A recent plunge in a new algorithmic stablecoin has triggered debate over the safety of the offering, which is trading on one of the most influential – and widely used – blockchains. So too has a design feature that some DeFi investors say may be flawed.

Yet Cardano, a blockchain network that boasts the fifth highest cryptocurrency by market cap, is determined to show that this version of an algorithmic stablecoin can overcome scepticism left over from the meltdown of Terra’s UST token last year.

‘Flash-crash’

Last week, doubts mounted when the stablecoin DJED fell to as low as 96 cents and then a staggering 13 cents on the dollar according to data on CoinMarketCap and CoinGecko. Stablecoins, which are typically pegged to the US dollar, are not supposed to fall pennies below $1 let alone 87 cents. Investors were shocked by what one called a “flash-crash.” Yet COTI, the blockchain venture that created DJED on behalf of Cardano, said the 13 cent price on Coingecko was due to an integration error.

“The price was displayed incorrectly,” said Prince, a community manager at COTI.

Still, the action didn’t deter DJED from becoming the fourth largest DeFi protocol on the Cardano blockchain at $10.5 million in total value locked a month after its launch, according to DeFiLlama.

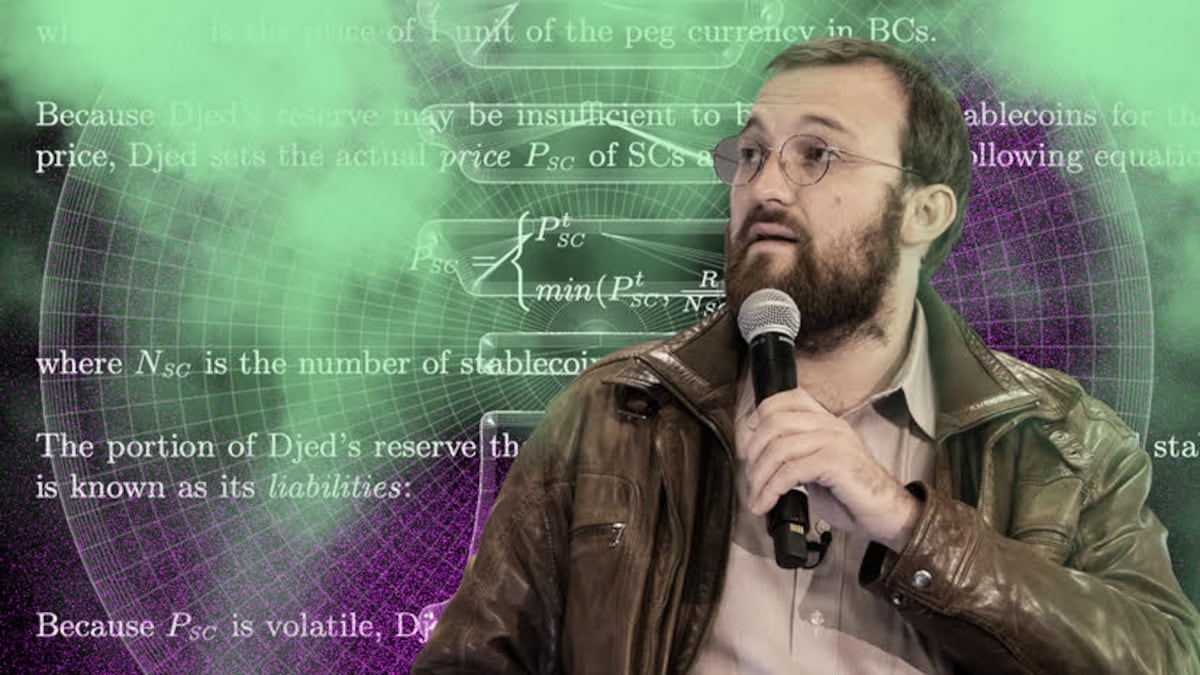

The rollout appears to be a win for Cardano founder Charles Hoskinson, a pioneer in DeFi who helped develop Ethereum. Hoskinson bristles at comparisons between DJED and TerraUSD, the algorithmic stablecoin that slipped its peg last May and triggered the collapse of a $60 billion ecosystem and spread contagion across the sector.

Asked how DJED is different from Terra’s UST, Hoskinson replied with a single word: ”Overcollateralisation.” This means the stablecoin is backed by a reserve several times its value.

READ NOW: DeFi ‘threat’ drives $1.5B tokenisation boom as Goldman, SocGen eye on-chain bonds

Ever since Terra’s failure, investors have been wary of algorithmic stablecoins.

This is because normal stablecoins are usually backed by the US dollar or the euro or even gold. Their relative stability makes them attractive to investors looking for havens from volatility. They also provide investors with hassle-free ways to trade cryptocurrencies without converting to fiat currencies.

But algorithmic stablecoins tend to be backed by other cryptocurrencies, making them far more volatile. They can slip their peg to the dollar under extreme market pressure, or due to flaws in their design.

‘People are still weary of algorithm controlled stablecoins even if they are overcollateralised.’

The plunges in DJED generated concern on Crypto Twitter. Critics are uneasy about the way the stablecoin works, saying its collateralisation approach is a key risk to the protocol’s safety.

At the heart of the offering is ‘overcollateralisation.’ DJED’s protocol requires a minimum reserve ratio of 400%. In practice, that means new DJED stablecoins can only be ‘minted’, or created, when the reserve’s value is at least four times the supply of outstanding DJED.

Direct implications

DJED’s reserve is made up entirely of Cardano’s native token, ADA, not dollars.

“People are still weary of algorithm controlled stablecoins even if they are overcollateralised,” Subcritical, the sobriquet of a Cardano DeFi user, told DL News. “Many in the community are not sure we need it, and would prefer to have a fiat-backed stablecoin.”

The stablecoin’s design has direct implications for holders of the DJED’s reserve token, SHEN. Contributors to DJED’s reserve create or ‘mint’ SHEN as they deposit their ADA to the reserve. In other words, investors who convert their ADA into SHEN act as lenders of last resort and assume the risk if DJED drops below the dollar peg. For helping build and maintain DJED’s reserve, SHEN holders are paid periodic rewards.

Redeeming tokens

If the value of DJED’s reserve falls below the minimum ratio of 400%, then the protocol is designed to lock holders’ SHEN until that ratio is met once again.

This, DJED’s detractors argue, would prevent SHEN holders from redeeming their tokens in order to withdraw the ADA they originally deposited to the reserve. So the maintenance of a steady reserve punishes investors who make the reserve possible in the first place. They cannot easily withdraw their funds.

DJED’s own whitepaper notes the risk of a bank-run-like dynamic emerging if the reserve ratio approaches its minimum threshold. SHEN holders may want to sell their holdings for fear of them getting locked, in turn lowering the reserve, and creating a self-reinforcing loop, it says. The collapse of Terra’s UST was also subject to a similar dynamic.

‘Barring the doors’

One user has speculated that a lockup of SHEN holders might prompt dumping of SHEN on decentralized exchanges.

maybe I don't understand $DJED correctly, what happens when the reserve gets to 400% and you cant burn shen, won't people just start dumping Shen on Dexes?

— Mike borman (@blocksplained) February 3, 2023

“You can lock in the collateral of SHEN holders by not allowing them to withdraw when reserves are low, but you cannot do anything about the value of that ADA collateral,” said Kyle Downey, CEO and co-founder of Cloudwall, a digital assets risk management firm.

“The question becomes: could that ‘barring of the doors’ itself trigger a panic that affects collateral value?” Downey said.

COTI told DL News that ADA has “deep liquidity” and that it had examined “the maximum monthly decrease of ADA’s price, which was found to be around 66% at the time of research.”

READ NOW: Hedge fund short seller says Silvergate crash may be a sign of the bottom

While a reserve ratio of 300% would be “sufficient” to cover such a decrease in ADA, COTI said it set the ratio at 400% “to provide additional safety for DJED holders in extreme cases.”

Reserve draining attacks

Looking at a past experiment, Cardano community members warn of other potential issues with DJED.

In 2021, a raid on a stablecoin’s reserves against an earlier version of DJED, called SigmaUSD, on the Ergo blockchain exploited a vulnerability. According to the Ergo blog post detailing the attack, holders of the reserve token, SigRSV – an analogue of SHEN – found themselves unable to redeem their funds because the attacker exploited a loophole that kept the reserves locked at the 400% ratio.

DJED’s whitepaper acknowledged the risk of such events, which are known as reserve-draining attacks. At the same time, it noted that later adjustments to SigmaUSD seem to have prevented further incursions.

The paper also said that SigmaUSD was able to maintain its peg during a market crash in May 2021, when Bitcoin dipped below $35,000 only to recover two months later.

“In order to conduct such an attack, the attacker would have to correctly predict ADA’s volatile price change, in accordance with the oracle’s price prediction” COTI said. “In addition, we set a 1.5% fee to prevent such an attack from being profitable.”