- Aave's founder told DL News how decentralisation opens doors for competition.

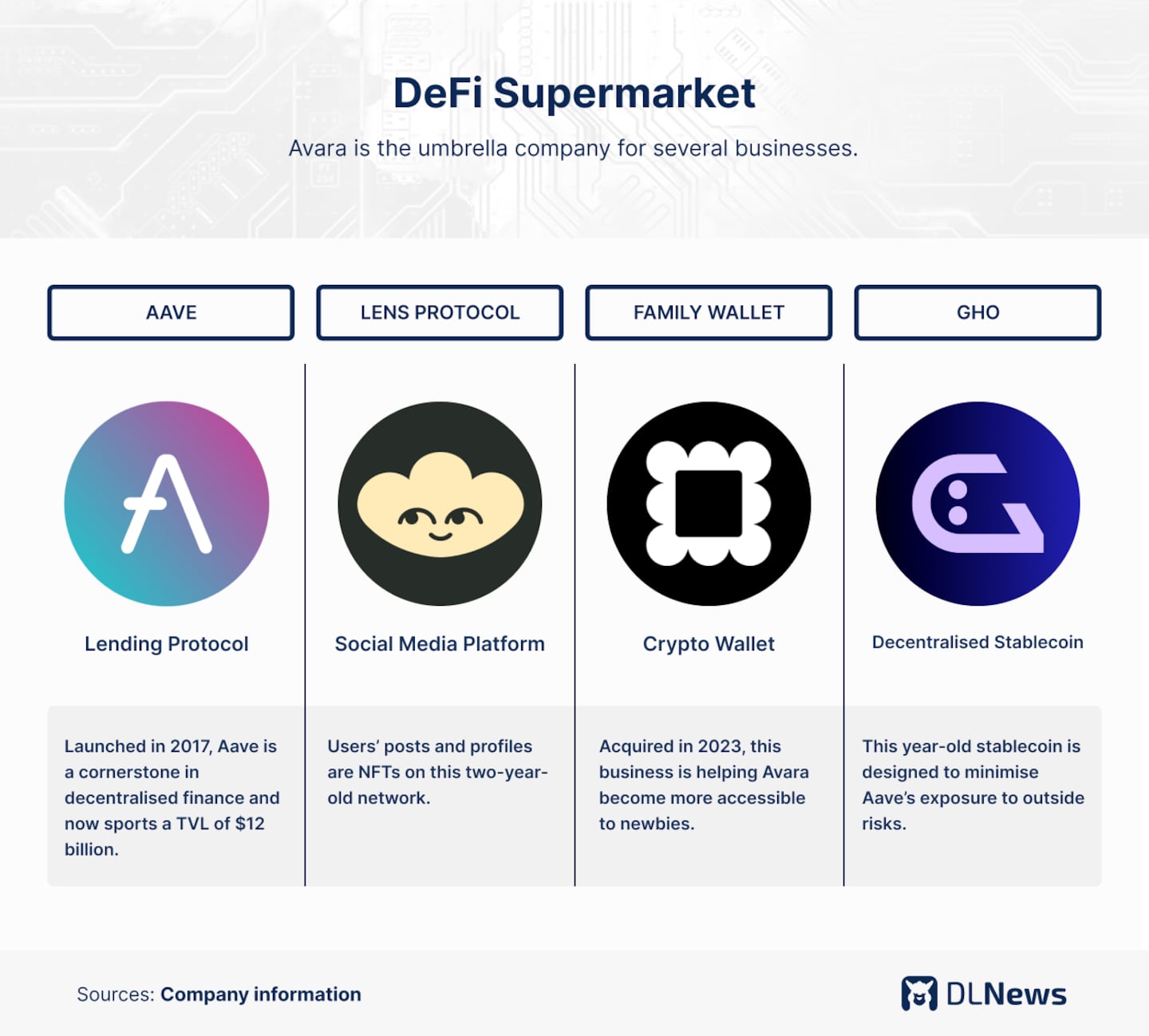

- Aave has morphed into a DeFi supermarket with a wallet, social media channel, and a stablecoin.

- Managing the complexity of new corporate structure brings challenges.

Aave Labs built its brand over the last seven years by setting up a no-frills lending platform.

It shunned complexity and weathered the 2022 bear market as a steady DeFi banking business.

Now Stani Kulechov, the venture’s Finnish founder, is turning Aave into a DeFi supermarket.

It comprises a stablecoin, called GHO; a crypto wallet called Family; and Lens Protocol, and a social media network that is in the process of raising $50 million from investors.

Along with Aave’s lending business, those units are now housed in a new parent company called Avara, based in London.

The moves are ramping up Aave’s rivalry with several DeFi ventures.

“Obviously, the point of a decentralised system is that there’s always open doors for competitors,” Kulechov told DL News.

None figures more prominently than MakerDAO, the seven-year-old stablecoin issuer that has long moved in lockstep with Aave. Even as Aave added new businesses, so too has Maker.

‘Every single person on the planet has social capital.’

— Stani Kulechov, Aave

In his bid to scale, Kulechov is swapping a simple model for a more complicated ecosystem.

Kulechov told DL News this won’t be an issue. By building a one-stop shopping platform, Avara will meet the needs of both DeFi newcomers and veteran crypto users.

“Every single person on the planet, across every language, every nation, every location has social capital,” Kulechov said.

“If we can solve the idea of owning what’s yours online, that fundamentally unlocks more value.”

So far, Kulechov and the Aave team have proved adept at unlocking value.

By charging users fees to borrow, lend, liquidate loans, and make deposits, Aave recorded about $100 million in revenue in the last 30 days, according to data from TokenLogic.

Aave’s total value locked, or deposits, has more than doubled in the last 12 months, to $11 billion, DefiLlama data shows. Aave, active on a dozen different blockchains, leapfrogged MakerDAO this year to become the third most valuable DeFi project.

Building a walled garden for Aave users may sound counterintuitive, but it makes sense, said Drew Osumi, co-founder of the venture studio Number Group.

“If Avara has social, wallet, lending, and stablecoin, I feel like there is a world where if someone is entirely new to crypto, they could see that as an easy onboarding experience,” Osumi told DL News.

“It feels like the grand plan is to be a permissionless and decentralised Meta, where users are actually valued at market value.”

Still, why does the world need another social media platform?

”The big idea probably won’t be to replace Twitter,” Kulechov said. “What’s going to be interesting is having a shared network that’s open, anyone can build, and there are users there today.”

Lens Protocol lets developers build Instagram-like apps and imbue them with crypto features.

It caters to NFT collectors by turning profile pics and user handles into nonfungible tokens. It also lets decentralised autonomous organisations, or DAOs, propose and vote on key issues for their community directly on Lens.

DeFi rivals

Aave and Maker have been the bedrock of decentralised finance since the ICO era of 2017. Both have enjoyed the meteoric rallies in crypto, and both endured market collapses.

The two have often collaborated even as they competed.

This duel peaked with competing stablecoins.

Maker issues DAI, the oldest decentralised stablecoin in DeFi. Aave started issuing its own stablecoin, GHO, in July 2023.

Both stablecoins are pegged to the dollar and are overcollateralised by other cryptocurrencies. Minting $1 of either stablecoin, for example, means you’d need to put more than $1 in another cryptocurrency such as Ethereum.

It’s a market expected to grow to $3 trillion in the next five years, according to analysts at Bernstein.

“Stablecoins are the biggest market opportunity in crypto,” said Lito Coen, head of growth at Socket Protocol, a cross-chain bridge protocol. “If you tackle another market after lending, stablecoins are the most logical expansion.”

Extreme volatility

With GHO, Aave is also making a competitive play. This is because Maker launched its own lending protocol, Spark, in 2023.

“GHO makes a lot of sense, especially when one of the biggest overcollateralised stablecoins directly launched a competitor with Spark,” said Coen.

The battle lines became clearer in April when the Maker community proposed backing $1 billion in DAI with a new and untested stablecoin issued by Ethena, a platform on the Ethereum blockchain.

Called USDe, the asset supports its $1 peg differently than GHO or DAI.

Rather than being overcollateralised, it’s backed by staked Ethereum and short Ethereum positions on exchanges that make money if the price of Ethereum drops. It’s a novel scheme but unproven in extreme market volatility.

For Aave, the advent of the Ethena market meant a lot of risk. If USDe buckled due to the market crashing, there was concern that DAI would also lose its peg.

With more than $130 million worth of DAI in Aave, that was a risk the Aave community couldn’t stomach.

1B $DAI

— Marc “Billy” Zeller 👻 🦇🔊 (@lemiscate) April 2, 2024

- minted out of thin air (20% of whole supply)

-into a non-battle tested protocol

-with zero risk mitigation

-weak oracles in less than a month

-for asset hyper sensible to market conditions

is the definition of reckless

Will propose LTV reduction of DAI in Aave today

In April, Marc Zeller, founder of a DeFi governance project called Aave Chan Initiative, proposed eradicating all DAI markets on Aave.

Kulechov agreed.

“The offboarding process should start immediately in case of favourable outcome,” Kulechov wrote in the Aave forum.

Kulechov chalked up the episode to risk management rather than head-to-head competition.

“There was a significant increase in the risk perception of DAI,” he told DL News. “If that risk is going to increase, the best thing to do is the most conservative thing.”

Meanwhile, Kulechov’s Lens Protocol is confronting competition from another crypto-powered social media protocol called Farcaster.

The two offer many of the same features, but Lens stores more activity — likes, follows, and posts — on the blockchain than Farcaster. Farcaster opts for speed and user experience.

Farcaster has a big lead so far, boasting almost 600,000 users compared to Lens’ 430000. It also recently closed a $150 million round at a $1 billion valuation led by Paradigm and joined by Andreessen Horowitz, USV, and other top VCs.

‘It’s a completely different sector within crypto, much less proven.’

— Lito Coen, Socket

Yet the staying power of both social media ventures remains to be seen.

“The most uncertain for me is Lens,” Socket’s Coen said. “It’s a completely different sector within crypto, which, in general, is much less proven.”

New fundraising round

Kulechov hopes so, too.

In June, DL News reported that he is pitching a new fundraising round that would value Lens at $500 million.

“I’m a big fan of what Stani is doing with Avara,” Coen said. “I don’t think enough teams are thinking big and trying to scale horizontally.”

For all of the novel technology and business models in DeFi, Kulechov’s moves show how old-fashioned product development and new markets are key to growth.

“We like progressing from building infrastructure to thinking of what are these businesses and also interfaces we can build,” Kulechov said.

Liam Kelly is a DeFi correspondent at DL News. Reach out at liam@dlnews.com.