A version of this article appeared in our The Decentralised newsletter on August 6. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Aave just made $6 million from liquidations.

- Solana gets a prediction market.

- New exchanges want to make DeFi easier to use.

Aave users get liquidated

Top DeFi lender Aave is up $6 million amid the most extreme crypto market selloff since 2022.

The protocol’s liquidators sold over $237 million worth of collateral put up by traders as crypto crashed some 15% on Monday.

The top collateral assets liquidated include:

- $92 million Wrapped Ether

- $34 million Lido Wrapped Staked Ether

- $6.6 million Wrapped Bitcoin

Aave holds almost $10 billion worth of deposits across 12 blockchains, per DefiLlama data.

Aave founder Stani Kulechov celebrated his protocol’s performance on X.

Aave Protocol withstood market stress across 14 active markets on various L1s and L2s, securing $21B worth of value.

— Stani.eth (@StaniKulechov) August 5, 2024

Aave Treasury was rewarded with $6M in revenue overnight from decentralized liquidations for keeping the markets safe.

This is why building DeFi is FTW.

Aave lets liquidators sell its users’ collateral when their positions become unhealthy.

This usually happens when a user puts up volatile collateral, such as Ether, and borrows other crypto assets, like stablecoins, against it.

If a user’s collateral falls in value, Aave lets liquidators sell it to recoup the protocol’s debt.

Liquidators realise a small profit from doing so, 10% of which is sent to the Aave DAO.

But liquidators don’t always stop Aave from losing money.

In November 2022, Aave was saddled with $1.6 million of bad debt after convicted crypto trader Avraham Eisenberg was liquidated as part of an alleged attack on the protocol.

A new prediction market

Drift Labs, the firm behind the Solana trading platform Drift protocol, attempts to cash in on the demand for election betting.

It’s launching a new prediction market to challenge Polymarket’s dominance.

The potential rewards are big.

Polymarket recently hit $1 billion in betting trading volume.

And Drift has an ace up its sleeve: The $5.2 billion of deposits on Solana, the blockchain the new market runs on.

Polymarket’s home, Polygon, has less than $900 million deposits in comparison.

Still, breaking into the lucrative prediction market sector will be tough.

The Polymarket brand has become synonymous with prediction markets and has appeal beyond crypto users.

Making DeFi simpler

DeFi is still difficult to use, but two upcoming exchanges want to lure users by making it easier.

Infinex and X10 want to do away with clunky tasks like calculating gas fees and managing private keys.

They’re leaning into social account signups, like using existing Google accounts to sign up, to streamline onboarding and reduce friction.

Each exchange is taking a different approach.

On Infinex, co-founded by Synthetix’s Kain Warwick, users trade through accounts on the exchange rather directly from their crypto wallet.

Users retain control of their assets and can still withdraw them to their own crypto wallets.

X10, the brainchild of Revolut’s ex head of Crypto Ruslan Fakhrutdinov, does something a little different.

When users join with a Google account, they get a new account that automatically generates and interacts with a wallet behind the scenes.

But making their exchanges easier to use is only half the battle.

The market for DeFi exchanges is packed.

Dozens have tried and failed to take users away from incumbents like Hyperliquid and dYdX, as well as centralised exchanges such as Binance.

Both Infinex and X10 await full launches later this year.

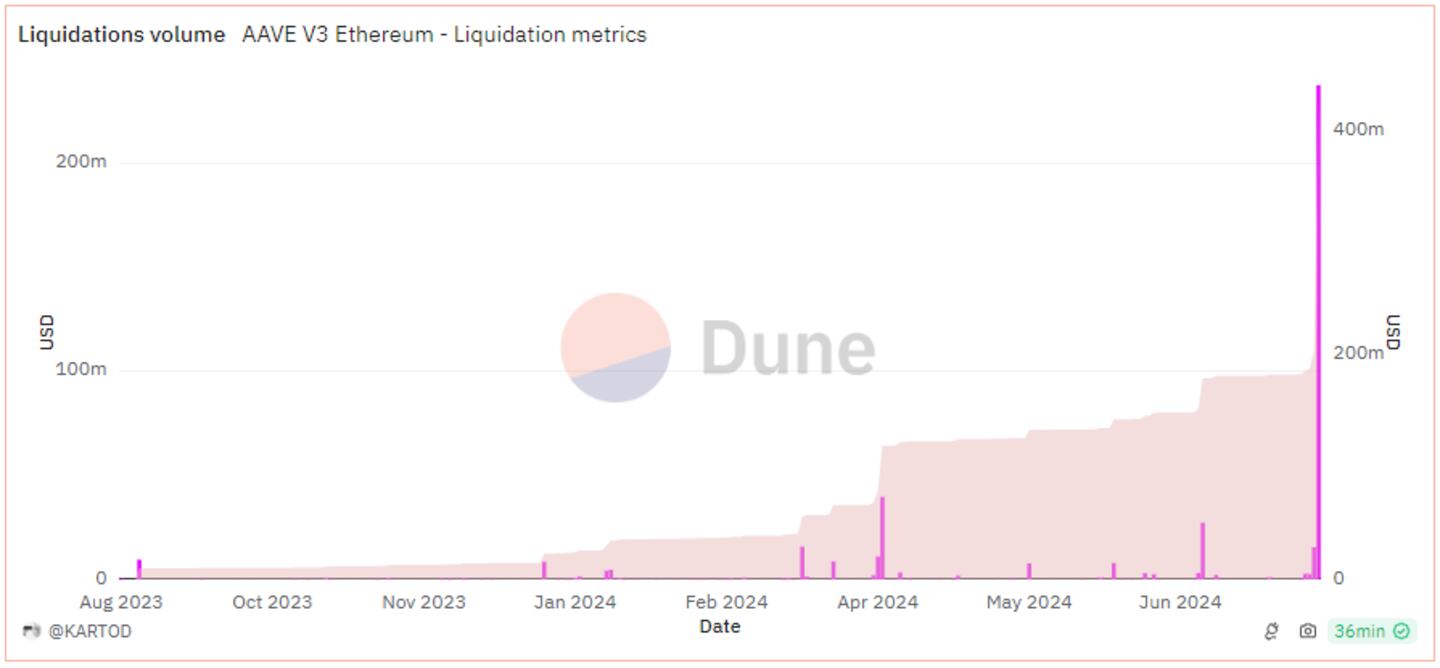

Data of the week

Monday’s market wipeout more than doubled the total amount of liquidations on Aave’s v3 version.

Users suffered $237 million of liquidations, bringing Aave v3′s total liquidated amount to over $441 million.

This week in DeFi governance

VOTE: Lido DAO wants to establish a delegate incentivization programme

TEMP CHECK: Uniswap DAO vote on OKX chain deployment

VOTE: Arbitrum DAO mulls temporarily pausing incentive programmes

Post of the week

The crypto industry is watching closely to see if Federal Reserve Chair Jerome Powell will cut interest rates — something widely viewed as bullish for prices.

Pseudonymous crypto comedian Gwart plays on the situation by referencing last month’s $87 million spending report from Polkadot.

Powell would have gone ahead and cut rates if he hadn’t seen that Polkadot marketing spend a couple weeks ago

— Gwart (@GwartyGwart) July 31, 2024

What we’re watching

Shocker, Sen. Elizabeth Warren doesn’t like election prediction markets, despite the clear public benefit from real-time information.

— Alexander Grieve (@AlexanderGrieve) August 5, 2024

Now we’re just opposing innovation for opposition’s sake. How is this serving your constituents? pic.twitter.com/snSc8rp7Ek

In the next leg of her crypto crusade, Democratic Senator Elizabeth Warren is going after political betting markets like Polymarket.

Got a tip about DeFi? Reach out at tim@dlnews.com.