- Several metrics point to increased DeFi use in recent weeks.

- Yearn Finance's new token system sets the protocol up for sustainable growth.

- DYdX launches its v4 version on its own Cosmos-based chain.

A version of this story appeared in our The Decentralised newsletter. Sign up here.

Hey everyone, Tim here.

Onchain metrics are trending up across the board, hinting at the possibility of a new wave of inflows into DeFi.

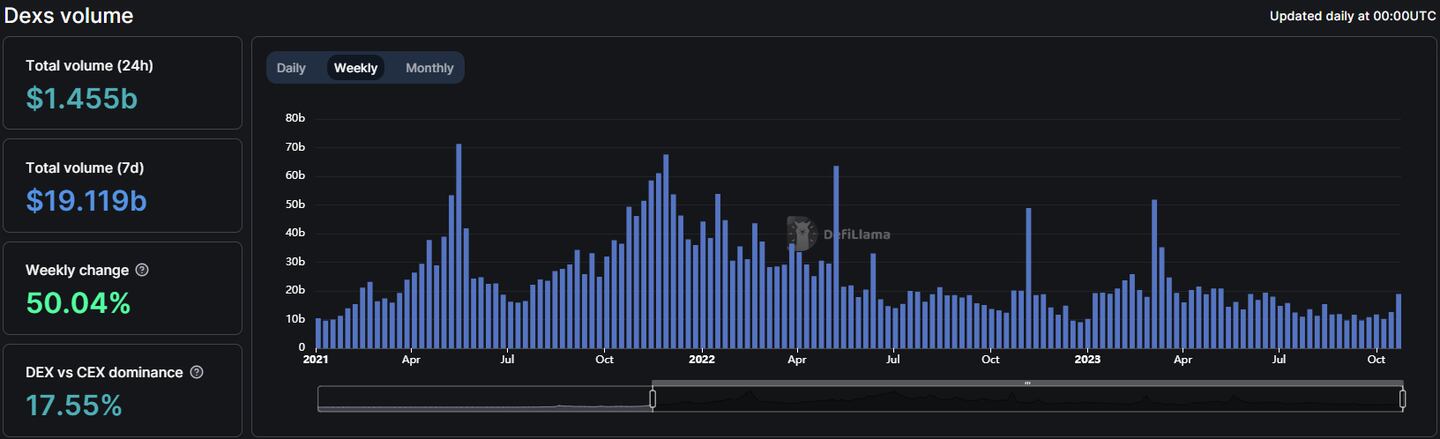

Decentralised exchange volume, one of the most popular indicators for measuring the overall health of onchain activity, popped over the past week hitting $18.9 billion. The metric is now at its highest since June.

Onchain options trading volume is also surging. The notional volume — the value of the underlying assets that options represent — surpassed $100 million after three straight weeks of gains.

Additionally, options open interest on centralised exchanges, like Deribit and the Chicago Mercantile Exchange, hit $17.7 billion on Friday, surpassing its 2021 bull market high. Increased options trading usually signals interest from sophisticated traders like hedge funds and family offices.

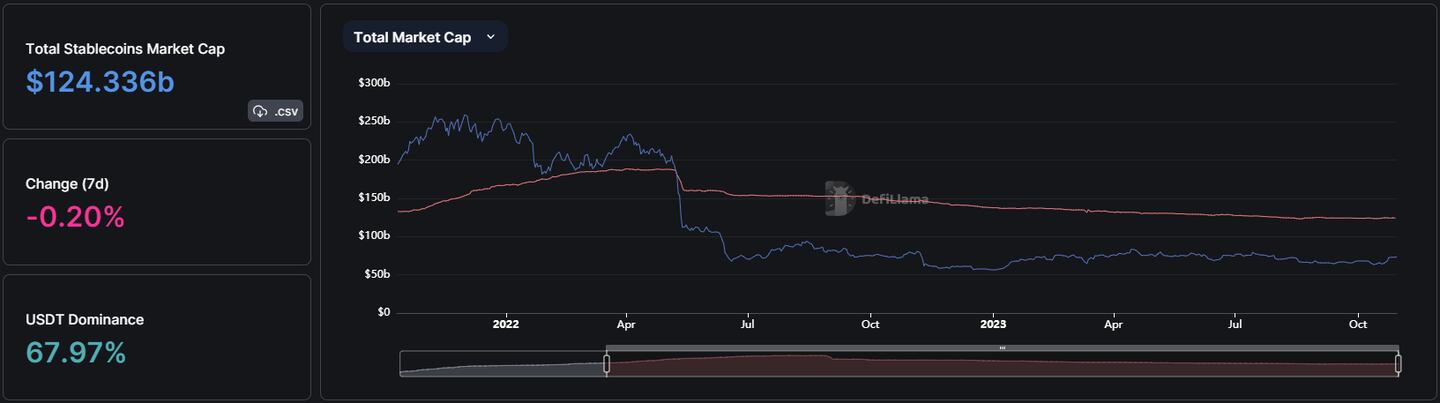

However, arguably the most important metric for DeFi growth is stablecoin total market capitalisation. Digital dollars are the lifeblood of DeFi, and many analysts posit that the ecosystem cannot sustainably grow without this metric also trending upwards.

After falling since April last year, the stablecoin total market cap spent the last few weeks going sideways.

With little fluctuation, it’s probably too soon to tell if money is entering the DeFi ecosystem just yet — but it’s notable that outflows appear to have stopped at least.

Accompanying the boost in onchain activity are some pretty important DeFi launches.

I explored Yearn Finance’s new token structure, dubbed veYFI. Yearn team members and investors alike said veYFI could help kickstart the flywheel on deposits after an extended lull.

VeYFI has roots in the vote-escrow system pioneered by decentralised exchange Curve Finance. After Curve launched its CRV token in August 2020, deposits more than quintupled in the month that followed.

While it might be hard for Yearn to replicate this kind of success outside of a full-blown crypto bull market, its new token system sets the protocol up for sustainable growth.

Last but not least, onchain trading platform dYdX launched its v4 version on its own Cosmos-based chain, completing the long-awaited transition from its previous home on Ethereum layer 2 StarkEx.

The move should be a substantial boon for the Cosmos ecosystem. DYdX regularly settles more than $4 billion worth of trades every week — even during the crypto winter.

However, a major transition for such a well-established platform like dYdX poses numerous challenges. DYdX needs to make sure the majority of traders follow it to its new home, and enough DYDX token holders stake their tokens to secure the new chain.

But if it can manage that, I can only see dYdX going from strength to strength.

Data of the week

Has the multi-year stablecoin downtrend bottomed out? The total stablecoin market cap has hovered between $123 and $124 billion since August.

This week in DeFi governance

VOTE: Lido to accept ownership of wstETH bridge on Base

PROPOSAL: Sunset Lido on Polygon

VOTE: Arbitrum to launch new onboarding quests

Post of the week

Commas are extremely important in headlines. pic.twitter.com/YfSL2jK44K

— nxthompson (@nxthompson) October 27, 2023

A Washington Post article covering the ongoing FTX trial highlights the importance of commas in headlines. h/t @nxthompson.

What we’re watching

Modular blockchain Celestia is set to launch its mainnet and token at 2pm London time today.

If you qualified and signed up for the airdrop, your new TIA tokens should appear in your Cosmos wallet once the blockchain goes live.

Have you joined our Telegram channel yet? Check out our News Feed for the latest breaking stories, community polls, and of course — the memes. https://t.me/dlnewsinfo

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out to him with tips at tim@dlnews.com.