GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Vitalik disses ‘ouroboros’ DeFi.

- $732 million backing the USDD stablecoin disappears.

- Everyone’s cashing in on memecoin fever.

Vitalik vs DeFi

Ethereum co-founder Vitalik Buterin ruffled feathers on social media by critiquing one of the blockchain’s biggest use cases — DeFi.

At the heart of the issue is yield — a broad DeFi term used to describe the returns users can earn on various crypto tokens.

“It feels like an ouroboros,” Buterin said in a discussion on X, referring to the snake that eats it’s own tail.

“The value of crypto tokens is that you can use them to earn yield which is paid for by... people trading crypto tokens.”

One problem, according to Buterin, is that such a system is “fundamentally capped” by demand for leveraging crypto tokens, and therefore can’t be the only activity that lures in new users.

> the yield comes from borrowers, trading fees, etc

— vitalik.eth (@VitalikButerin) August 25, 2024

Right, so this worries me. Because it feels like an ouroboros: the value of crypto tokens is that you can use them to earn yield which is paid for by... people trading crypto tokens.

Even if the answer is something clear like…

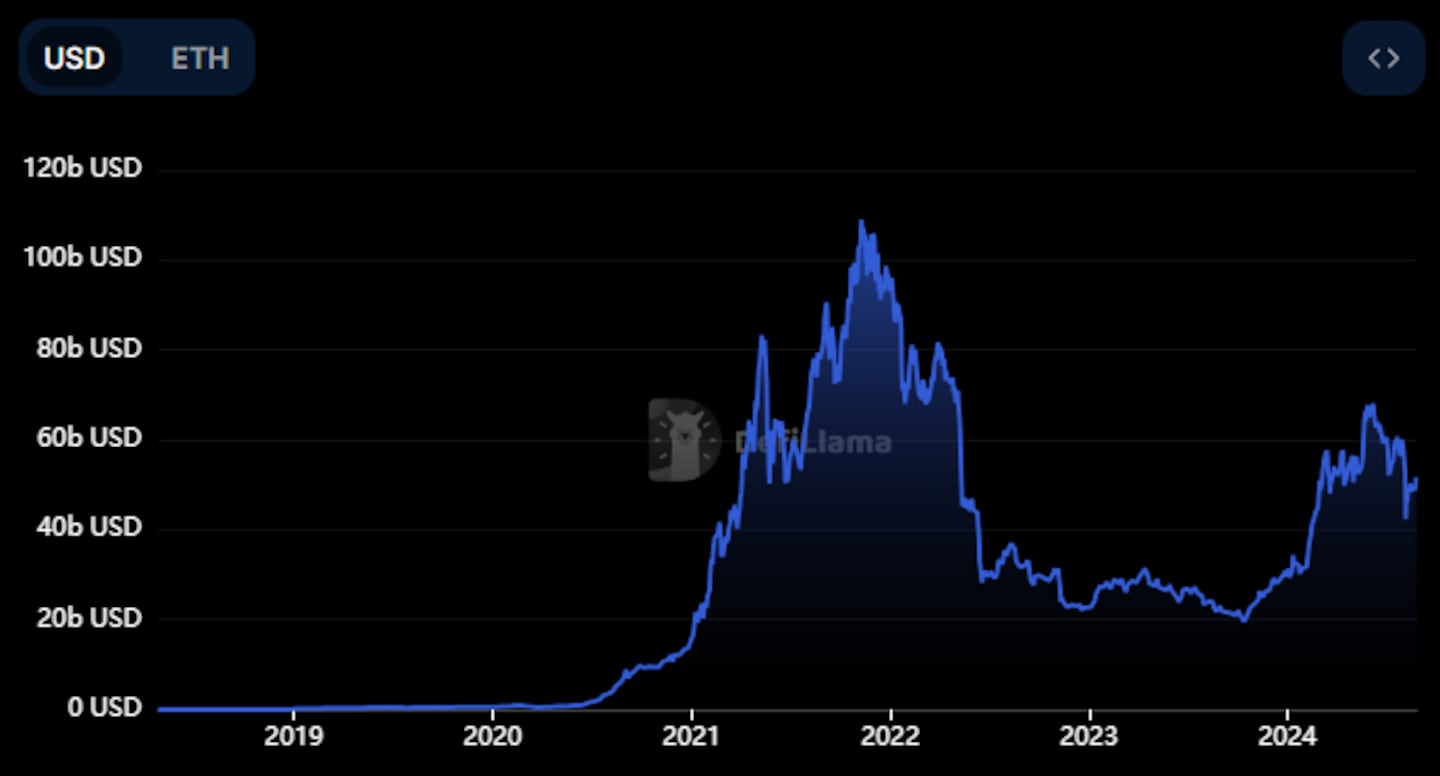

The Ethereum blockchain hosts the biggest single DeFi ecosystem in crypto, with $51 billion worth of user deposits.

However, the growth of DeFi on Ethereum — as well as many other blockchains — has stalled in recent years.

While the price of Bitcoin hit a new all-time high this year, DeFi deposits are still well below their 2021 peak.

Those pushing back against Buterin say the way yield is generated in DeFi isn’t a problem. It’s how the traditional financial system works after all.

Still, Buterin’s comments reaffirm a desire to see Ethereum meaningfully expand to other use cases, such as decentralised identity systems, credit scores, or social media.

USDD says ‘bye’ to Bitcoin

USDD, a Tron-based stablecoin, used to be backed by some $732 million worth of Bitcoin.

Not anymore.

The Tron DAO Reserve, which manages USDD, just removed 12,000 Bitcoin backing the stablecoin.

USDD is now almost entirely backed by TRX, the Tron blockchain’s volatile native crypto.

The problem, onlookers say, is that while the project claims to function as a decentralised autonomous organisation — or DAO — it didn’t conduct a vote on the Bitcoin withdrawal.

Tron founder Justin Sun said there’s nothing to worry about.

“Previously, the Tron DAO Reserve would also frequently make adjustments based on the collateral factor,” Sun told DL News, while citing his X post on the matter.

Even after the Bitcoin removal, the value of assets backing USDD is more than twice the value of the stablecoin in circulation, according to the USDD website.

Still, the Tron DAO Reserve has provided no explanation for why the Bitcoin collateral was removed. That lack of transparency, as well as other discrepancies, is an issue for some.

Stablecoin rating agency Bluechip gave USDD its lowest rating, and strongly advises against using it.

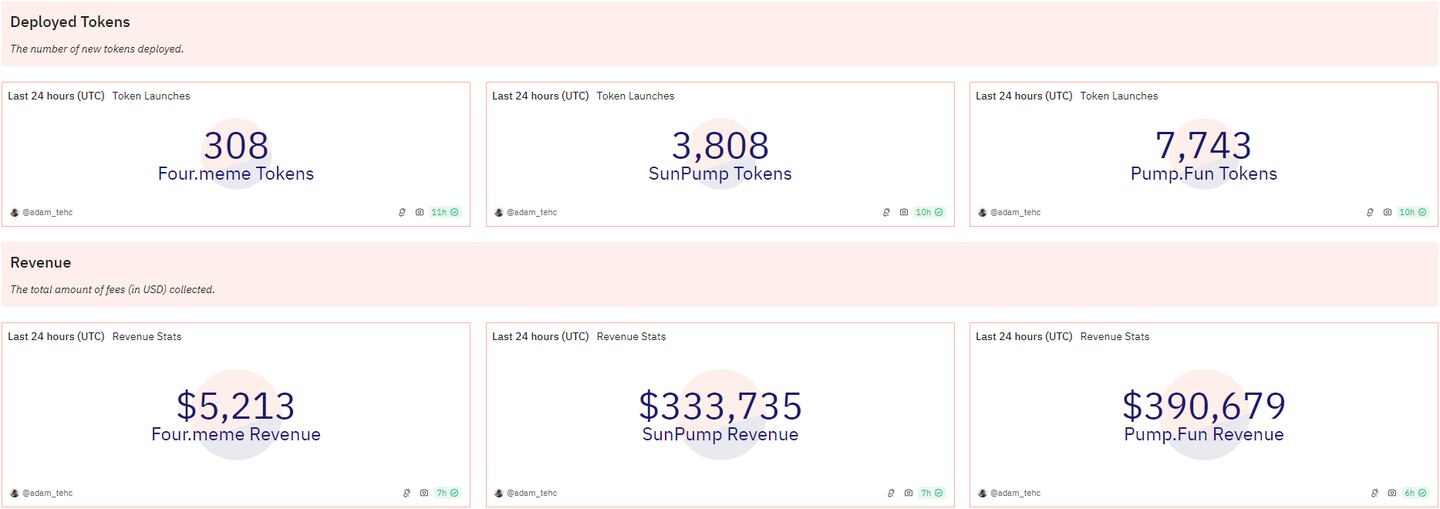

Memecoin fever spreads

Pump.fun, which allows anyone to design and launch their own memecoin for a small fee, has become one of the most profitable protocols in DeFi.

In the wake of its success, others are spinning out their own versions of the popular Solana protocol across competing blockchains.

Tron has its own memecoin platform SunPump, while the Binance-affiliated BNB Chain has one called FOUR.meme.

Trader Joe, an Avalanche-based decentralised exchange, is the latest project to swerve into memecoins.

It’s revealed Token Mill, a platform similar to pump.fun.

Trader Joe is hoping Token Mill can revive its fortunes.

The decentralised exchange, which once generated $2.6 million a week in revenue back in 2021, made less than $10,000 last week.

Pump.fun, on the other hand, made a whopping $3.4 million over the past seven days, per DefiLlama data.

Data of the week

The so-called “Memecoin wars” are heating up.

SunPump, a Tron protocol that lets users create their own memecoins, just surpassed, pump.fun, the Solana protocol it’s based on, in new tokens created.

Pump.fun still brings in slightly more revenue, though.

This week in DeFi governance

PROPOSAL: Lido to set up DAO-Adjacent ‘BORG’ for its Alliance Programme

VOTE: Will Arbitrum DAO sponsor the Ethereum Foundation’s security audit event?

PROPOSAL: Jupiter DAO discusses new Microgrants Initiative

Post of the week

DL Research sends Senior Analyst Ryan Celaj to the WebX 2024 conference in Tokyo from August 28 to 29. Be sure to reach out if you’re attending!

We are sending our greatest Kaiju @rcel1559 to represent DL Research at this year's @WebX_Asia conference in Tokyo.

— DL Research (@dl_research) August 22, 2024

Shoot him a DM to schedule a meetup and explore collaboration opportunities! pic.twitter.com/IP3TPSg5PK

What we’re watching

Soneium, a new Ethereum layer 2 blockchain developed by Japanese tech giant Sony, is teasing Wednesday August 28 as a big date for the project.

It’s not yet clear if the blockchain will launch on that date, or if the post is referencing some other upcoming announcement.

08.28.2024 pic.twitter.com/TvjnRCFVE1

— Soneium 💿 (@soneium) August 25, 2024

Got a tip about DeFi? Reach out at tim@dlnews.com.