A version of this article appeared in our The Decentralised newsletter on June 18. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Why adopting stablecoins could help the ballooning US debt.

- The ZK token launch causes congestion.

- Tapioca DAO rolls out an Andre Cronje-inspired airdrop.

DeFi and US debt

More politicians are arguing that dollar-backed stablecoins could be the answer to the US government’s $33 trillion debt.

Former speaker of the house Paul Ryan is the latest. He made the case for taking stablecoins seriously in a June 13 opinion piece for the Wall Street Journal.

He said promoting dollar-backed stablecoins could cause a “durable increase in demand for US debt” at a time when previous big buyers are retreating.

This is because to issue dollar-backed stablecoins, companies like Tether must hold dollars or dollar equivalents like US debt in reserve.

Stablecoins are the lifeblood of DeFi. Traders often look at stablecoin supply to gauge market sentiment.

Policymakers deciding to take stablecoins more seriously and expediting a regulatory framework for them should benefit DeFi.

Others have also noticed the trend.

“Many Republicans recognise the strategic advantages of a private-sector US dollar stablecoin,” Pranav Kanade, a portfolio manager at VanEck’s Digital Assets Alpha Fund, previously told DL News.

ZK launch clogs network

Airdrop recipients rushing to claim ZKsync’s ZK token congested the network Monday morning, calling into question the network’s ability to scale.

As with several previous airdrops, Remote Procedure Calls — or RPCs — were the main bottleneck.

(1/2) The network is currently under high load. Some RPC services may experience degraded performance.

— ZKsync (∎, ∆) (@zksync) June 17, 2024

Teams are working to increase RPC capacities.

Stay tuned for updates.

RPCs are protocols that let users do stuff involving different servers, like sending transactions to blockchains.

At 8 am London time, claims for 3.6 billion ZK tokens opened for almost 700,000 addresses.

According to the ZK Nation X account, more than 45% of the airdropped ZK token supply was claimed by over 225,000 addresses in the first two hours.

ZKsync is a blockchain built on top of Ethereum and uses zero-knowledge proofs to offer faster transactions with lower fees.

Tapioca’s options airdrop

Tapioca DAO, a fledgling money market protocol built on LayerZero, is trying something different to deal with airdrop attackers.

Instead of handing out free tokens, its airdrop will give users the ability to buy its native token at a discounted price using call options.

The plan appears to be working. Since the airdrop began on June 14, the protocol has brought in over $1.5 million.

Tapioca DAO co-founder Matt Marino previously told DL News the inspiration for the airdrop came from Andre Cronje, the so-called DeFi godfather behind protocols Yearn Finance, Keeper Network, and Solidly.

“He talked about call options, and I was a big fan of Keeper Network,” he said. “I just really agreed with the principle of what he was talking about, and we just ran with it.”

Cronje first floated the idea of incentivising using call options in 2021.

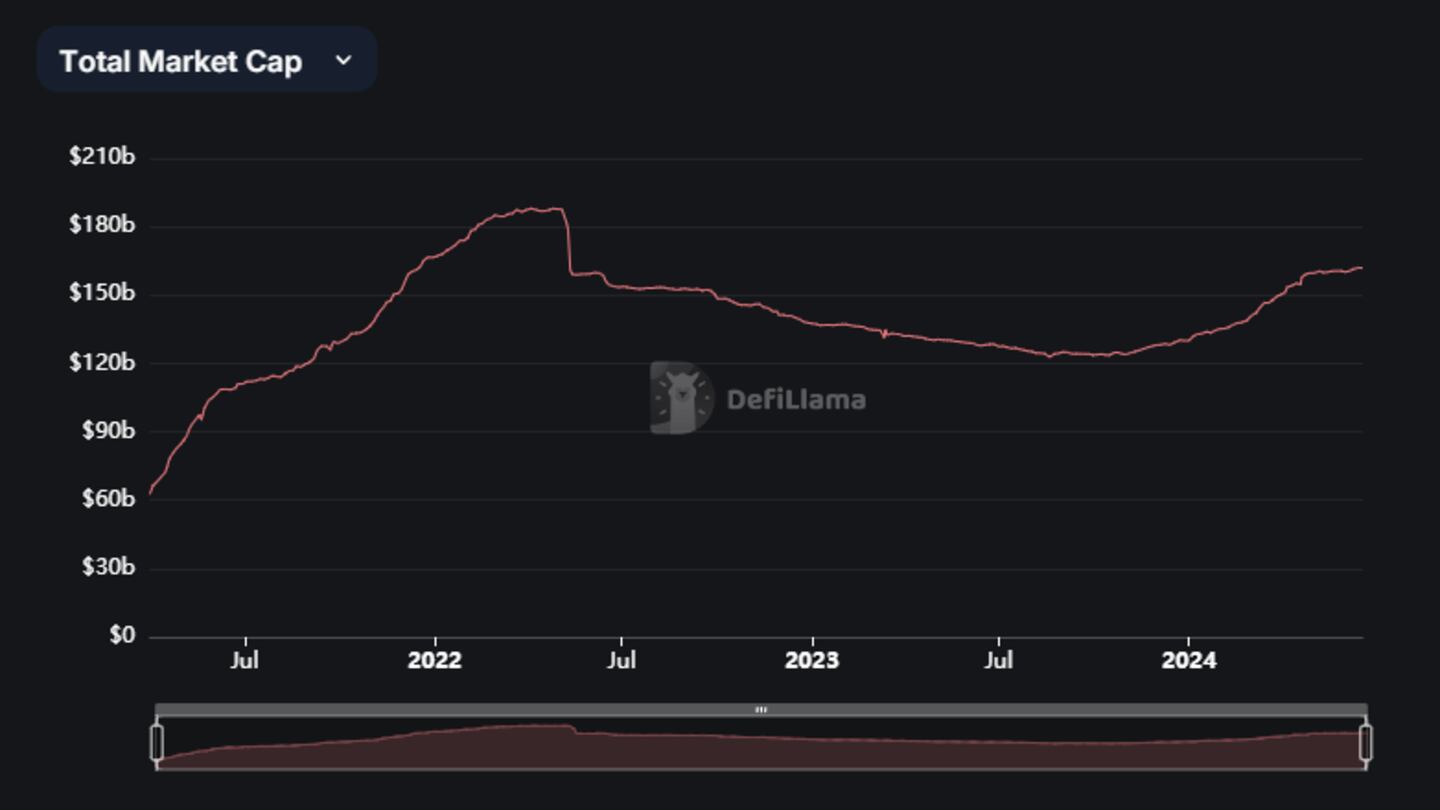

Data of the week

The increase in the total market value of stablecoins has slowed after strong growth through the end of 2023 and start of 2024.

Tether’s USDT and Ethena’s USDe have buoyed the metric over the past month, while other stablecoins, like Circle’s USDC, suffered a 3% decline.

This week in DeFi governance

VOTE: Jupiter DAO to fund new Uplink Working Group

PROPOSAL: ACI proposes Aave V3 deployment on ZKsync

VOTE: Seamless DAO votes to adjust interest rates for WETH

Post of the week

Coin Center’s Neeraj Agrawal jokes that President Biden could start sporting a Milady NFT profile picture — a symbol of degen crypto culture — to match Donald Trump’s recent pro-crypto posturing.

i believe there is a Biden campaign staffer currently working up the courage to suggest a milady pfp

— Neeraj K. Agrawal (@NeerajKA) June 13, 2024

What we’re watching

Will process the data and produce a research piece on the events triggered by CRV liquidation shortly. Will be about determining safety parameters of soft liquidations and price oracles.

— Michael Egorov (@newmichwill) June 16, 2024

The research will be applied right away on @CurveFinance

Curve co-founder Michael Egorov promises a post mortem after the liquidation of his leveraged CRV token position on Curve Lend caused $10 million of bad debt.

Disclaimer: The two co-founders of DL News were previously core contributors to the Curve protocol.

Got a tip about DeFi? Reach out at tim@dlnews.com.