Whether you’re a crypto trader looking for an edge, a researcher looking at the shiniest new DeFi primitives, or even a journalist digging for a scoop, being able to easily compare DeFi protocols is a must-have in any analyst’s arsenal. While different people may have different motivations for analysing protocols, the need for an easy-to-navigate way to compare them remains constant. This is where data aggregators such as DefiLlama prove essential. This article will explain how to use DefiLlama for all your protocol comparison needs.

Uniswap vs Curve Finance: a tale of two DEXs

Most DeFi investors and traders know they should always keep a certain adage in mind: DYOR, or “Do Your Own Research.” Any researcher worth their salt usually starts with a question — a hypothesis they want to put to the test.

A possible research question might be something like: “How did Uniswap fare versus Curve following the 2022 FTX collapse?” Uniswap and Curve Finance are quite different in how they operate, but as decentralised exchanges, they both vie for the same market share across metrics like total value locked (TVL) and trading volume. So answering this question might give us better insight into how these protocols are used and their place in DeFi.

We’ll use this question as an example to help illustrate how to use DefiLlama to compare DeFi protocols.

This research question has several components:

- First: “How did Uniswap fare?” This poses a number of problems. Which metric best defines “fare?” Could it be a change in TVL, or perhaps a change in trading volumes on the protocol? The answer could require a combination of several metrics.

- “Following the 2022 FTX collapse.” This phrase deals with an event in time — the 2022 FTX collapse — so a researcher will probably want to plot charts to see how their chosen metrics behaved before, during, and after the event.

With any research question, there are usually at least two parts to consider:

- The object studied (the independent variable). This is the “FTX collapse.”

- The thing changed by the object (the dependent variable). This could be “TVL in Uniswap and Curve.”

The role of metrics in protocol research

Users can track many different metrics on DefiLlama that can help answer research questions like those concerning Uniswap and Curve. Here are some of the most useful:

Total Value Locked (TVL) is a metric that tracks how much crypto is locked up in a DeFi protocol’s smart contracts. Tracking TVL can be complicated by things like staking, double counting, and native governance tokens. Read our previous article on calculating TVL for more info.

Market Capitalisation, or market cap, is a measure of the total market value of a protocol’s native token. It is calculated by multiplying the amount of a protocol’s token in circulation by its price. For example, if Curve has 1,000,000 tokens in circulation at a price of $5 per token, it will have a market cap of $5,000,000.

Fully diluted valuation (FDV) is similar to market capitalisation, but takes into account tokens that are not yet in circulation. This includes tokens that have yet to be distributed, such as reserved staking rewards or locked tokens bought by institutional investors.

Liquidity represents the availability of funds, or the amount of tokens locked up to enable trade. The more liquidity a token has, the less a trade will impact its price.

Other popular metrics include token price, fees earned, annual revenue, assets staked, assets borrowed, yields, funding raises, and more. For certain protocols, DefiLlama includes data on governance proposals, major market events, and token unlock schedules.

How to compare protocols on DefiLlama

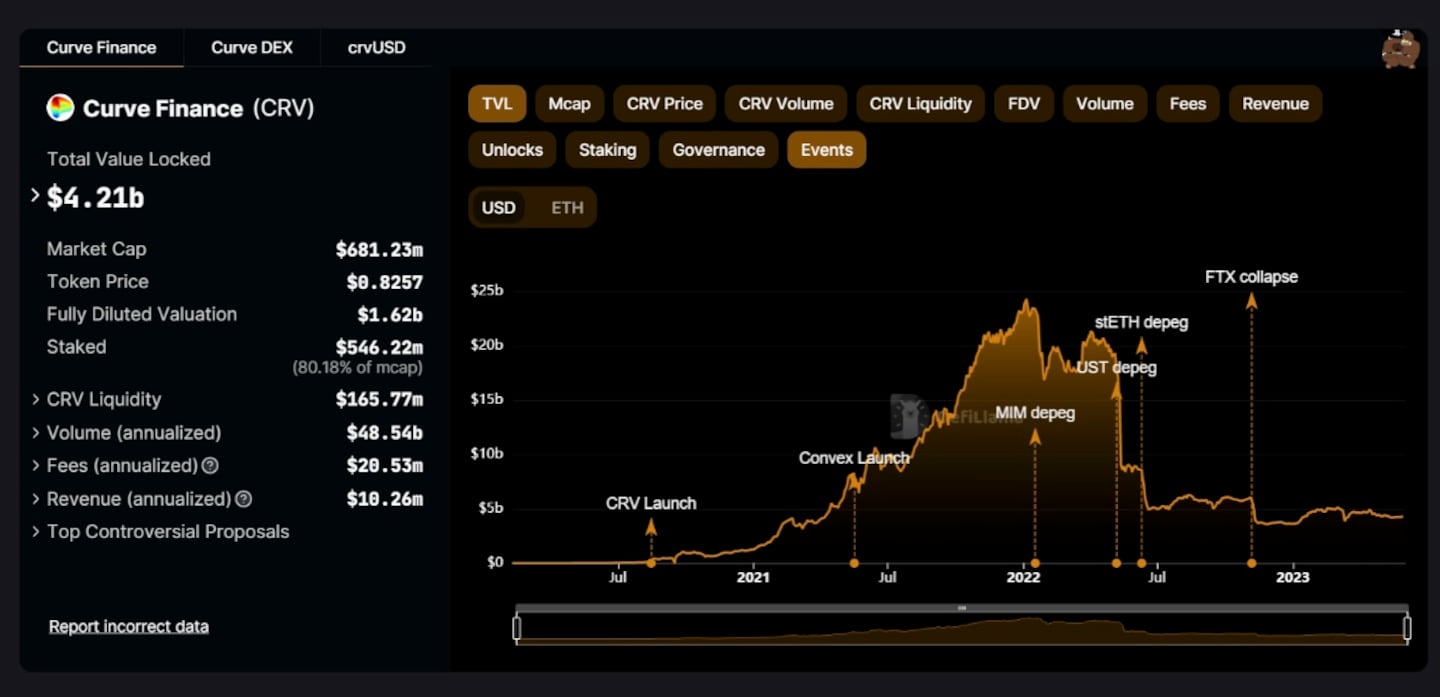

The quickest way to assess a protocol is to find it right on the DefiLlama homepage. Scroll down to see a list of protocols ranked by TVL. The metric by which the protocols are ranked can be changed by clicking the top of any of the columns. To see more about an individual protocol, click on its name.

Inside an individual protocol’s page, several of the previously mentioned metrics become available. TVL features prominently in the upper left, and below it are several metrics that vary depending on the protocol. In general, the page will at the very least display TVL, market cap, and token price. DefiLlama developers add other metrics based on the information contributors provide to them.

Click any of the metrics at the top to add them to the chart. Note that metrics like TVL can be viewed either in USD or the native asset of the blockchain the protocol resides on. Toggling this can affect the story you see.

If you see a substantial decline in USD value, yet the native asset remains relatively stable, it offers a clue. This stability suggests that the protocol hasn’t genuinely suffered a “loss in TVL.” Instead, it has merely been impacted by broader market dynamics.

Conversely, if the native asset shows a significant decline while the USD value remains consistent, it indicates that the protocol might be facing inherent challenges or issues, separate from general market trends.

This reversed scenario underscores the importance of evaluating both metrics to obtain a comprehensive view of a protocol’s health.

Another feature that appears on the charts of some protocols is a visual marker for major market events.

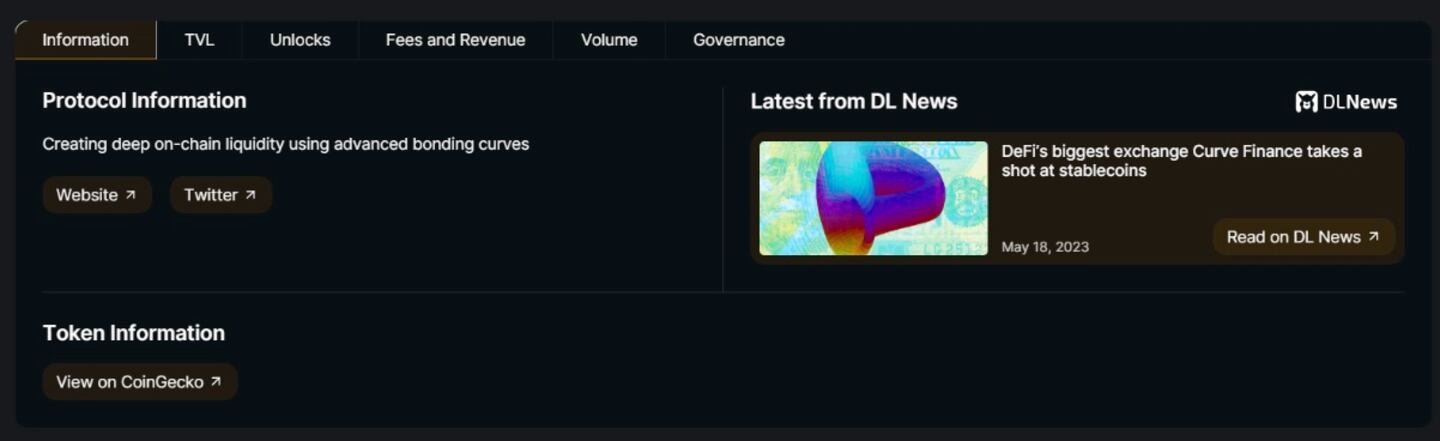

Scroll down from the chart to see a series of tabs with more information, including links to relevant news posts from DL News. As with the metrics section above, the amount of data found here will depend on the protocol.

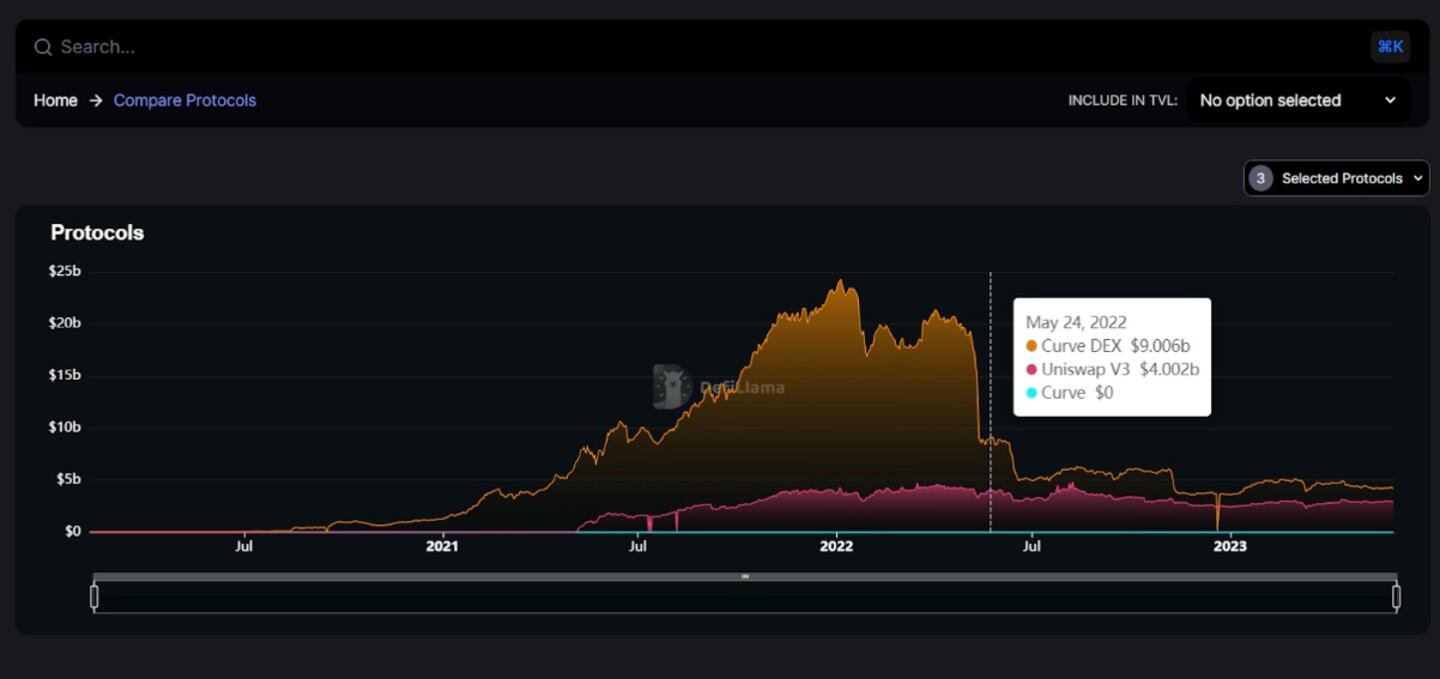

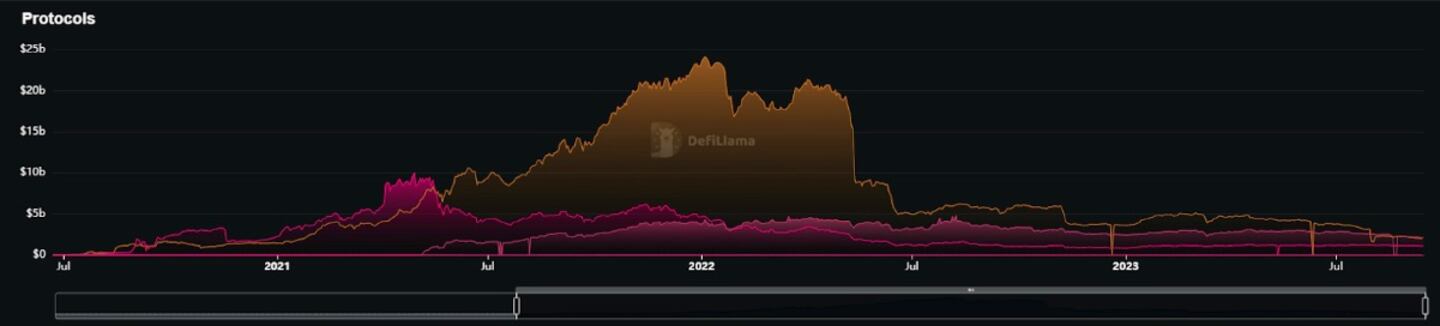

DefiLlama has also added a “Comparison” section to the site, which allows users to select several protocols at once, and superimpose their respective TVL figures on a single chart. At this time, TVL is the only metric that can be displayed this way.

By simultaneously displaying Curve (orange) and all versions of Uniswap (pink), we can see that Curve was hit much harder around the FTX collapse of 2022, and even more so during the Terra/Luna crash earlier in the year. This is just one example of how to build out a research question and tackle it with DefiLlama. As DefiLlama’s comparison functionality improves, it will become easier than ever to draw research conclusions from multiple protocols. Now set out, and put the power of comparison to work!

Next steps

- Pick two protocols from the same DeFi sector, and compare their TVLs on DefiLlama.

- Learn about DeFi trading volumes and how to track them.