- DeFi lending protocol Euler Finance suffered a $200 million loss due to an exploit in March, which it not only recuperated but also gained from the subsequent price appreciation.

- Since the exploit, Euler has been inactive, but there are plans for a relaunch slated for this year.

- Separately, the protocol's co-founder encountered a personal loss of around $3.8 million in the protocol's governance tokens.

Update, January 30: Euler co-founder Michael Bentley later told DL News that he managed to regain access to his tokens. This story remains unchanged, but the update has been covered on The Decentralised newsletter on January 30.

DeFi lending protocol Euler Finance navigated one of crypto’s largest heists last year and managed to recover assets amounting to $240 million — more than what it lost.

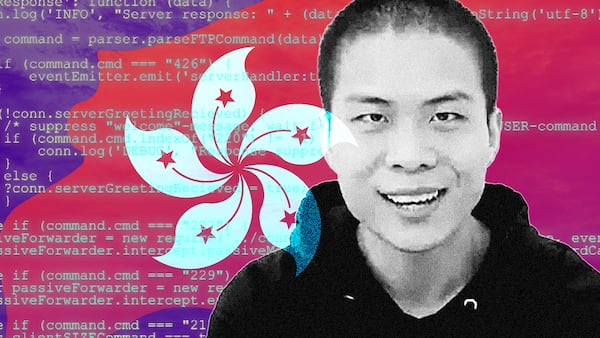

But its co-founder Michael Bentley’s personal experience tells a different tale.

In a first-person reflection note shared with DL News, Bentley detailed his ordeal of balancing professional crises and personal affairs, including his son’s birth and family illnesses.

He said his recent misfortune in November involved a malfunction in his personal crypto wallet and the subsequent loss of the private key necessary for fund recovery.

“Somewhere in between the birth of my son, our exploit recovery efforts, personal and family illnesses, I made an error and it turns out that one of the private keys is no longer recoverable,” he said in a note shared with DL News.

“I’ve now lost a substantial percentage of the crypto assets I held in cold storage, accumulated over more than seven years, including the majority of the EUL allocated to me for participating in Euler governance.”

EUL, short for Euler, is the governance token of Euler Finance. Governance tokens grant their holders the ability to vote on and propose changes within a DeFi project. These token also carry a dynamic market price and can be traded on cryptocurrency exchanges.

Bentley’s approximately 1.2 million EUL tokens, representing 4.4% of the total token supply, mean that he lost $3.8 million in today’s price.

In September 2022, when the token’s price peaked at $12.78, his holdings would have been worth about $15 million.

His personal misfortune adds a new dimension to the story of Euler Finance, a DeFi lending protocol by the UK-based company Euler Labs.

The protocol faced one of the most significant heists of crypto in March, enduring a $200 million loss due to a code vulnerability exploit. After a puzzling turn of events, Euler recouped $240 million, benefiting from an appreciation in the value of the recovered holdings.

The difference in the value between the amount initially lost and later recovered by Euler was due to the hacker swapping the stolen funds from dollar-pegged stablecoin USDC to Ether, which appreciated between the hack and Euler recovering the funds.

The exploiter’s on-chain messages over the summer pointed to the social media accounts of a 20-year-old Argentinian named Federico Jaime.

Jaime told DL News in July that he was indeed the exploiter and currently imprisoned in a French jail over an unrelated money-laundering case. DL News could not independently verify his claims, and Bentley declined to comment.

To compensate for the personal loss, Bentley is planning an appeal to the protocol’s DAO with a proposal.

“Ultimately I take responsibility for whatever happens next. I would have once found this outcome absolutely devastating, but the earlier events of the year really helped put the important things in life into perspective for me,” he said.

But, Bentley said, he’s currently entirely focused on the upcoming relaunch of Euler Finance, which has remained inactive since the exploit.

Update, January 12: Bentley’s governance token allocation has been corrected from 120,000 EUL to 1,200,000 EUL.