White House’s 30% crypto mining tax in peril ahead of debt ceiling agreement

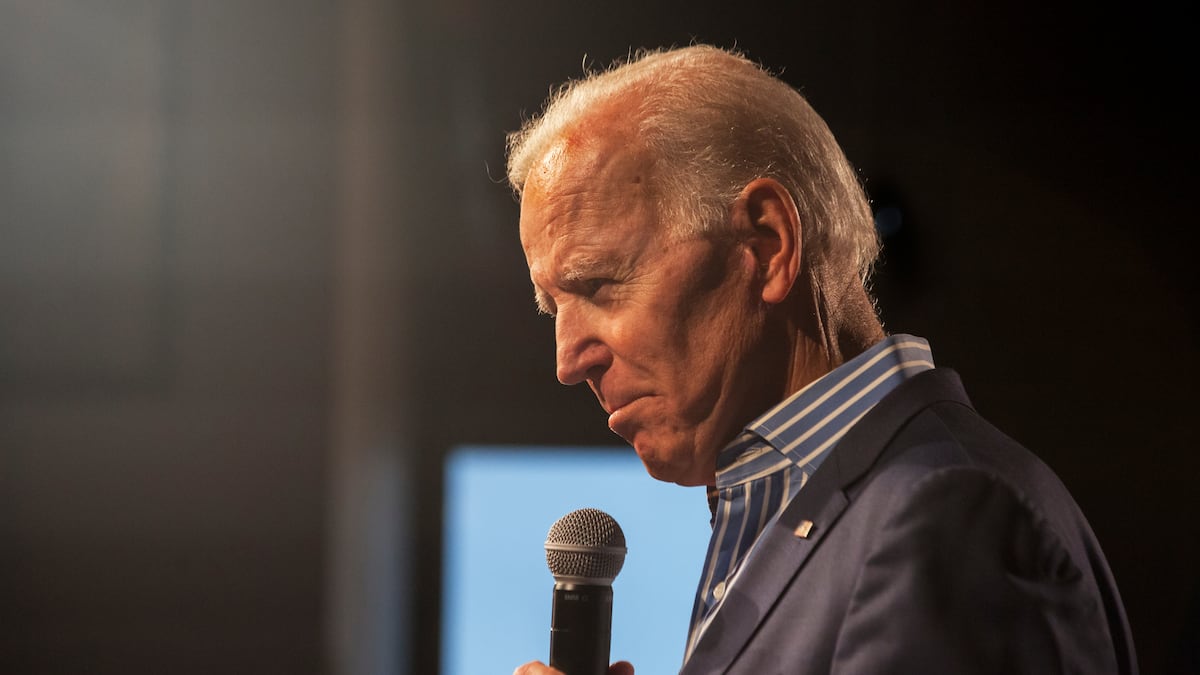

The Biden administration may scrap its proposed crypto mining tax as part of a deal to prevent a US debt default, Decrypt reported.

The proposed 30% Digital Asset Mining Energy tax would make miners pay to cover what the White House referred to as its environmental and societal harm.

The debt ceiling agreement that may have marked its demise is currently underway, and Congressperson Warren Davidson confirmed in a tweet that part of the negotiations involved “blocking proposed taxes,” referring specifically to the DAME tax.

Yes, one of the victories is blocking proposed taxes.

— Warren Davidson 🇺🇸 (@WarrenDavidson) May 29, 2023

NOW READ: Crypto volumes tank amid US debt standoff

Bitcoin miners earn highest transaction fees since 2021 as Ordinal frenzy continues

Bitcoin miners in May earned the highest transaction fee revenue seen since 2021, thanks in part to the popular new inscription method Ordinals, The Block reported.

Transaction traffic saw 14.9 million transactions — an all-time record — as Ordinals allowed Bitcoin users to mint NFTs on the network for the first time.

Despite the benefits for miners, the heightened activity congested the network to the point major exchange Binance temporarily halted transactions earlier in the month.

NOW READ: Rookie DeFi traders bear the brunt of bot attacks: ‘Even small trades are at risk’

Genesis and Gemini file to dismiss SEC lawsuit

Financial services firm Genesis and crypto exchange Gemini filed motions to dismiss a US Securities and Exchange Commission lawsuit on Friday, The Block reported.

The SEC sued the two firms in January on grounds that their partnered staking programme, Earn, acted as a sale and offer of unregistered securities.

The companies denied the agency’s claim in the recent filing, with Genesis saying the SEC has not provided ample facts to back up its claim.

NOW READ: ‘Treat restaking like AI’: Ethereum’s emerging trend sparks concerns about network stability

Russia nixes state-run crypto exchange ambitions, eyes regulatory framework for firms

Russian lawmakers have ended plans for the creation of a state-run crypto exchange and will allow existing firms to operate under new rules, according to a Russian news report Sunday.

Russian officials outlined a lack of desire by the Ministry of Finance to establish a single national exchange. They instead pointed towards the ability for business to handle cross-border payments and exchange services under a regulatory framework.

Crypto operators in the country voiced enthusiasm for the decision, which they say may pave the way for innovation and competition.

More web3 news from around the web...

Curve Finance CEO and wife purchase two mansions in Australia worth around $40 million — The Block

Meet the crypto rich who want to live forever: Inside Vitalik’s Zuzalu — Decrypt

Dogecoin chart pattern suggests volatility explosion ahead — CoinDesk