- Modular blockchain Celestia announces launch and token airdrop.

- Su Zhu's arrest in Singapore may benefit Three Arrows Capital's creditors.

- DAO rage quits are becoming more and more common.

A version of this story appeared in our The Decentralised newsletter. Sign up here.

Hey, Tim here.

The slew of blockchains coming out over the past year has left most DeFi denizens apathetic to new launches. There was Aptos, Sei, and Sui, not to mention about half a dozen new Ethereum layer 2s.

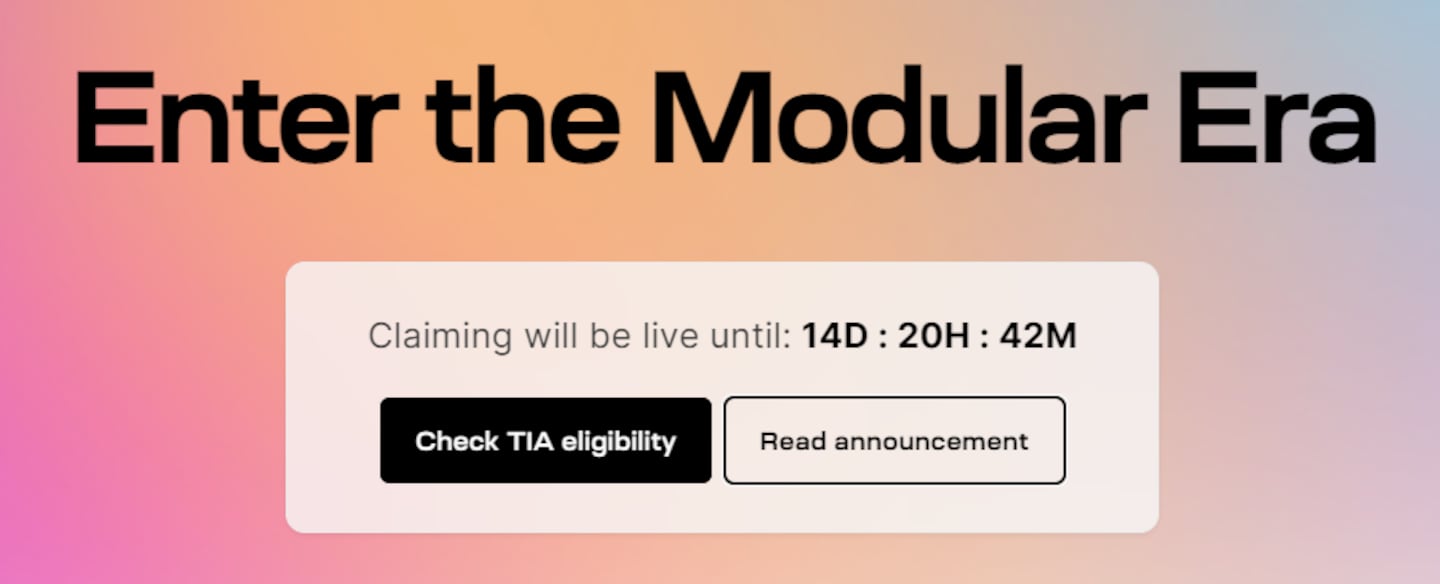

Another contender, Celestia, just announced it’s about to join the fray.

Even if you haven’t been paying attention to Celestia, you could still be eligible for an airdrop of its TIA token if you’ve been an active user on one of Ethereum’s many layer 2 networks.

Token airdrops have proven themselves as a great way to bootstrap users and liquidity — look no further than the top layer 2 Arbitrum. But as other new launches show, dishing out valuable tokens doesn’t always guarantee success.

Celestia probably has a better shot than most because its focuses on something unique: modularity.

This means that instead of one blockchain doing everything, Celestia uses interconnected modules that are each responsible for specific functions.

According to Celestia, this specialization provides breakthroughs in scalability, flexibility, and interoperability. That’s worth paying attention to.

The arrest of Three Arrows Capital co-founder Su Zhu last week offers a few lessons.

Among them: going on a soul-searching trip to Bali and then spinning up another crypto business isn’t enough to shirk responsibility for the collapse of your $3 billion trading firm.

Zhu’s arrest in Singapore weighed heavily on his latest venture OPNX — a crypto exchange that also lets users buy and sell bankruptcy claims for FTX, Voyager, and, ironically, Three Arrows Capital. Its token, OX, crashed over 44% on the news and shows little sign of recovering.

On the bright side, those who lost money lending to Three Arrows Capital may have a better chance at getting some of it back now Zhu is being forced to cooperate with liquidators.

Singapore authorities also have an arrest warrant for Kyle Davies, the other Three Arrows co-founder. He was last seen in Dubai, where he planned to open a restaurant focusing on chicken-based cuisine.

Lastly, Osato Avan-Nomayo wrote up another story on DAO rage quitting, this time at Jade Protocol.

Rage quitting is becoming more and more common among DeFi protocols.

There are dozen of DAOs that raised funds, often by selling tokens, tried to make something work, but failed. Many still have sizable war chests left. Now, token holders are increasingly voting to dissolve what’s left to recoup some of their losses.

I expect the DAO rage quits to continue. There’s still many more DAOs in similar positions, and with increased competition for a declining pool of blockchain-based liquidity, it’s going to get harder for many projects to justify burning investors’ cash.

That is, as long as token holders have the motivation to hold team members accountable.

Data of the week

Crypto projects have airdropped users a whopping $2.2 billion worth of tokens in 2023 so far.

Airdrops have not only become a way for projects to acquire users and cut out middlemen (as @0xren_cf points out), but also to efficiently decentralise ownership.

Including Celestia, there has been $2.2 billion of airdrops in 2023

— ren (wassie arc) (@0xren_cf) September 26, 2023

You might think this is outrageous but airdrops are just a new form of customer acquisition that gives ownership to users by cutting out ad middlemen

For context, mobile games spent $27B on ad spend in 2023 pic.twitter.com/bepKy3Z6KK

This week in DeFi governance

PROPOSAL: Uniswap Foundation requests $62 million second tranche of funding

PROPOSAL: Aave plans to activate v3 governance

VOTE: MakerDAO’s Spark Lend to launch on Gnosis Chain

Post of the week

Pseudonymous Yearn Finance developer Banteg has put together a heatmap of over 2.1 billion native Ether transfers.

Hidden within the noise are transfer patterns which visualise liquidation cascades and likely Sybil attacks over the past seven years of Ethereum activity.

For me, the trademark purple hue makes Banteg’s chart all the more mesmerising, and shows how with the right approach, data doesn’t have to be soulless and dry — it can be beautiful, too.

the entire history of ethereum

— banteg (@bantg) September 28, 2023

if you want to learn how this chart was made, read my new article.https://t.co/cdoZeKIqEO pic.twitter.com/pbNvIBW6cm

What we’re watching

FTX’s bankruptcy proceedings entered a new stage last week when the courts gave the defunct crypto exchange the go-ahead to start liquidating its crypto holdings.

But former customers are increasingly worried that FTX’s new management may try and clawback funds from those who exited the exchange in the 90 days before its collapse.

As @0xg00gly points out, the precedent set in the liquidation of crypto lender BlockFi may protect those who withdrew less than $250,000 or are based outside the US.

Have you joined our Telegram channel yet? Check out our News Feed for the latest breaking stories, community polls, and of course — the memes. https://t.me/dlnewsinfo

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out to him with tips at tim@dlnews.com.

Disclosure: Tim holds over $1,000 worth of Ether, Swell staked Ether, Redacted Cartel, and GMX. He also holds an insignificant amount in NFTs.