- DeFi native lending on MakerDAO is booming once again.

- Crypto-backed loans are now the DeFi giant’s biggest earner.

- Maker’s real-world asset vault has now been pushed into second place.

- Investors' renewed bullishness is driving the shift.

Big bettors’ renewed crypto bullishness has turned DeFi-native lending into MakerDAO’s biggest moneymaker, according to the protocol’s revenue chart.

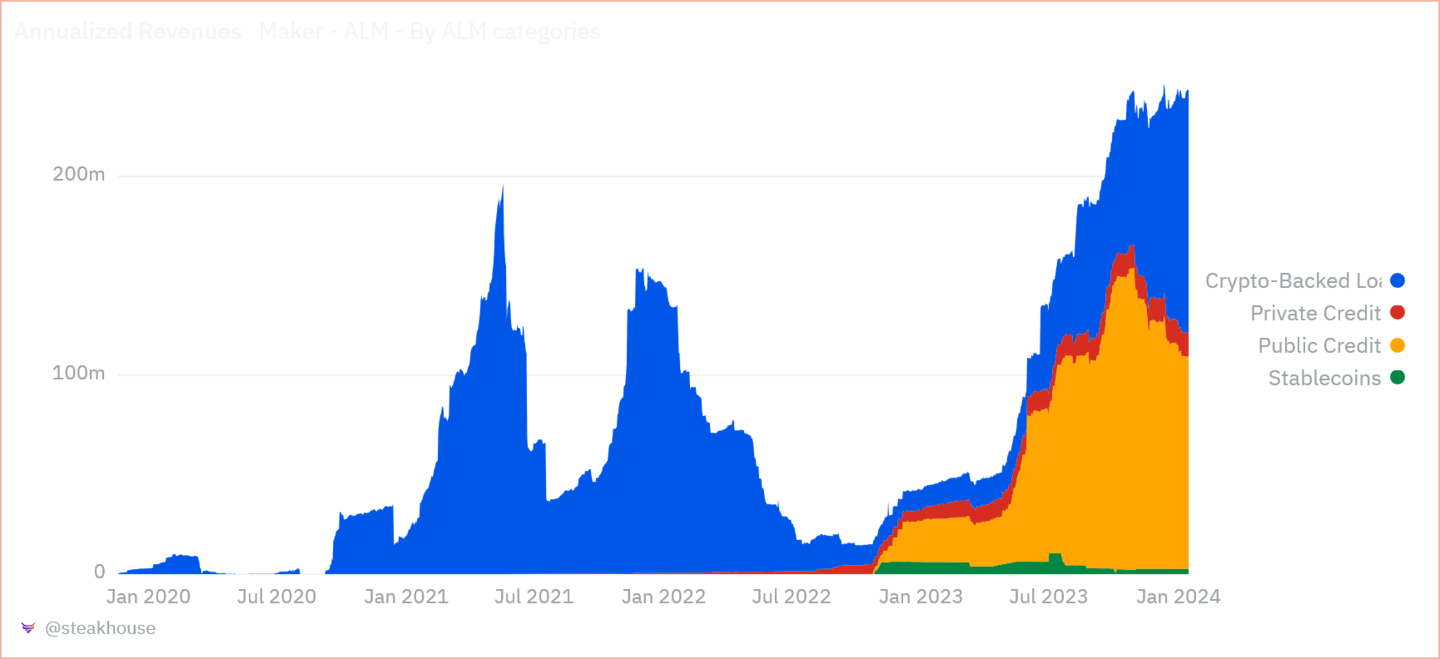

Crypto-backed lending currently accounts for over 50%, or over $122 million, of MakerDAO’s $243 million in total projected annual revenue, which is generated from lending its DAI stablecoin.

This significant portion of revenue is derived from the interest rates charged on the $2.4 billion in crypto-backed loans issued by Maker.

“Maker is earning more on [DeFi-native loans] as it captures more of the users who are coming online wanting to take leverage now that the bull market is happening,” Sam MacPherson, CEO of Phoenix Labs, creator of MakerDAO’s retail lending app Spark Lend, told DL News.

It marks a shift from November when Maker’s then-$3.5 billion real-world asset vault made up two-thirds of the protocol’s revenue, DL News reported at the time.

Real-world assets refers to investments in bonds and other traditional assets.

Now, real-world assets have shrivelled up to $2.1 billion and only make up 44% of MakerDAO’s revenue, showing how much DeFi-native loans have swung back.

The recent shift comes as the market has turned bullish, in no small part due to the highly anticipated approval of 11 spot Bitcoin exchange-traded funds last week.

Crypto-backed lending

The return of DeFi-native lending is likely due to a change in the sentiment of crypto bigwigs from risk-off to risk-on, MacPherson said.

Last year, crypto whales parked their funds in low-risk investment vehicles like US Treasury bills, content to earn 5% amid a DeFi slump caused by the tumult of 2021.

But with the market doubling its valuation to $1.7 trillion last year and the expectation of interest rate cuts by the US Federal Reserve, the optimistic high-leverage bettors are back and so it seems is their appetite for stablecoin loans to fuel their trades.

As a result, the DeFi rate is trending higher than what is available in the traditional market.

DeFi rate is analogous to the Fed rate but for the crypto market. It represents the cost of capital for stablecoins, which are the main instruments for providing liquidity in crypto trading.

The DeFi rate spent most of the last two years tailing the Fed rate by a significant margin, but it has now surpassed the latter.

Both sides

For MacPherson, the switch to DeFi-native loans being the big earner for MakerDAO shows the protocol’s ability to maximise revenue on both sides of the market risk profile.

The Phoenix Labs CEO said Maker’s current earning potential should help dispel the misconception that the protocol was “earning a lot” last year because of the Fed’s relatively high rate.

Instead, MacPherson pointed to the last crypto bull market in 2021 when Maker earned $200 million from DeFi-native lending.

“Maker will actually earn the maximum of either the TradFi risk-free rate or the DeFi rate,” MacPherson said.

As a result, Maker’s revenue expectations may not be dampened by the switch from real-world asset preeminence to crypto-backed loans taking centrestage.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.