A version of this article appeared in our The Decentralised newsletter on April 23. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

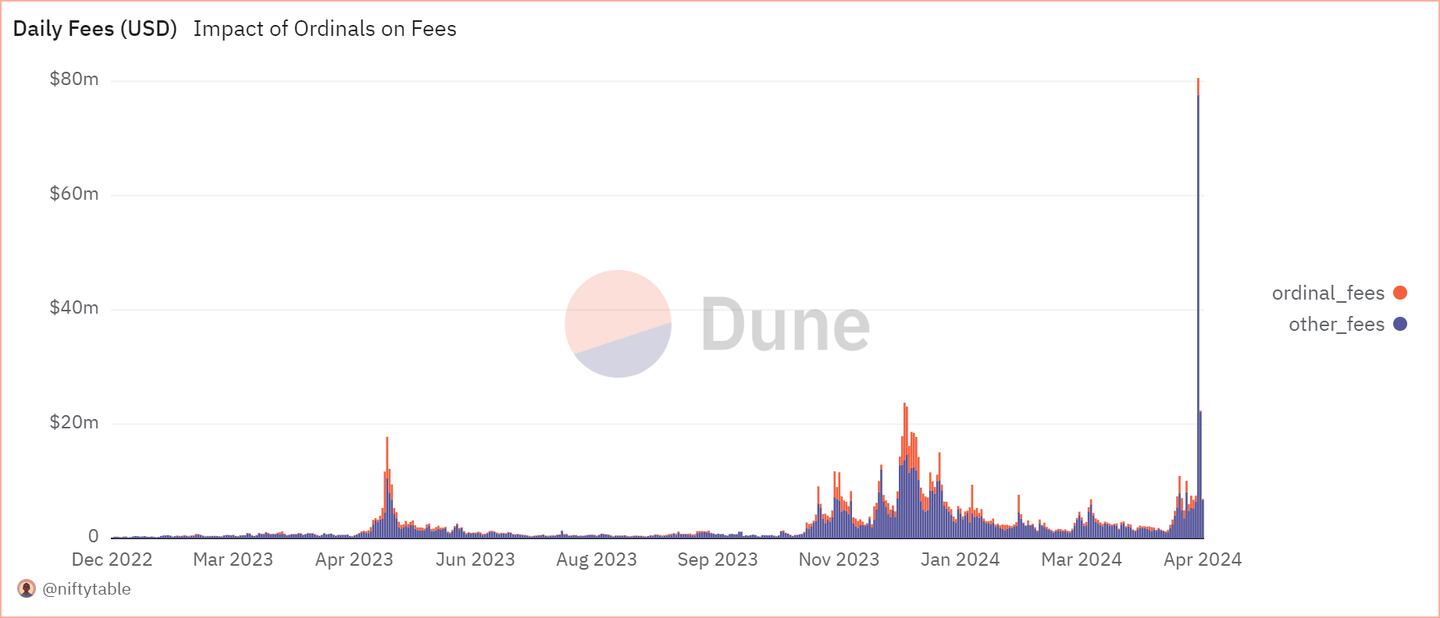

- Bitcoin users spend $80 million on fees in a day.

- Avraham Eisenberg’s code is law trial ends in conviction.

- Are DeFi users getting tired of airdrops?

Runes drives Bitcoin fees to record

Bitcoin is back to normal after fees on the blockchain hit an all-time high.

The reason? It wasn’t the halving.

Users creating and trading Runes, the latest iteration of NFTs and memecoins on Bitcoin, spent a whopping $80 million on April 20. That’s triple the previous one-day record for fees spent on the Bitcoin blockchain.

And it could be just the beginning.

Compared to its predecessor, Ordinals, Runes introduces two big improvements: it maintains all transactional data onchain, and has a smaller onchain footprint.

Brian Rudick, senior strategist at crypto market maker GSR, told DL News that Runes could become the de facto fungible token standard on Bitcoin.

Ordinals went through multiple waves of activity as new memecoins and NFTs launched.

If Runes really are the big improvement they’re heralded to be, expect more of the same.

What Mango Markets case means for DeFi

The conviction of Avraham Eisenberg, the trader who exploited Mango Markets for $115 million, shocked the DeFi world — not because it thought Eisenberg was innocent, but because of the precedent the verdict could set for future DeFi-related cases.

Some say it could embolden prosecutors who have hesitated to bring charges against traders who take advantage of poorly designed DeFi protocols, according to crypto attorney Gabriel Shapiro.

“He was definitely guilty of market manipulation of the price of MNGO on [centralised exchanges] — I take no issue there,” Shapiro told DL News, referring to a Mango Markets-issued token.

But Shapiro said it wasn’t clear Eisenberg had actually defrauded Mango’s users.

“I agree more with the defence — you can’t defraud someone if you don’t lie to them or they don’t rely on your lies,” he said.

Eisenberg was found guilty of commodities fraud, commodities market manipulation, and wire fraud. He is set to be sentenced on July 29.

Airdrops aren’t what they used to be

Crypto airdrops are losing their charm — at least that’s what the DeFi community’s reaction to recent airdrop news indicates.

Real estate trading platform Parcl’s PRCL token plummeted after it airdropped 8% of its supply to early users. The week before, Wormhole’s W token suffered a similar fate.

The problem, according to some, is that these tokens launched at very high valuations.

Once the initial hype of free tokens wore off, many who received them appeared to get cold feet.

What’s more, interest in future airdrops also appears to be waning.

Ethereum layer 2 Scroll recently took another shot at running a points programme, which many in DeFi view as a prelude to a token airdrop.

CC2, a pseudonymous trader known for his serial airdrop farming, told DL News, that more projects — including Scroll — are twisting airdrops in their favour to drum up more activity.

In short, airdrops are getting more effective for the projects, and less lucrative for users, CC2 said.

Data of the week: Runes mania

Bitcoin’s new Runes standard got off to a strong start over the weekend as users piled in to mint the new assets.

The biggest winners so far appear to be Bitcoin miners.

They received an additional $80 million in fees in a single day on Saturday from Runes minters — far surpassing the previous record for transactions fees paid on the Bitcoin network.

This week in DeFi governance

VOTE: Avalanche and Arbitrum are neck and neck as Aave DAO votes for GHO cross-chain rollout

VOTE: GnosisDAO looks to expand its offerings with a VPN

Post of the week

Crypto’s most famous sleuth is preparing to drop something big.

ZachXBT has previously helped track illicit funds laundered by North Korean hackers Lazarus Group, and uncovered the identities of multiple serial crypto scammers.

Putting final touches this week on an investigation I have been working on for 15+ months.

— ZachXBT (@zachxbt) April 22, 2024

By far my biggest project to date and I look forward to sharing it soon.

Expect no other new posts in the meantime.

What we’re watching...

🚨News Alert

— Safe.eth (@safe) April 23, 2024

SAFE Token is now transferable!

🔗 https://t.co/oIq9BEgjMS https://t.co/8o4znSHopj pic.twitter.com/jXKxqcm45d

SafeDAO, the DAO associated with the Safe multi-signature wallet, just made its SAFE token transferrable.

Ecosystem contributors are set to split an airdrop of 25 million tokens, with half available immediately and the rest vested over four years.

Got a tip about DeFi? Reach out at tim@dlnews.com.