $1.6 million in fees daily.

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out to him with tips at tim@dlnews.com.

Disclosure: Tim holds over $1,000 worth of Ether, Swell staked Ether, Redacted Cartel, and GMX. He also holds an insignificant amount in NFTs.