Jump Trading netted $1.28bn propping up Terra stablecoin

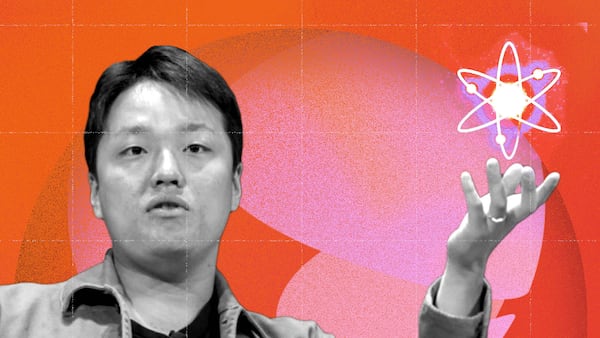

High speed-trading giant Jump Trading has been confirmed as the company that propped up the TerraUSD stablecoin one year prior to its collapse, according Securities Exchange Commission filings.

The filings state Jump purchased over 62 million UST after the asset lost its peg in May 2021, which restored its $1 parity and allowed founder Do Kwon to credit the recovery to the Terra Luna algorithm, The Wall Street Journal reported.

Jump benefited from the arrangement in a deal which enabled the purchase of Luna tokens at a steep discount, and eventually netted the firm $1.28 billion in profits.

Last week, an investor initiated a class action lawsuit against both Jump Trading and its president Kanav Kariya for involvement in stabilising Terra.

Kwon was granted a €400,000 bail by a Montenegrin court on Friday after he was arrested in March, accused of attempting to travel with fake passports.

He had been a fugitive from the law since Interpol issued a red notice for his arrest in September, following the $60 billion collapse of his crypto empire in May 2022.

The lawsuit claimed that the Chicago trading giant joined hands with Terraform Lab’s then-CEO Do Kwon to drive up the price of UST.

— Amber Holston (@Amber_H_) May 15, 2023

It also noted that Jump Trading was an early partner and financial supporter of Terraform Labs.

READ NOW: Do Kwon prosecutor warns of flight risk as crypto fugitive granted €400,000 bail and house arrest

Banks join Republican opposition to SEC’s new proposed custody rules

Prominent banks and business groups have backed a US Republican-drafted letter which slammed new custody rules proposed by the SEC.

The American Bankers Association and Securities Industry and Financial Markets Association supported Republicans’ “strong concerns” in regards to the new rules, saying they could further harm the digital asset space.

The proposed changes could see custodianship of digital assets restricted to federal custodians, a move which crypto firms such as Coinbase fear would jeopardise their deposits, The Block reported.

READ NOW: Stablecoin laws could give US an edge — if they ever get off the ground

Active Bitcoin addresses fall to 2021 levels

Active addresses on the Bitcoin network have dropped to 2021 levels as transaction volumes reach record heights.

Bitcoin has seen heightened transaction activity thanks in part to a 2023 rally, as well as hype surrounding Ordinals and BRC-20 tokens, which allow for NFTs to be minted on the network.

One factor that may drive the drop in active users is an eightfold increase in transaction fees since this time last year, as a result of increased network activity, The Block reported.

NOW READ: Bitcoin fee surge spurs calls for changes to treat NFTs and meme coins as spam

Lido staking unlocks as V2 deployed on Ethereum

Ethereum liquid staking protocol Lido upgraded to its version two on Monday, which allows users to unstake their Ether from the protocol for the first time.

The upgrade saw Lido’s price jump 10%, as users could now verify the platform would function as promised.

Lido currently holds 80% of all Ethereum liquid staking derivative market share.

Following a successful on-chain vote, Lido V2 is officially here.https://t.co/36EmuagToD

— Lido (@LidoFinance) May 15, 2023

🏝️ pic.twitter.com/sl4kjNpUYw

US Secret Service touts ‘amazing’ blockchain crime-fighting potential in Reddit AMA

The US Secret Service touted the transparency of blockchain technology in an “Ask Me Anything” session hosted by Reddit on Monday, and highlighted the agency’s NFT collection.

The Secret Service and California cybercrime authorities gave insight into a variety of scam methods, and praised blockchain for providing “an amazing opportunity to track the flow of money.”

When asked if the agency would consider releasing a token or coin, Secret Service agents pointed to an NFT collection released by the San Francisco field office last year.

READ NOW: Zhong’s heist of 50,000 Bitcoin gives way to new ‘industrial’ era in crypto crime

More web3 news from around the web…

Large investors led 2022 runs on crypto platforms, study finds — Bloomberg

US prosecutors drop extortion charges against early adviser to Ethereum network — CoinDesk

Gensler: SEC ‘stands ready to help’ as crypto startups face wave of enforcement actions — Decrypt