A version of this article appeared in our The Decentralised newsletter on August 20. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Ethereum’s never been this cheap to use.

- $63 million stablecoin AEUR hit by bank blow-up.

- Arbitrum DAO wants to solve its voter apathy woes.

Ethereum’s low fees

Ethereum’s transaction fees are the lowest they’ve ever been — and that’s having some undesired effects.

Transactions on the top smart contract network now cost less than $0.10, while tokens swaps can be done for less than a dollar.

That’s in stark contrast with the $100 plus fees that plagued users during the 2021 crypto bull run.

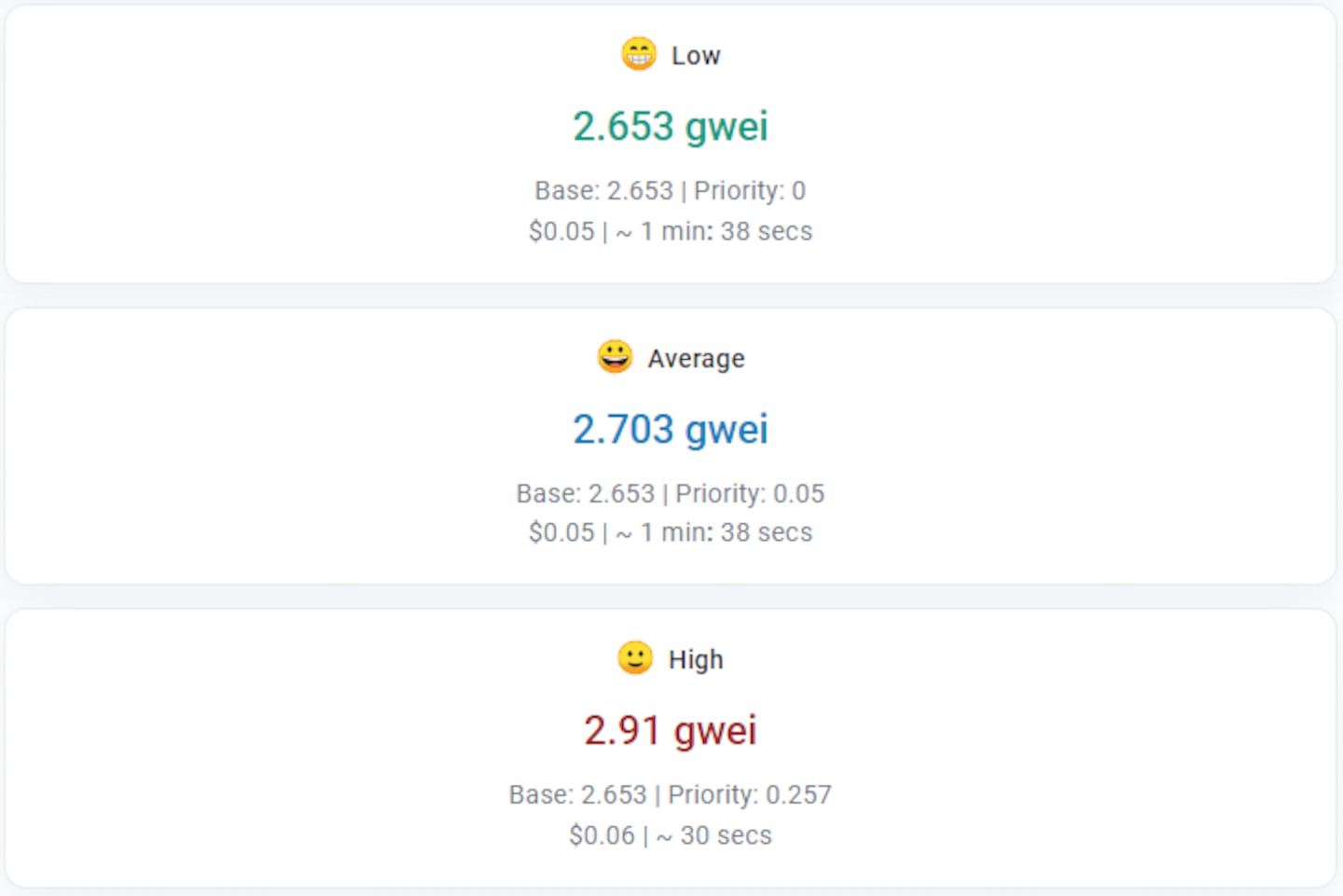

Fees are so low that Etherscan’s Ethereum Gas Tracker, a popular way to check transaction costs, has started reporting fees in decimals.

The reason for the low fees is that activity has moved over to layer 2s — separate blockchains built on top of Ethereum that offer much faster and cheaper transactions.

Ethereum’s March Dencun upgrade juiced the cost savings layer 2s can offer, accelerating their adoption.

But there’s a problem: The low fees are breaking Ethereum’s economic model.

Ethereum no longer destroys — or “burns” — more Ether tokens than it creates.

In other words, its economics are now inflationary — a dirty word among crypto users who often revile the money printing ingrained in the traditional financial system.

“The meme of ‘ultra sound money’ is broken,” Ethereum core developer Preston Van Loon told DL News.

AEUR in trouble

Anchored Coins AG, the Swiss company that issues the euro-pegged stablecoin AEUR, has paused withdrawals, leaving holders in the lurch.

The reason? The bank where Anchored Coins kept part of the reserves backing its $63 million stablecoin — FlowBank — has gone bankrupt.

It’s not yet clear whether the stablecoin issuer can recover the collateral.

But if it can’t, Anchored Coins said in a statement, losses would be socialised among all AEUR holders, per Swiss law.

Anchored Coins did not respond to a request for comment.

For now, the funds are in limbo until authorities appoint a liquidator to oversee the return of deposits to creditors ― a process that could take time.

FlowBank’s bankruptcy isn’t the only crisis the stablecoin issuer has suffered in recent times.

Binance paused AEUR trading in December, four days after its initial listing on the exchange because the token soared 200% to $3.25 ― an unusual occurrence for a stablecoin.

The crypto exchange attributed the token’s upward depeg to factors including “users who might not have realised its standing as a stablecoin.”

DAO voter apathy

Members of the Arbitrum DAO are voting on key changes to its native token, ARB, to protect its treasury from hostile takeover.

The proposals are designed to address voter apathy among DAO members.

They include making the ARB token stakable, and potentially diverting a portion of the blockchain’s profits to ARB holders.

A decline in DAO participation poses a very real danger, according to pseudonymous Arbitrum DAO delegate Frisson.

“It is becoming economically attractive for a malicious actor to launch a governance attack on the DAO treasury,” he said in a post on the Arbitrum governance forum.

A governance attack is where a coordinated group buy up a DAO’s token and vote to push through changes that benefit them — often at the expense of the protocol’s users.

Other DAOs have already been attacked in this way.

In July, Compound, an Ethereum-based lending protocol, was the target of a $25 million governance attack.

The DAO managing the Ethereum Name Service, a protocol that lets users turn their crypto addresses names and titles, is also fighting off attacks.

Data of the week

Tron is the only blockchain to see an increase in trading volume over the past seven days.

Sunpump.meme, a copy of the Solana-based memecoin generator pump.fun, recently launched on the blockchain.

This week in DeFi governance

VOTE: CoW DAO votes on Wintermute liquidity deal for its COW token

TEMP CHECK: Arbitrum DAO mulls new conflict of interest policies

VOTE: Solana stablecoin protocol UXD is shutting down

Post of the week

Polygon Chief Information Security Officer Mudit Gupta riffs on the serious issue of DeFi protocols unknowingly hiring North Korean developers.

Found the perfect spot for next Devcon.

— Mudit Gupta (@Mudit__Gupta) August 16, 2024

Most devs are apparently based there anyway so less travel on average. pic.twitter.com/kUAp9HZgYL

What we’re watching

Deepak Thapliyal, the CEO of blockchain firm Chain, has sold the rare alien Cryptopunk NFT that he purchased for $23.7 million in 2022.

Thapliyal hasn’t disclose the sale price.

Woahhhhh. Alien Punk #5822 that holds the record for the highest Punk sale of all time (8,000 eth, $23.7M USD) in Feb 2022 just changed hands 30 minutes ago. Was a private deal, price undisclosed. https://t.co/tOSu6UNNof pic.twitter.com/ldGUNhC6yP

— DGMD (@DGMD22) August 19, 2024

Got a tip about DeFi? Reach out at tim@dlnews.com.