A version of this article appeared in our The Decentralised newsletter on May 7. Sign up here.

GM, Aleks here filling in for my colleague Tim.

Here’s what caught my DeFi-eye recently:

- EigenLayer’s upcoming airdrop cuts out Americans.

- Aave’s v4 announcement ruffles feathers.

- DL News may have confirmed the real identity of ZKasino’s pseudonymous founder, Derivatives Monke.

It’s airdrop szn

DeFi projects are announcing token airdrops left and right in a bid to cash in on rising crypto prices.

Just this past week, so-called SocialFi platform friend.tech handed out over 13 million FRIEND tokens to early users, netting some recipients six-figure airdrops.

But the friend.tech airdrop will likely pale in comparison with the upcoming EIGEN airdrop, scheduled for May 11.

Crypto deposited in friend.tech stood at $13 million on Monday. EigenLayer? More than $15 billion.

Undoubtedly, a good portion of EigenLayer deposits came from users in the US.

So American users were miffed to find out they would be barred from the upcoming airdrop because of their location in a “jurisdiction otherwise considered high risk with respect to the airdrop.”

And, no, a VPN won’t save them.

Excluding Americans from airdrops isn’t new. As far back as 2021, crypto perpetual futures exchange dYdX barred US users from its airdrop.

But now airdrops are rarely retroactive. Many protocols have switched to running “points” campaigns to lure in more deposits. The result is airdrops that look more and more like yield farming.

Many argue that EigenLayer shouldn’t have accepted deposits from those in the US if it never planned to include them in the airdrop — it’s like a bank advertising a lucrative interest rate then refusing to pay it out to depositors.

And EigenLayer isn’t the only multi-billion dollar DeFi protocol gearing up for an airdrop. Cross-chain bridge LayerZero has also shared similar plans.

LayerZero and its related crypto bridge Stargate have no problem letting US send crypto or provide liquidity for bridge transactions.

Airdrop hopefuls are now watching closely to see if LayerZero will also bar US users.

OSS drama continues

I find comfort in the steady rhythm of a ticking clock, the bounce of a basketball, and a crypto founder complaining that a competitor stole their code.

For our past coverage on crypto’s open-source conundrum, see here and here and here.

A refresher: Open-source development is sacrosanct in crypto. The OG cryptocurrency, Bitcoin, is open-source. Folks are free to use the code as they please.

After all, folks in the industry are trying to build a more open and transparent financial system. Might as well let everyone take a peek at what’s happening under the hood.

Here’s the problem: Good ideas spread rapidly, but often at the expense of the people who cooked them up in the first place. IP? Copyright? Fugheddaboutit.

The latest kerfuffle came last week, when Aave Labs announced “Aave 2030,” an ambitious set of proposals that include a rebrand and a new version of the company’s eponymous lending-and-borrowing protocol, dubbed “V4.”

Within hours, competitors voiced their displeasure.

What's going on @GHOAave, you just got a proposal to steal?https://t.co/ge155DkFAe pic.twitter.com/geQD7K7jMu

— Curve Finance (@CurveFinance) May 1, 2024

Curve founder Michael Egorov told DL News he spoke with Aave founder Stani Kulechov, and they’re simpatico.

“[Aave] likely won’t copy the algo. They are fascinated by the feature, but would implement [it] on their own. That is fine in this case,” Egorov said.

“But also not an insignificant thing to build! That’s like building a rocket. Building your own to go to space is a good thing. … Going to space is not a ‘concept’ you can steal.”

Disclaimer: The two co-founders of DL News were previously core contributors to the Curve protocol.

Who is Derivatives Monke?

Last month, ZKasino, a crypto gambling platform, disappeared $30 million in user deposits, exchanging users’ deposited Ether for a protocol-issued token, ZKAS.

The switch brought on a huge outcry as depositors were unable to redeem their Ether.

New documents shed light on the identity of one of its pseudonymous founders, Derivatives Monke.

“The FIOD arrested a 26-year-old man who is suspected of fraud, embezzlement and money laundering,” FIOD Belastingdienst, a Dutch agency that combats financial fraud, said in a statement.

“The investigation focuses on a large-scale scam surrounding the alleged gambling platform ZKasino,” the agency said.

It isn’t clear who Dutch authorities arrested in connection with the missing millions.

But legal documents viewed by DL News show Elham Nourzai, a 26-year-old Dutch national known online under the pseudonym Derivatives Monke, was the main figure behind ZKasino.

Other evidence, including pictures on social media, company registration documents, and a scan of a passport shared with DL News, suggests Nourzai and Derivatives Monke are one and the same.

Nourzai, who has lashed out at previous accusations on social media, didn’t respond to a DL News request for comment.

ZKasino investors are now focused on getting their crypto back.

Previous clawback attempts from crypto projects have had limited success. But Dutch authorities making an arrest in connection with ZKasino could be a breakthrough in recovering the funds.

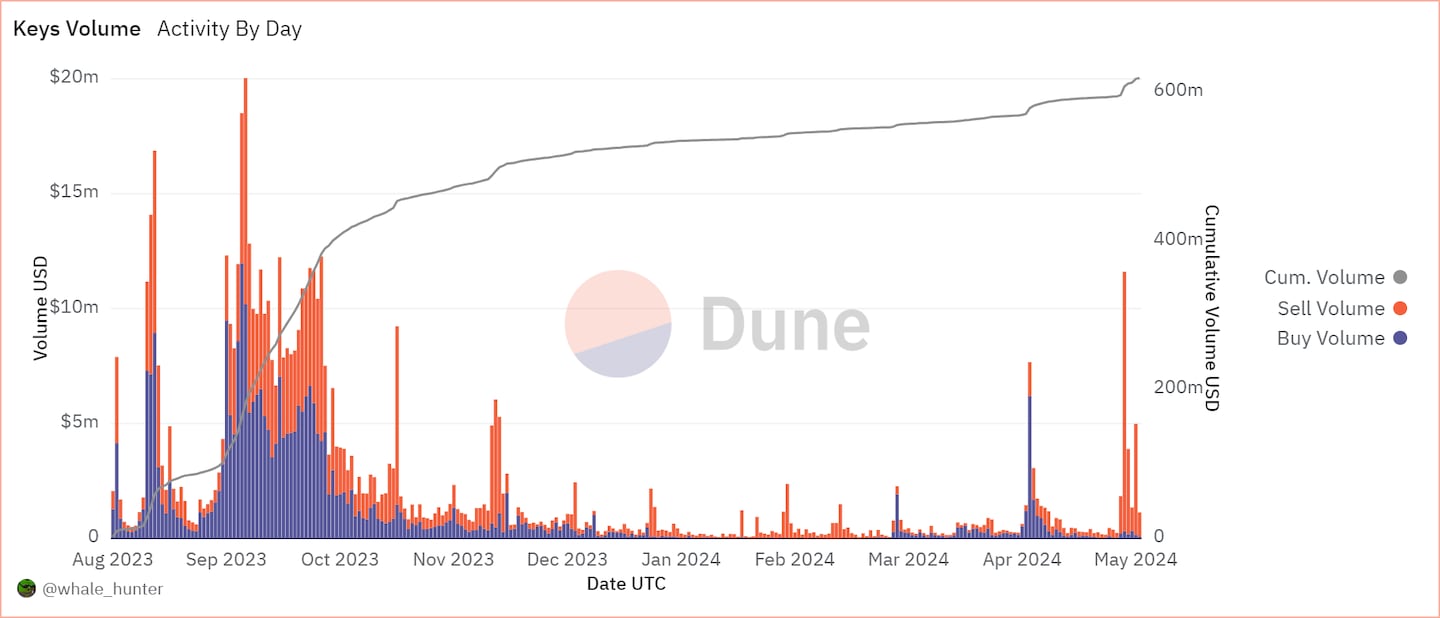

Data of the week — a friend.tech revival?

We’re keeping an eye on friend.tech activity, to see whether last week’s airdrop can revive interest in the struggling protocol.

This week in DeFi governance

PROPOSAL: Aave details ambitious “Aave 2030″ plans, including major upgrade and rebrand

VOTE: GMX considers ending multiplier points rewards

VOTE: Rocket Pool mulls contributor stipends

Post of the week

John Paul Koning weighs in on USDT issuer Tether’s gargantuan first quarter profits.

A stablecoin reporting $4.5 billion in profits in Q1 with just a few dozen employees is a great illustration of how insanely profitable it can be to engage in regulatory arbitrage of the U.S.'s AML framework.

— John Paul Koning (@jp_koning) May 1, 2024

What we’re watching...

As the launch season approaches, MakerDAO is preparing to introduce two new tokens - NewStable and NewGovToken.

— Sky (@SkyEcosystem) May 3, 2024

Explore the details below ↓ pic.twitter.com/twFAVkE1nZ

MakerDAO’s ambitious, controversial “Endgame” transformation is about to unveil some major changes.

Founder Rune Christensen believes Endgame will place Maker and its dollar-pegged, digital token DAI beyond the reach of any government, impossible to shut down or turn off. And that starts with a stablecoin to replace DAI, codenamed NewStable.

Got a tip about DeFi? Reach out at tim@dlnews.com.