A version of this article appeared in our The Decentralised newsletter on October 15. Sign up here.

GM, Tim here.

- Base overtakes Arbitrum.

- Trump’s crypto project sets date for its $300 million token sale.

- Why the UNI token soared on Uniswap’s layer 2 news.

Base becomes the biggest L2

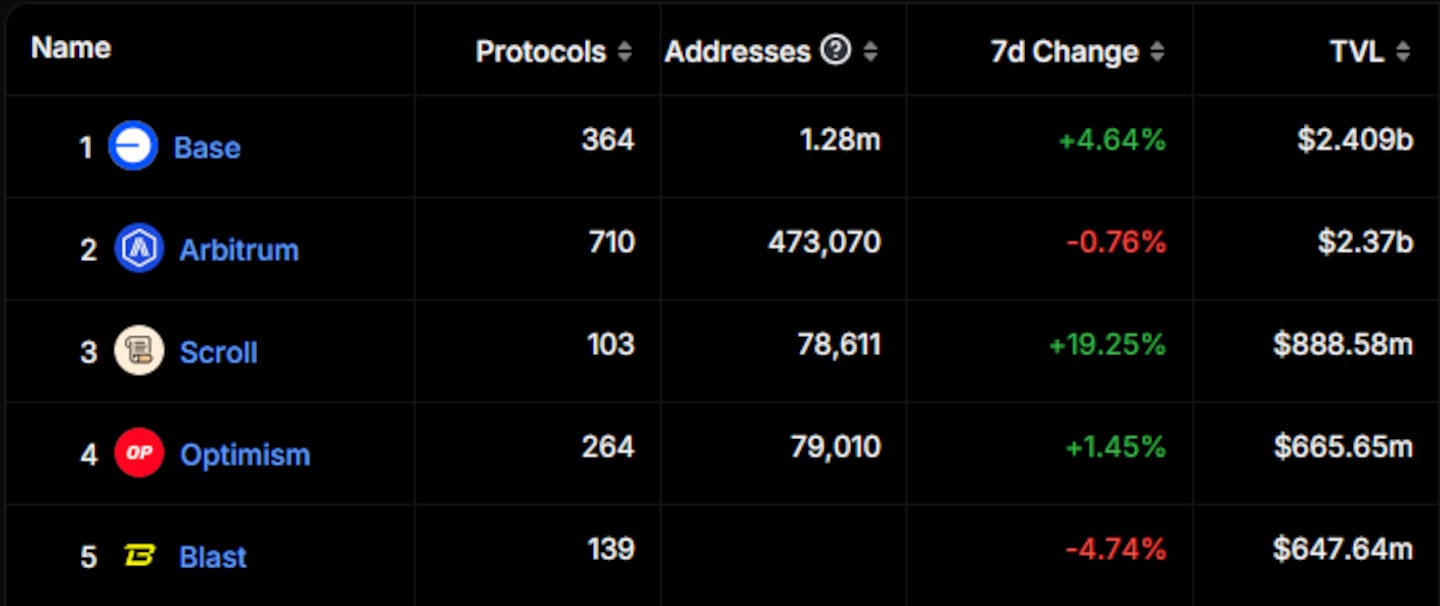

Coinbase’s Base just became the biggest layer 2, with over $2.4 billion in DeFi deposits.

Layer 2s are separate blockchains built on top of the main Ethereum network. They are designed to offer faster, cheaper transactions while inheriting some of Ethereum’s security.

There are several factors driving Base’s growth:

- Popular DeFi protocols like Aerodrome offering high yields.

- Its ability to leverage Coinbase’s large userbase.

- The recent launch of Coinbase’s Wrapped BTC product.

At the same time, Arbitrum, the layer 2 that previously held the top spot, has struggled to turn the vast amounts its DAO, the community that governs Arbitrum, spends into meaningful growth.

The move shows how powerful Base’s Coinbase connection is. The support, resources, and brand of the $44 billion company have undoubtedly contributed to Base’s success.

As of June, Coinbase had over 8 million monthly active users, according to data platform Backlinko.

Base isn’t the only Ethereum layer 2 backed by a big crypto company.

There’s also Linea, a layer 2 developed by crypto wallet MetaMask developer Consensys. Many of the factors driving Base’s success should also hold true for Linea.

Despite launching a month earlier than Base, Linea has only attracted $454 million of DeFi deposits so far.

The $300m WLFI sale

Donald Trump’s crypto venture, World Liberty Financial, will start selling its WLFI token today.

The Republican candidate promoted the upcoming sale following a post from the official World Liberty Financial X account on Friday.

World Liberty Financial plans to sell 20% of its token at a $1.5 billion valuation, netting it $300 million, according to documents seen by The Block. Code tests previously indicated the project planned to raise $540 million at a $1.8 billion valuation.

The move marks the first time a US presidential candidate has launched a crypto token.

Many in DeFi — including some of Trump’s most vocal supporters — worry that World Liberty Financial could damage the former president’s campaign.

“Is there something that we, as Crypto Twitter, can collectively do to stop the launch of World Liberty Coin?” Nic Carter, founding partner of Castle Island Ventures, said on X.

“It genuinely damages Trump’s electoral prospects, especially if it gets hacked.”

Only those who have passed know-your-customer checks will be able to purchase tokens. In the US, only accredited investors can buy WLFI.

Uniswap launches an L2

Uniswap Labs, the firm behind the top decentralised exchange, says it will release an Ethereum layer 2 before the end of the year.

But what’s really piqued the interest of DeFi natives is how Uniswap DAO’s UNI token factors in.

The new blockchain, called Unichain, will share its revenue with UNI holders who opt to lock up, or “stake,” their tokens.

Uniswap has collected more than $3.8 billion in fees since its launch almost six years ago. While most of these fees go to liquidity providers, a small percentage could be redirected to UNI holders in the future.

There are additional ways Unichain could deliver a return to UNI holders:

- It could share some of the profit it makes arbitraging the difference between transaction fees and settlement costs.

- It could also share the cash generated from maximal extractable value — or MEV.

While nothing has been confirmed, traders are optimistic — the UNI token jumped 10% on the news.

This week in DeFi governance

VOTE: Arbitrum DAO mulls $1.5 million events budget for 2025

ARFC: Aave DAO proposes renewing Chaos Labs as a DAO service provider

PROPOSAL: Jito DAO proposes $4 million grants programme for its upcoming restaking product

Post of the week

As Uniswap announced Unichain, Seed Club’s Cheryl Douglass poked fun at the large number of Ethereum layer 2s launched in recent months.

was so worried i was going to wake up today and there wouldnt be a new L2

— Cheryl Douglass (@cherdougie) October 10, 2024

thank god

Got a tip about DeFi? Reach out at tim@dlnews.com.