- Bybit offers security experts $140 million.

- Kaito AI airdrops its token to 85,000 wallets.

- Ethena raises $100 million.

A version of this article appeared in our The Decentralised newsletter on February 25. Sign up here.

GM, Tim here.

Bybit offers bounty

Crypto exchange Bybit is offering up to $140 million to onchain sleuths who help track down the $1.4 billion the exchange lost in Friday’s hack.

Those who play an active role in the recovery of portions of the stolen funds stand to receive 10% as a reward.

“We want to officially reward our community who lent us their expertise, experience and support,” Ben Zhou, co-founder and CEO of Bybit, said in a statement.

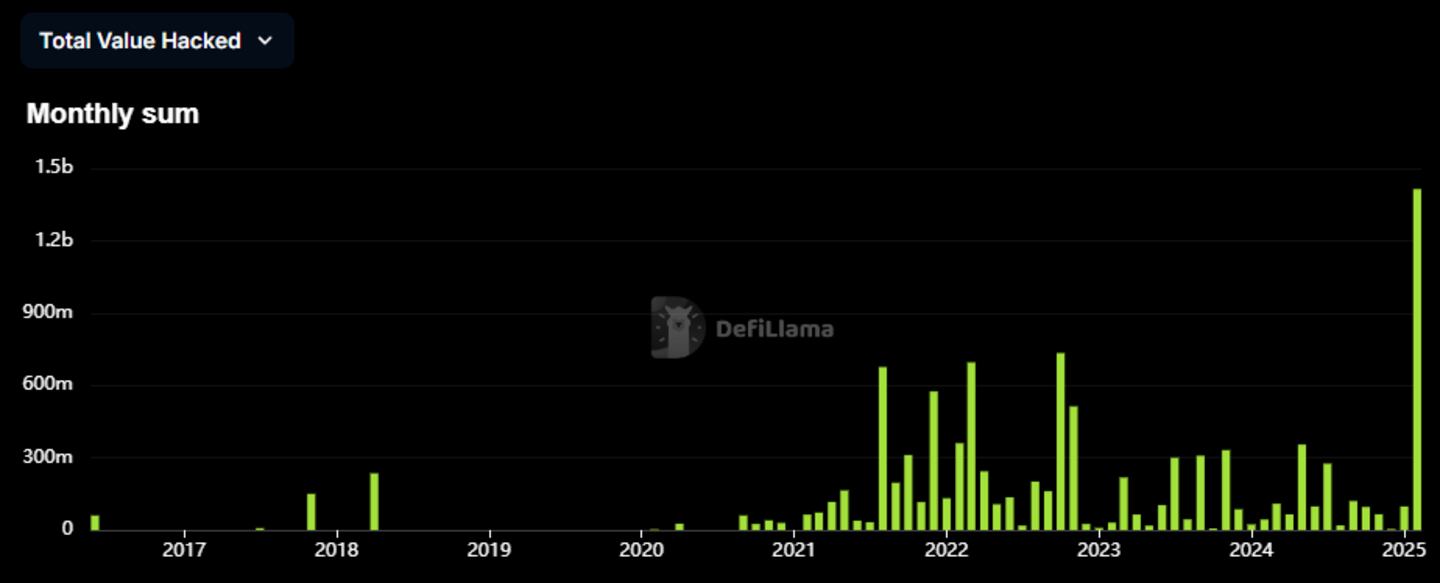

On Friday, a hacker drained $1.4 billion worth of Ether and staked Ether tokens from one of Bybit’s crypto wallets. It’s the biggest hack in the industry’s history.

Post-hack bounty programmes have become common practice.

Often, they are aimed at the attackers themselves, encouraging them to return stolen funds in exchange for a smaller amount of “clean” funds.

But the Bybit hack was likely conducted by North Korea, making a return of funds unlikely.

Yet, crypto security experts who help recover funds by tracking, locating, and freezing portions of the $1.4 billion could earn millions doing so.

Some funds have already been recovered.

Mudit Gupta, Polygon’s chief security officer, said on Saturday that Security Alliance, a group of crypto security experts, had helped recover 15,000 cmETH — Mantle’s Ether liquid staking token — worth around $43 million.

The same day, Tether CEO Paolo Ardoino said his firm had frozen $181,000 worth of its USDT stablecoin connected to the Bybit hack.

Kaito AI’s airdrop

X users are cashing in on Kaito AI’s newly-launched token.

The crypto intelligence platform, which monitors social chatter to provide insights, gave out 10% of its Kaito governance token through an airdrop on Thursday.

Over 85,000 wallets got the airdrop, with the biggest accounts receiving over $100,000 worth of tokens each, according to Nansen data.

Ahead of the airdrop, those who signed up to the platform and participated in crypto discussions on X could earn tokens representative of their contributions.

The Kaito token is currently up over 28% from its launch price, per CoinGecko data.

In recent years, many newly-launched crypto tokens have struggled to hold their value.

A September report from crypto market maker Keyrock found that in 2024, 88% of tokens launched alongside airdrops declined in price, with most crashing within 15 days.

Berachain’s BERA token slid 60% days after it launched on February 6.

Whether Kaito can buck this trend remains to be seen — the token has only been trading for five days.

Ethena’s $100m raise

Ethena, the DeFi app behind the USDe dollar-pegged token, has raised $100 million through a token sale to VC firms, Bloomberg reported on Monday.

In December, the protocol finalised a deal which sold ENA tokens for $0.40 each to Franklin Templeton, F-Prime Capital, Dragonfly Capital Partners, Polychain Capital, and Pantera Capital.

At the time, ENA traded between $0.90 and $1.10. It has since fallen in value and now trades around $0.40.

Ethena’s USDe is created by depositing Bitcoin, Ether, or Solana to the Ethena protocol, which then opens shorts, or bearish bets, on futures exchanges like Bybit.

This creates a neutral position where the value of the assets and the short cancel each other out to remain at a stable price in aggregate.

This is different to Circle and Tether’s stablecoins, which are backed at a one-to-one ratio by dollars or dollar-equivalent assets like US Treasury bonds.

Ethena’s dollar token has proven popular with DeFi users. There’s almost $6 billion USDe in circulation, making it the third-biggest dollar-pegged crypto.

In January, Guy Young, Ethena’s founder, said the platform planned to roll out a new version of USDe tailored for regulated financial institutions.

This week in DeFi governance

VOTE: Compound DAO mulls incentives for DAO participation

VOTE: Arbitrum DAO votes on new programme to help apps get audited

VOTE: Aave DAO votes to deploy protocol on Soneium layer 2

Post of the week

ETF Store president Nate Geraci sums up the crypto space in 2025.

Eth vs memecoin investors… pic.twitter.com/JF4nW76TlS

— Nate Geraci (@NateGeraci) February 24, 2025

Got a tip about DeFi? Reach out at tim@dlnews.com.