- RWA protocols enable DeFi investors to bet on assets like government and corporate bonds.

- Returns offered by real-world assets are outpacing those found in DeFi.

- The RWA sebsector is dominated by stUSDT on the Tron blockchain, helmed by Justin Sun.

- “stUSDT yields come from government bonds,” Justin Sun told DL News, declining to elaborate further.

DeFi protocols have tapped into a new way to generate yield, riding rising interest rates to pile user assets into traditional investments like government and corporate bonds.

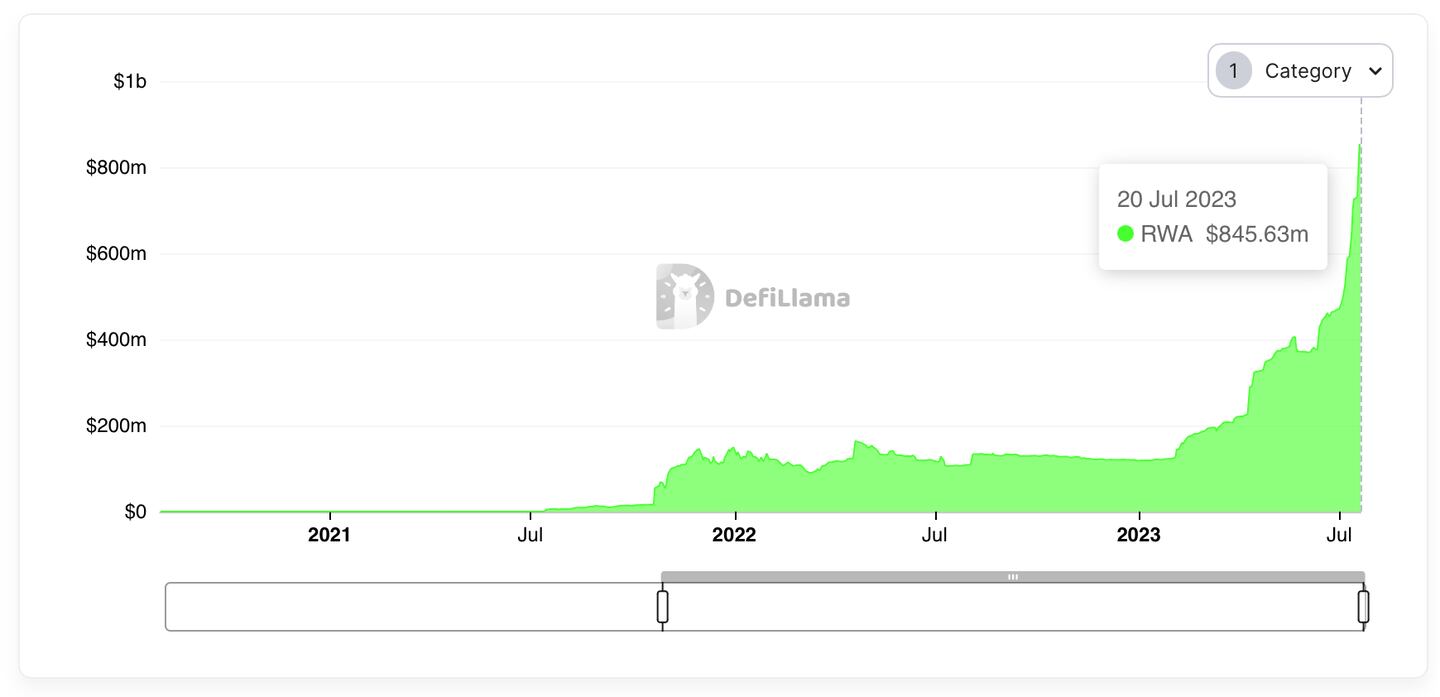

Deposits in protocols investing in so-called real-world assets, or RWAs, have doubled since June, with DefiLlama data showing a jump over half a billion dollars.

The figure is flattered by one dominant player: stUSDT on Tron, the blockchain helmed by billionaire Justin Sun.

Launched on July 2, stUSDT is already the top RWA protocol — it has $317 million worth of deposits and makes up about 37% of DeFi’s total RWA investments of $845 million, according to DefiLlama.

The protocol offers depositors around 4.2% annually on Tether USD stablecoin.

Bonds — especially those issued by the US government — are historically among the safest bets in financial markets.

But that may help create a facade of safety in the riskier corner of crypto known as DeFi.

Details about how stUSDT works are sparse. And what stUSDT does with depositors funds to earn yield is unclear. Daily attestations imply the protocol invests in bonds, but information explaining whether they are government or corporate, who issued them, or their risk rating, is absent. The stUSDT website only says it invests users’ deposits into “blue-chip assets.”

“stUSDT yields come from government bonds,” Justin Sun told DL News, declining to elaborate further.

NOW READ: As Ether staking yields fall, protocols will have to get creative

In a blog post announcing the stUSDT launch, the protocol says it wants to invest in real-world assets to create its own version of Yu’e Bao. That’s a money market fund product offered by Ant Financial, part of conglomerate Alibaba. Yu’e Bao was the world’s largest money market fund until recent regulatory crackdowns.

Tron and its associated DeFi protocols have faced run-ins with regulators and doubts about funding and marketing tactics since the blockchain was launched by cryptocurrency entrepreneur Justin Sun in 2017. Stablecoin rating agency Bluechip gave USDD, a Tron-based stablecoin backed by Sun, an F rating, indicating it is unsafe for investors.

Yet despite the dominance of stUSDT, the trend in DeFi in real-world asset investments still has legs, Ignas, a pseudonymous DeFi researcher, told DL News.

“Real-world asset protocols offer higher yield than DeFi offers,” said Ignas, adding that RWA protocols’ dollar-denominated yields are higher than the 3.49% offered by the Maker protocol on its Dai stablecoin.

And Ondo Finance, the second-biggest RWA protocol with $136 million in deposits, offers users investments in a range of real-word assets, such as US Treasuries and corporate bonds, by investing in US exchange-traded funds on their users’ behalf.

“There’s more than $100 billion in stablecoins not earning any yield,” Justin Schmidt, president and COO of Ondo Finance, told DL News. “Until Ondo launched its US Treasuries-backed token, which is currently earning more than 5% yield, on-chain capital had few options for cash management.”

NOW READ: SEC’s probe of puny BarnBridge DAO augurs deep DeFi crackdown

The protocol custodies user’s crypto deposits at Coinbase, and uses prime brokerage platform Clear Street to purchase and custody the ETF shares which back its products. It also posts on its website the on-chain wallets where user funds are kept.

In addition to its commitment to transparency, Flux Finance, a sister protocol where users can take out loans against real-word assets issued by Ondo, is driving the protocol’s popularity, according to Ignas.

Users are primarily depositing USDC to Ondo to earn yield from its short-term US government bond fund, Ignas said.

NOW READ: A 20-year-old Argentinian behind the $200m Euler hack says he’s now in a Paris jail

They then deposit their receipt tokens to Flux, borrow USDT at a lower interest rate than what the government bonds yield, then convert their USDT into USDC and repeat the process.

Because users can borrow USDT at a lower interest rate than what US government bonds yield, every time they loop deposits they earn more yield.

Eric Johansson contributed to reporting.

Do you have a tip or information on RWA protocols or another story? Reach out to me at tim@dlnews.com.