- Crypto’s real-world asset market has plummeted 37% in the last three months.

- A recovery appears unlikely until the next crypto bear market, predicts one founder.

- DeFi heavyweights like Maker are now on the hunt for their yield elsewhere in the market.

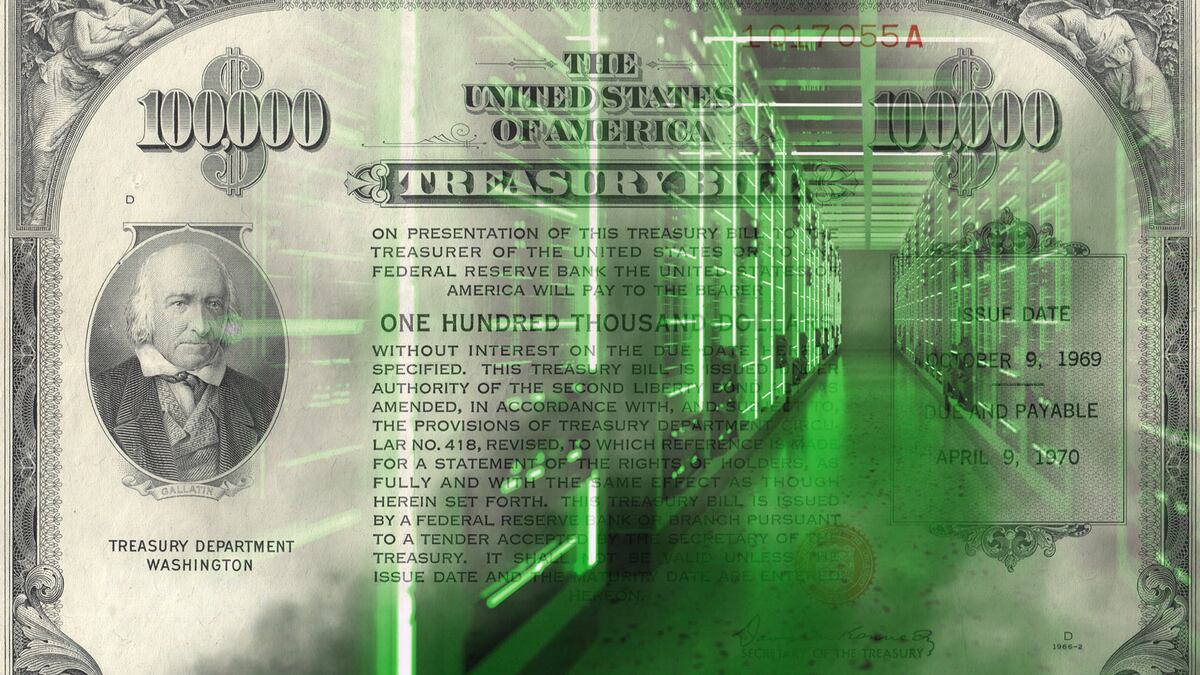

Real-world assets, the industry’s buzzy investment thesis last year, has lost some of its lustre.

The market segment that offered crypto investors exposure to bonds and other traditional assets has slumped to $3.9 billion, a 37% decline from its $6.3 billion peak in October, making it one of the worst-performing niches in the last three months.

The slump may get worse, too, as investors pivot to higher-yielding markets like DeFi lending and liquid restaking.

“I don’t think real-world asset demand returns in any meaningful way until the next bear market,” Guy Young, founder of Ethena Labs, the team behind the stablecoin project Ethena, told DL News.

In its heyday last year, proponents like Allan Pedersen, the CEO of Monetalis Group, an asset management firm specialised in connecting DeFi with traditional finance, predicted that broad-based asset tokenisation was fast on the horizon.

BlackRock’s CEO Larry Fink has repeatedly suggested that tokenisation is the future of finance.

Still, others, like Young, say the current slump is no surprise.

“Real-world asset demand is very much a bear market phenomenon where you need crypto prices and volatility to be low, and rates elsewhere in the system to be compressed,” Young said.

Last year’s real-world asset advance

Crypto’s real-world asset market took off last year amid record-high US Treasury bond yields that topped 5.5% on short-dated bonds – much higher than the prevailing DeFi rates.

DeFi rates represent the cost of capital for stablecoins across a host of lending markets, which are the primary liquidity driver for crypto trading.

Crypto’s big bettors compare both rates to determine where to park their idle fortunes.

MakerDAO piled heavily into this trade last year, racking up a real-world asset vault worth $3.5 billion at its peak.

The protocol’s push ended up generating two-thirds of its revenue by November, with reports that it may look to parlay some of those gains into the $1.5 trillion private credit market for even more yield.

That vault also provided the majority backing for its decentralized DAI stablecoin last year, but that’s no longer the case.

Instead, MakerDAO’s crypto-backed loans now provide the biggest backing for its DAI stablecoin.

“Maker is earning more on [DeFi-native loans] as it captures more of the users who are coming online wanting to take leverage now that the bull market is happening,” Sam MacPherson, CEO of Phoenix Labs, creator of MakerDAO’s retail lending app Spark Lend, previously told DL News.

Protocols engaged with real-world investment must quickly switch between higher-yield crypto lending products to maintain an edge over the rivals who are firmly focused on the former without any avenue to offer the latter, Young noted.

“During a bull market, [you] don’t see real-world asset rates sustaining above crypto rates for any long period of time,” the Ethena Labs founder said.

Stepping back, crypto’s overall market size has more than doubled since last year, hitting $1.8 trillion since the start of 2024.

With crypto on the cusp of a bullish advance, its real-world asset sub-market might have to take a back seat. At least for now.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.