A version of this story appeared in our The Decentralised newsletter. Sign up here.

GM, Tim here,

Here’s what caught my DeFi-eye recently:

- Bitcoin purists have reported Ordinals to the US government

- LayerZero confirms it will launch a token

- Why does the market think Jito is worth so much?

Ordinals labelled vulnerability

An unknown person has reported the code that allows Bitcoin users to create unique inscriptions, or Ordinals, to the US government’s National Vulnerability Database.

Ordinals don’t cause any material harm or compromise Bitcoin’s security, so what’s the big deal?

According to Bitcoin core developer Luke Dashjr, whose X post was linked in the report, users inscribing data on the Bitcoin blockchain using the Ordinals protocol are exploiting an unintended vulnerability within the blockchain’s code.

PSA: “Inscriptions” are exploiting a vulnerability in #Bitcoin Core to spam the blockchain. Bitcoin Core has, since 2013, allowed users to set a limit on the size of extra data in transactions they relay or mine (`-datacarriersize`). By obfuscating their data as program code,…

— Luke Dashjr (@LukeDashjr) December 6, 2023

The extra data encoded within Ordinals means sending and receiving them takes up a lot more blockspace than conventional transactions.

Dashjr, and others who strictly adhere to Bitcoin’s creator Satoshi Nakamoto’s vision of Bitcoin solely as a peer-to-peer electronic cash system, don’t like people using this limited blockspace to trade JPEGs and memecoins.

However, many other Bitcoin users and developers view Ordinals as a positive innovation because it introduces new uses for the network beyond simple peer-to-peer payments.

The worry now is if enough Bitcoin stakeholders agree Ordinals constitute a vulnerability, they could break off and form their own version of the blockchain.

Such an event — known in crypto circles as a hard fork — is not unprecedented. Bitcoin has already undergone multiple hard forks in its history, creating the Bitcoin Cash and Bitcoin Satoshi Vision blockchains, among others.

LayerZero confirms token — and possible airdrop

After years of speculation, LayerZero has officially confirmed that it will launch a token.

LayerZero has always been built with the ability to have a native token within the protocol, as can be seen in the immutable code launched on day 1. We’ve heard the community discussion over the last few months and the lack of clear communication around this. We’ll state now in…

— LayerZero (@LayerZero_Core) December 7, 2023

According to the official X post from LayerZero Labs, the distribution of the token is something the firm is “committed to getting right,” and expects to launch the token in the first half of 2024.

While such wording likely means LayerZero wants to distribute tokens through an airdrop, it doesn’t explicitly say so.

The timing of the confirmation may not be a coincidence either.

With activity in the crypto market picking up, several projects have recently announced tokens and promised to airdrop them to early users. LayerZero probably realises the marketing power of airdropping tokens and doesn’t want to get forgotten.

What LayerZero’s token will be used for, though, is another question entirely. My bet is it will serve as the governance token for an upcoming LayerZero DAO.

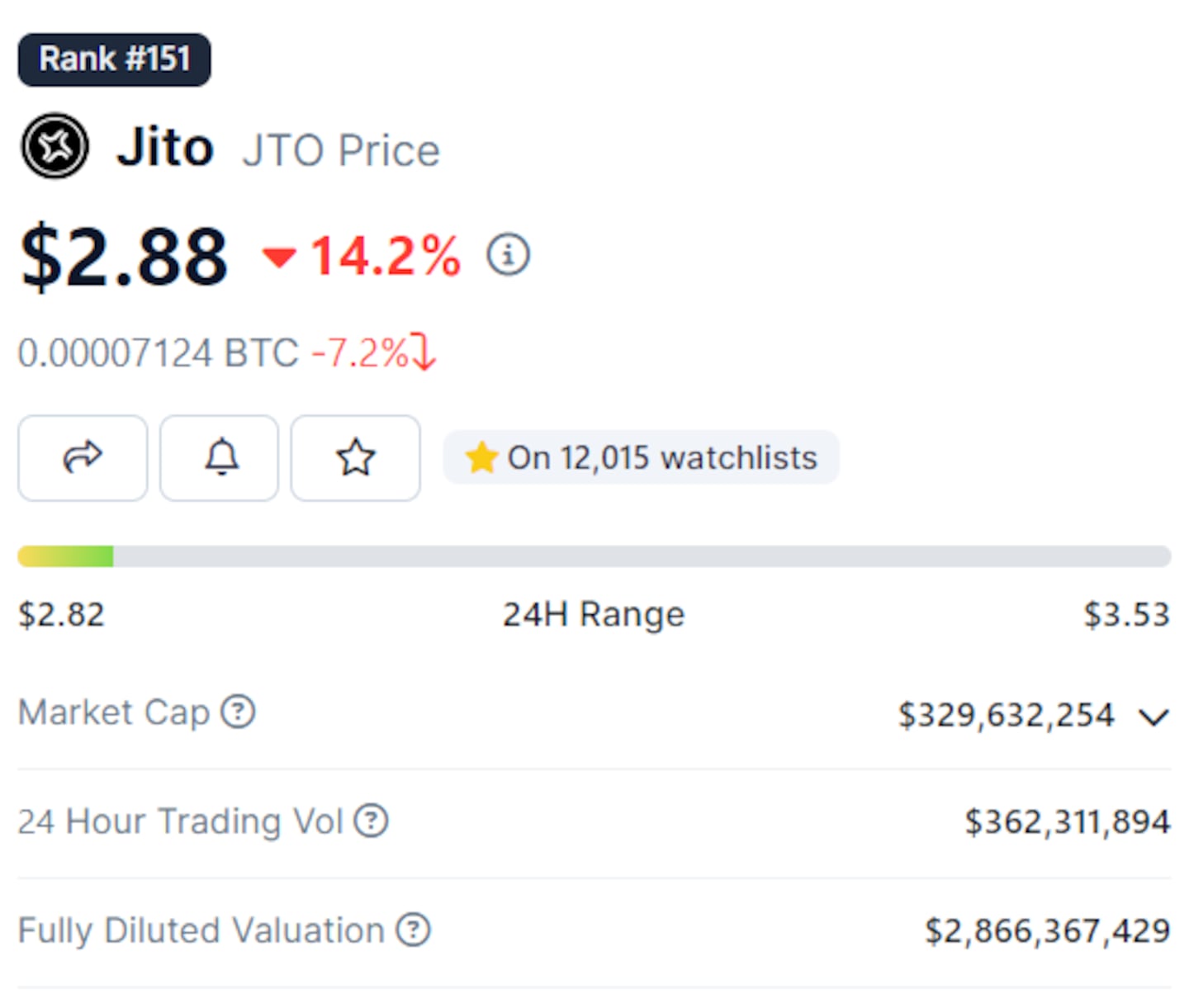

Jito’s bonkers valuation

Speaking of airdrops, Jito Labs just distributed 11.5% of its total token supply to around 10,000 addresses that interacted with the protocol before November 25.

The JTO token started trading on December 7 at around $1.50 and within days surged to hit an all-time high of $4.36.

At JTO’s current peak, those who received the smallest tier of airdrop — 4,941 tokens — could have sold them for over $21,500.

For me, the wackiest thing of all is Jito’s fully diluted valuation, the value of all JTO tokens in existence, not just those in circulation.

It has surpassed that of Lido, the biggest liquid staking protocol with over $20 billion worth of deposits. For comparison, Jito only has $440 million worth of deposits.

Lido’s FDV sits at around $2.2 billion, while Jito’s has reached over $2.8 billion.

The reason for such a huge discrepancy? Almost 90% of Lido’s LDO token is already in circulation compared to just 11.5% of Jito’s. With far fewer tokens to go around it was much easier for JTO traders to push up its value amid the post-airdrop euphoria.

Needless to say, Lido supporters aren’t particularly pleased with the price imbalance.

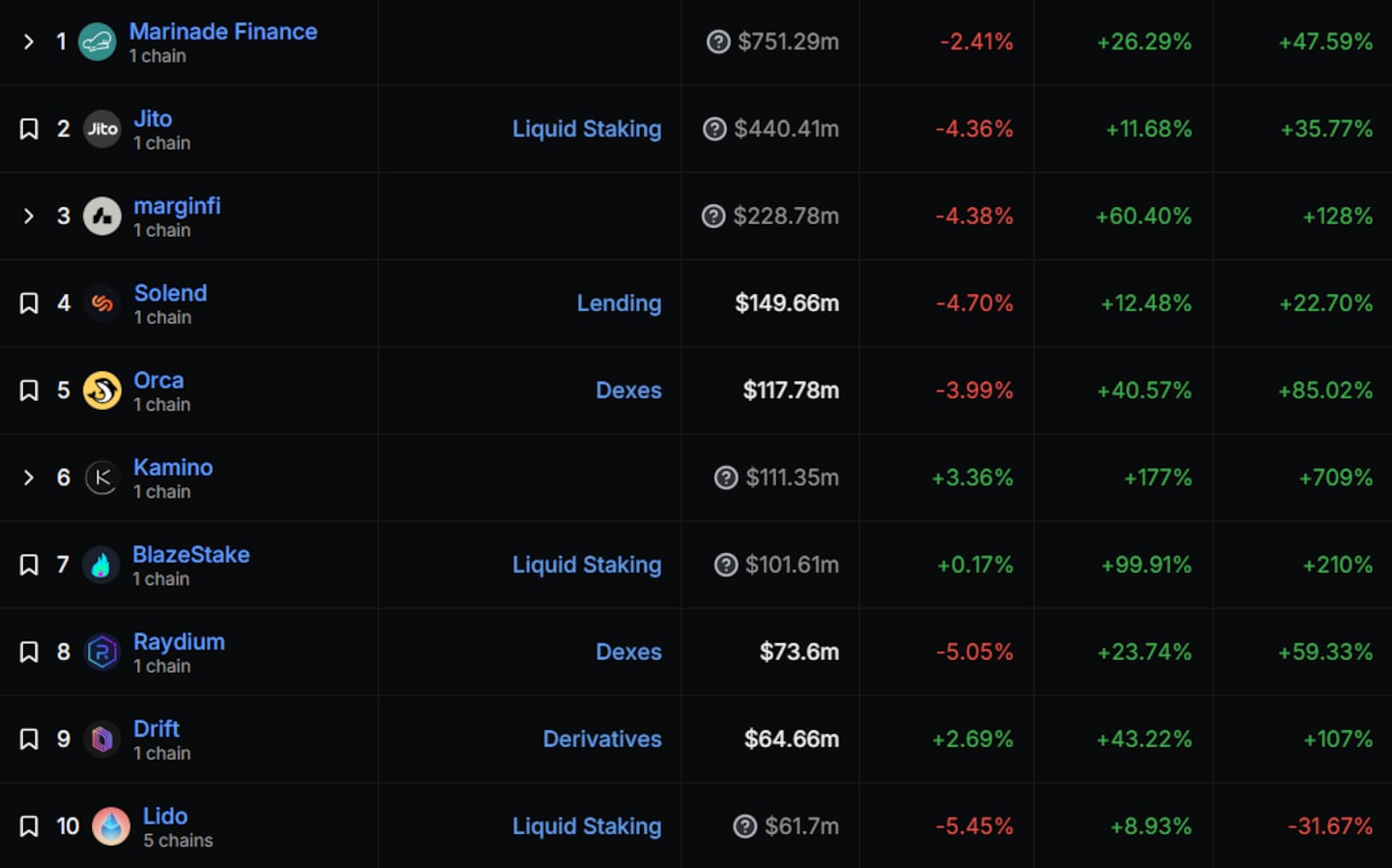

Data of the week

Following Jito’s huge airdrop payout, DeFi users are now looking to other Solana protocols likely to launch a token.

The hope is by depositing to these protocols now, users could receive airdrops in the future.

Lending and leveraged trading protocol Kamino is the biggest winner with a 177% increase in total value locked over the past week. BlazeStake, a liquid staking protocol and rival to Jito, also saw a 99% increase in deposits.

This week in DeFi governance

VOTE: Gauntlet recommends reactivating CRV borrowing on Aave v3

VOTE: Lido to make entry to its Ethereum validator set permissionless

VOTE: Frax greenlights PayPal USD for the Frax Curve Automated Market Operator

Post of the week

Ambient Finance founder Doug Colkitt absolutely nails the kind of standup routine 1990′s Jerry Seinfeld would be performing if he were into crypto.

“And what’s the deal with L2s. If the rollup is so much faster and cheaper, why don’t they just make the base layer out of whatever the hell they’re doing on the L2?” pic.twitter.com/XETvbVfKa7

— Doug Colkitt (@0xdoug) December 9, 2023

What we’re watching

A very important @rollbitcom proposal is currently supported by 78% of the community. It would change the current buy & burn mechanic into a revenue share model w/deflationary mechanics & eliminate a lot of FUD around the platform. Proposal 👇 pic.twitter.com/qdvCNL2ube

— CryptoCondom (@crypto_condom) December 11, 2023

Crypto casino Rollbit is voting on whether to change its current buy and burn tokenomics to a revenue sharing model.

Have you joined our Telegram channel yet? Check out our news feed for the latest breaking stories, community polls, and of course — the memes.

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out with tips at tim@dlnews.com.