A version of this story appeared in our The Decentralised newsletter on January 23. Sign up here.

GM, Ryan here.

Here’s what caught my DeFi-eye recently:

- Liquid restaking tokens surge in total value locked

- Mass Ether staking withdrawals may pose a risk to the peg of liquid staking tokens

- Hector Network community members face yet another setback

Liquid restaking tokens boom

You may have heard of liquid staking providers such as Lido and Rocket Pool, but now liquid restaking is becoming the hot new trend in DeFi.

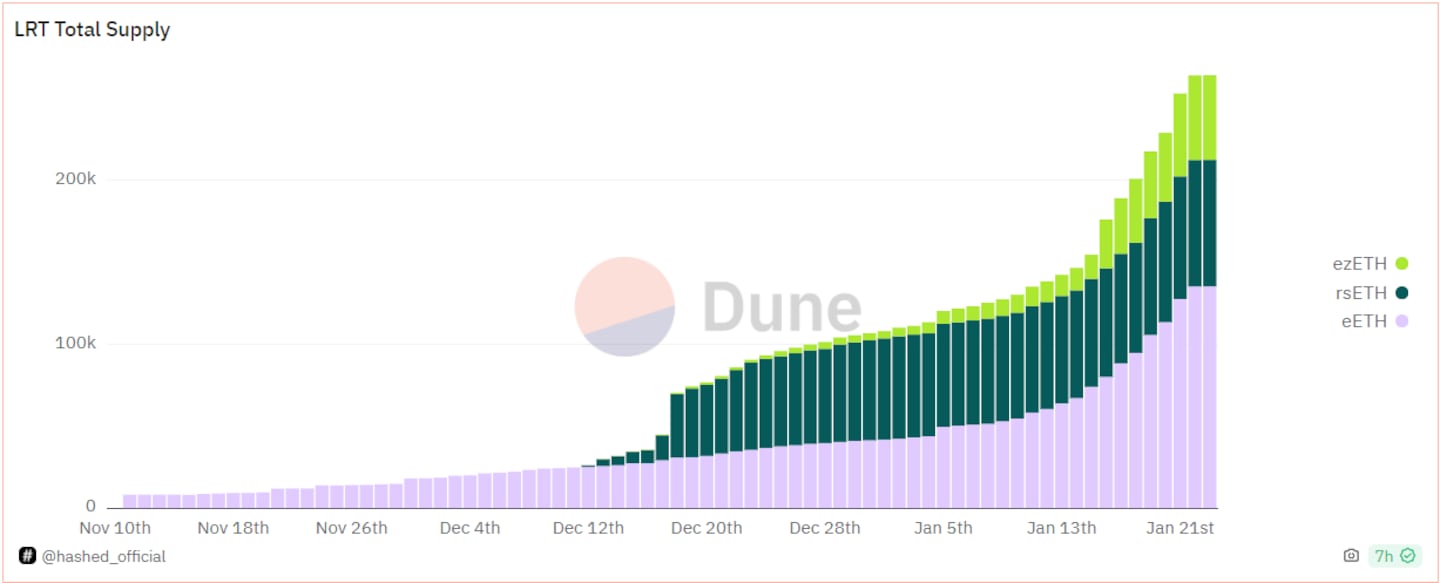

This new sector, which tokenises deposits to restaking protocol EigenLayer, just surpassed $600 million in total value locked, and shows no signs of slowing.

Leading the charge for liquid restaking are protocols such as Ether.Fi, Kelp DAO, and Renzo.

These protocols allow DeFi users to stake their Ether, which they then automatically restake in EigenLayer. Users receive receipt-like liquid restaking tokens in return for their deposits.

EigenLayer is revolutionising the use of staked Ether, enabling it to secure protocols beyond Ethereum.

This innovative approach has attracted considerable attention, with over 150,000 Ether, valued at around $350 million, deposited to the protocol since January. The total deposits in EigenLayer recently exceeded $1.7 billion.

What’s fueling the influx is EigenLayer’s rewards system, which offers points for deposits.

These points are stirring speculation among users about a potential future airdrop, adding an element of excitement and anticipation to the mix.

However, this rapid growth isn’t without its challenges. The Ethereum community is actively debating the risks this could pose to the network.

The EigenLayer team, led by founder Sreeram Kannan, is keenly aware of these concerns and is working on updates to address them.

With the mainnet launch of EigenLayer expected in the first half of the year, the frenzy around these developments is only likely to intensify.

Billion dollar bottleneck

Defunct crypto lender Celsius recently withdrew $1.6 billion in Ether, staked on-chain, causing a bottleneck in Ethereum’s staking withdrawal queue.

This congestion poses risks for Lido and its stETH token, the largest Ether liquid staking token with over $23 billion circulating.

Analysts, including Riyad Carey from Kaiko, have expressed concerns over stETH’s liquidity. They fear that a prolonged queue might cause stETH to depeg from Ether, potentially triggering mass liquidations in lending protocols.

Lido asserts stETH is sufficiently liquid, but Carey highlights a lack of liquidity to back over $3 billion in leveraged positions on Aave.

In a situation where Ethereum’s validator exit queue becomes congested, Lido won’t be able to convert stETH to Ether, increasing reliance on trading pools for stETH-Ether swaps. A depeg in this situation could trigger significant liquidations on Aave.

Post-Ethereum’s Shapella upgrade, Lido ceased liquidity incentives, leading to a decline in stETH liquidity from $800 million to $274 million on Curve Finance.

Lido is considering measures to secure stETH liquidity, including a proposal by Glass Markets for a liquidity assessment report, though the current status of these efforts remains unclear.

Hector Network investors face another devastating loss

DL News’ DeFi Correspondent Osato Avan-Nomayo reports on an unauthorised withdrawal of $2.7 million from a $11 million pool, set aside for a rage-quit settlement at Hector Network.

This has left investors facing a 22% loss on their expected returns, while communications from the so-called liquidation committee have ceased.

This incident is part of a larger saga involving Hector Network, which saw its treasury plummet from $100 million to $16 million, alongside a 99% drop in the value of its governance token.

The breach involved transferring $11 million in USDC from Hector Network’s treasury to a smart contract for distribution.

A non-accredited wallet was marked eligible, enabling the withdrawal of $2.7 million, which was then converted to Ether and distributed across multiple wallets.

This event adds to Hector Network’s history of security issues, totaling around $40 million in losses.

Hector Network’s core team could not be reached for comments. Sparring Legal, a law firm and one of the liquidators, declined to comment.

Data of the week

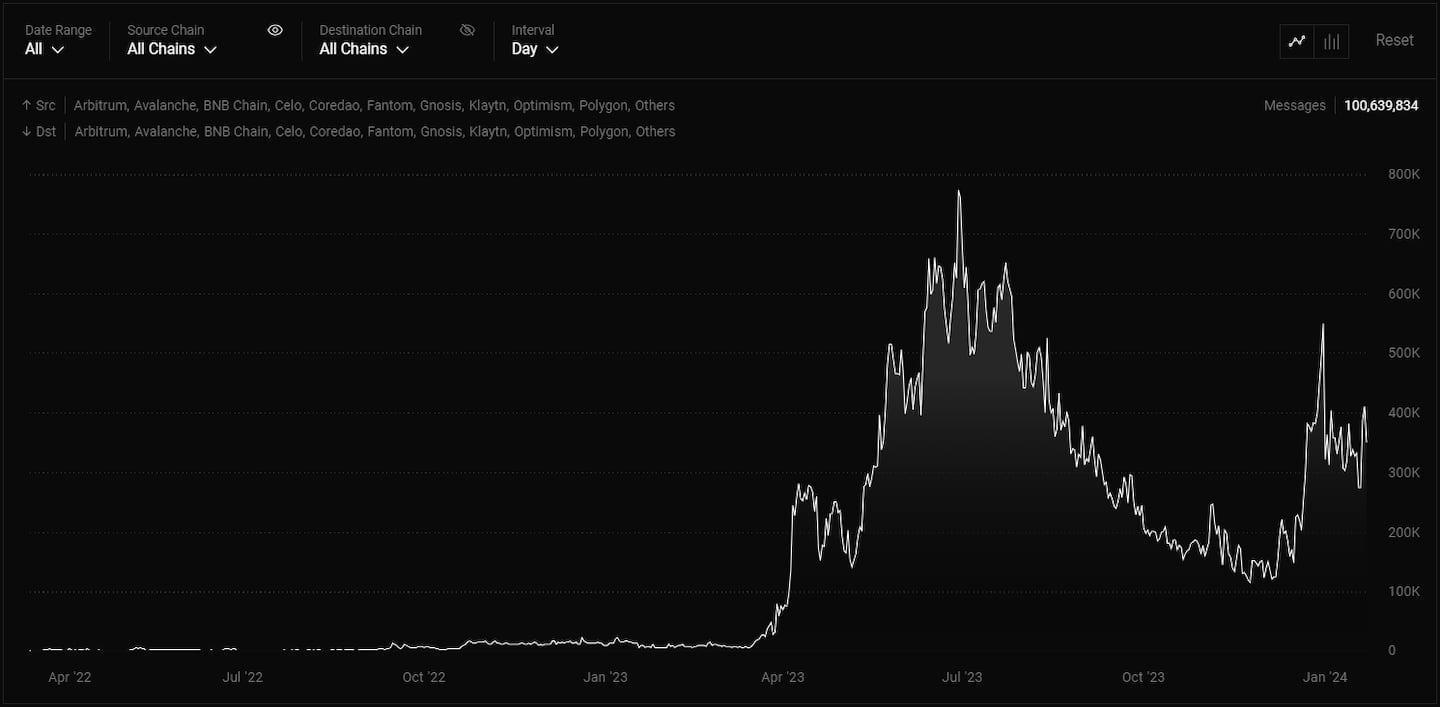

LayerZero messages have exceeded 100 million, a mark that many users were speculating would coincide with an airdrop snapshot for the highly-anticipated LayerZero token.

LayerZero Labs co-founder Bryan Pellegrino took to X to clarify that the snapshot has still not taken place, and that it would be made abundantly clear when it has.

This week in DeFi governance

VOTE: Fraxwheel funding comes down to the wire

REQUEST FOR COMMENT: Aave V3 deployment on Scroll mainnet

VOTE: Long-Term Incentives Pilot Program by Arbitrum DAO

Post of the week

DefiLlama developer 0xngmi compares initial coin offerings and the current points farming craze hitting DeFi.

one way to think of points farming is as a regulatory-compliant ICO

— 0xngmi (@0xngmi) January 19, 2024

users are effectively swapping money for coins through fees

What we’re watching

The Pyth week in review 🔮

— Pyth Network 🔮 (@PythNetwork) January 20, 2024

Another week packed with news and updates for the Network!

Pythians have been furiously staking $PYTH and now more than 54k wallets have staked in preparation for governance and the upcoming DAO Constitution vote.

🏅 Milestones

- 54k stakers

- 187k+… pic.twitter.com/kGqyZahCXj

The total number of Pyth stakers is quickly increasing.

Fueling the surge is speculation from various X users that staking the PYTH token could qualify users for future airdrops from protocols that rely on Pyth’s oracle network.

Got a tip about DeFi? Reach out at ryan@dlnews.com.