- Two-thirds of DeFi stalwart's interest rate revenue stem from real-world assets, say analysts.

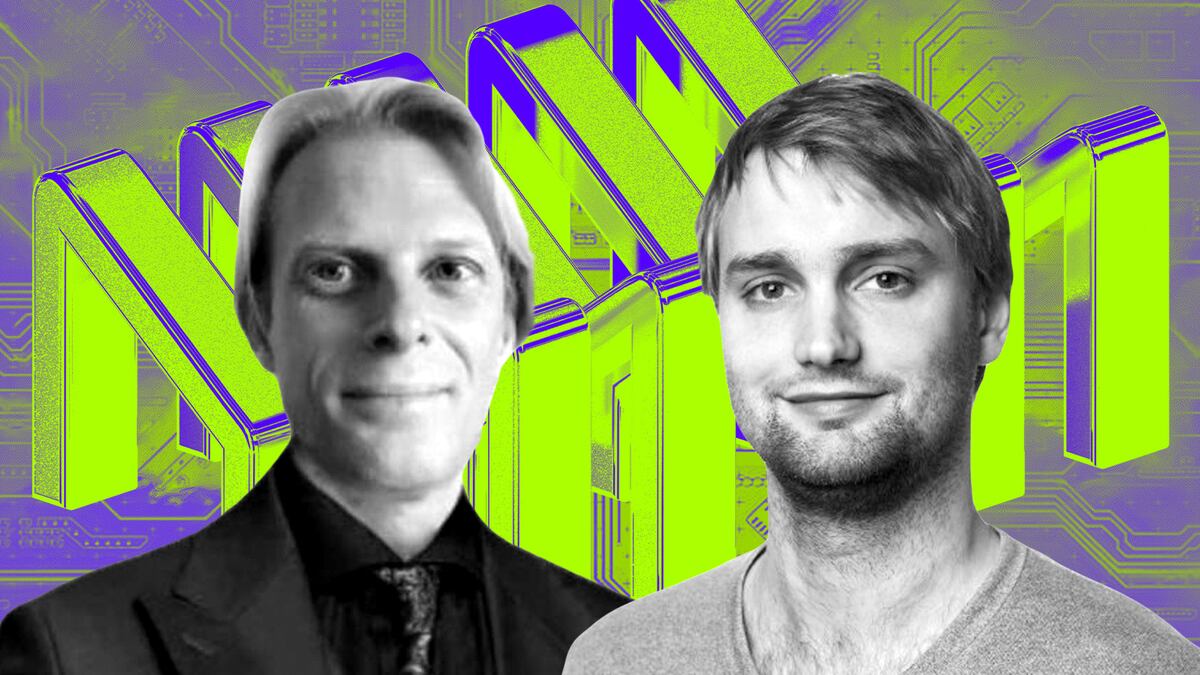

- Allan Pedersen, CEO of Monetalis Group, tells DL News that Maker could move into high-yield private credit.

- MakerDAO has defied the malaise in crypto with its careful approach.

MakerDAO, the second biggest DeFi protocol with $8.4 billion in deposits, is that rare thing in crypto — a venture that’s played it safe and is now poised to rake in profits.

Now the protocol might want to up the stakes by going after the double-digit yields on offer in the $1.5 trillion private credit market, said Allan Pedersen, the CEO of Monetalis Group, an asset management firm that specialises in connecting DeFi with traditional finance.

“To get a little bit higher yield, we would imagine that MakerDAO would start going into private credits and collateralised loan obligations,” Pedersen told DL News.

The key for Maker: leveraging its expertise in real-world assets.

Revenue generator

Maker boasts real-world assets exposure of $3.5 billion, according to the latest report by DAO analysis service Steakhouse Financial. Maker’s real-world asset vault is the protocol’s biggest business — it has accounted for two-thirds of MakerDAO’s interest rate revenue for DAI-based lending so far this year.

To be sure, MakerDAO has not brought up Pedersen’s idea for a vote. Yet it’s an intriguing thought experiment given how well MakerDAO has performed relative to its peers in DeFi.

The DeFi issuer largely dodged the crypto lending crash last year by tapping into real-world assets, which is crypto-speak for loans, bonds, and other traditional instruments. Maker has used RWAs, as they’re known, to back Dai, the largest DeFi-native stablecoin with a market cap of $5.3 billion.

MakerDAO is on course to earn $73 million in profit this year, according to estimated figures from analytics platform Makerburn. And its token, MKR, has soared 89% since the end of the second quarter, which is in line with the rebound in other DeFi names such as Aave and Lido.

Liquid bond strategy

Monetalis is one of the asset management firms that is part of Maker’s real-world asset push. The outfit manages Maker’s liquid bond strategy. The Monetalis vault is worth around $1.2 billion, according to Steakhouse figures. Trading activity on this vault recently resulted in MakerDAO paying $1.5 million in stamp duty tax in Switzerland.

Pedersen says these real-world asset investments will have to fully move on-chain before Maker can push into private credit.

He predicts this could begin to happen as early as six months from now based on several ongoing technical and legal exercises by developers and regulators to bring about broad-based tokenisation of traditional finance.

It could take another year before private credit and collateralised loan obligations are in the appropriate tokenised form, Pedersen said.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.