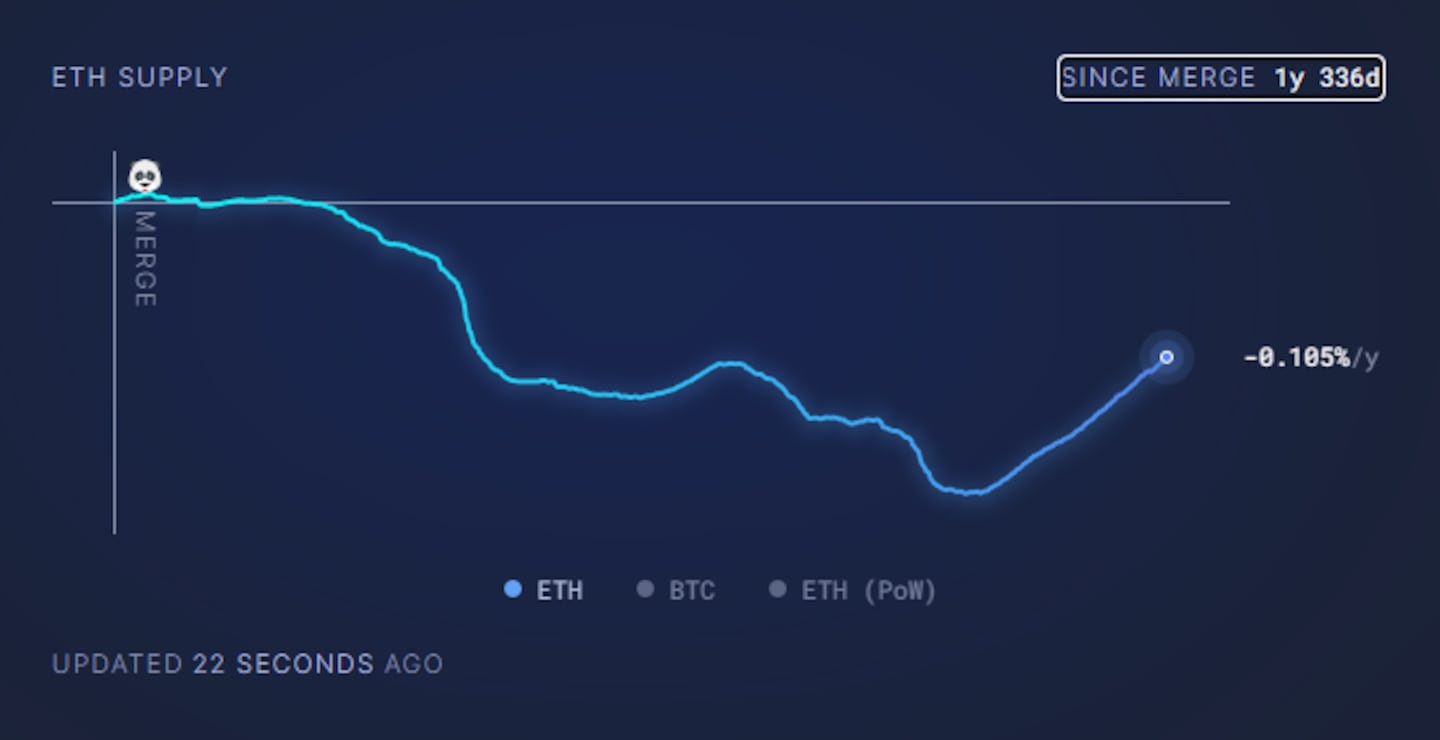

- Ether's supply has been increasing since mid-April.

- It's the result of lower transaction costs on layer 2 networks.

- Ethereum's faithful are spilt of the issue.

The extreme transaction fees that plagued the Ethereum blockchain have become a thing of the past.

In recent weeks, fees on the network have dropped as low as a single gwei — about $0.06 — for a simple transaction.

Some say that has come at a cost.

The rock-bottom fees mean that Ethereum no longer destroys — or “burns” — more Ether tokens than it creates. In other words, its economics are now inflationary — a dirty word among crypto users who often revile the money printing ingrained in the traditional financial system.

Still, some Ethereum developers don’t see it that way.

“I’m very confused that people think Ethereum having low gas fees is a problem,” Marius van der Wijden, an Ethereum core developer, told DL News.

“This is what we are working towards. The burn was, in my opinion, never meant to be an economic indicator.”

These conflicting views reveal the differing priorities of Ethereum stakeholders.

Developers are happy the network can now handle many more transactions without charging users high fees.

Some investors, on the other hand, see the inflationary economics as hurting their investment in Ether — the volatile token used to pay for Ethereum transactions.

Ultra sound money?

When users send Ethereum transactions, the Ether they pay is destroyed, or burned.

If the amount burned from transaction fees is greater than the amount of new Ether rewarded to validators for processing those transactions, the total supply shrinks and becomes deflationary.

This situation, often referred to as Ether being “ultra sound money,” is favourable for the network because it rewards those who help run it without inflating the supply of Ether.

Still, if users don’t spend enough Ether on transactions, as is the case now, the Ether supply will inflate indefinitely, breaking the network’s economic model.

“The meme of ‘ultra sound money’ is broken,” Ethereum core developer Preston Van Loon told DL News.

Van Loon said it’s all because of a March upgrade that made it much cheaper for Ethereum layer 2 networks like Coinbase’s Base or Offchain Labs’ Arbitrum to operate.

Layer 2s are separate blockchains built on top of Ethereum. In recent years, much of Ethereum’s activity has left the main network and moved over to comparatively cheaper and faster layer 2s.

Some worry that the move to layer 2s means Ethereum will never be deflationary again.

“Layer 2s will constantly manoeuvre around each other to avoid creating a high fee environment for themselves,” 0xbreadguy, a pseudonymous DeFi developer, said in a widely circulated X post.

The result? Fees on Ethereum will remain low unless the network increases transaction demand significantly.

Van Loon said he’s “not totally convinced” by the argument.

He said he believes that as Ethereum grows through layer 2 networks, more and more activity will eventually funnel up to Ethereum mainnet.

“Mainnet will become the settlement layer and a place for end users to hold assets for long-term storage, while layer 2s become the user activity layer,” he said.

Make Ethereum deflationary again

Among those who believe the low transaction fees are an issue, there’s a popular solution: Get more users to transact on the Ethereum mainnet.

“You have to balance scaling through layer 2s with keeping your power users on mainnet — not pushing them off indiscriminately to one of a dozen ecosystems,” 0xbreadguy said.

That could be a hard sell. No matter how well Ethereum balances demand, transactions on layer 2s will always be cheaper.

Martin Köppelmann, founder of Ethereum sidechain Gnosis, said one way to increase mainnet use is by raising the network’s gas limit.

Doing so would increase Ethereum mainnet’s transaction capacity and reduce fees. But it also runs the risk of raising operational costs for validators — those running the software that helps process transactions on the network.

Ethereum co-founder Vitalik Buterin also suggested raising the gas limit during a January “Ask Me Anything” session on online forum Reddit.

Whatever solution the community chooses, they need to do so fast.

As more DeFi protocols and users switch to layer 2s, it’s less likely they will want to move back.

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out with tips at tim@dlnews.com.