A version of this article appeared in our The Decentralised newsletter on August 13. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Why one MakerDAO adviser is worried about Wrapped Bitcoin.

- The reason Coinbase’s cbETH supply dropped by $2.4 billion.

- Ethena expands its synthetic dollar to Solana.

Wrapped Bitcoin concerns

MakerDAO adviser BA Labs warns that an upcoming change in management for Wrapped Bitcoin, or WBTC, could pose a serious threat to the protocol.

On August 9, WBTC owner BitGo announced plans to transfer control of the product to a joint venture with crypto custody platform BiT Global.

BA Labs’ concern? That the change comes with links to Tron founder Justin Sun.

BA Labs pointed to the situation with dollar stablecoin TrueUSD as a cause for concern.

In 2023, China-based conglomerate Techteryx took control of TrueUSD. A lot has gone wrong since. So far:

- TrueUSD’s previous management team resigned.

- It suspended its real-time proof of reserves.

- It suffered several depegs caused by interruptions to its redemption service.

Sun has denied any involvement with TrueUSD or Techteryx.

BıtGo CEO Mike Belshe responded to concerns over Sun’s involvement.

“He is not in the management team of BiT Global nor does he have any key material access. But he is materially involved,” Belshe said.

BA Labs proposed that Maker and its lending protocol Spark take immediate actions to limit the growth of WBTC exposure.

If BitGo cannot demonstrate WBTC will be safe, BA Labs said, it would consider recommending Maker offboard the asset entirely.

WBTC is a version of the top cryptocurrency that can be used across DeFi.

Users can deposit Bitcoin to receive an equal amount of WBTC on either Ethereum, Tron, or one of several other blockchains.

There’s over $9 billion worth of WBTC in circulation.

MakerDAO still has time to debate the issue.

The transfer of control from BitGo to BiT Global won’t happen until October 8.

$2.4bn of cbETH redemptions

DeFi sleuths have long wondered why the supply of Coinbase’s liquid-staking token — cbETH — shrunk by over 50% in recent months.

Despite concerns, the answer may be fairly mundane: A planned infrastructure upgrade implemented in June.

“We updated the total reserve pool volume to streamline our infrastructure,” a Coinbase spokesperson told DL News.

“The cbETH decrease in supply was an intentional outcome of these updates.”

What happened is that Coinbase changed the way it calculates the staked Ether backing for cbETH.

As such, Coinbase deemed it necessary to adjust the token supply.

“The new total supply figure is now closer to the circulating supply, while still accommodating the market liquidity needs,” the Coinbase spokesperson said.

Ethena expands to Solana

Solana users can now create Ethena’s USDe synthetic dollar with SOL tokens.

It’s the latest initiative to keep growing the $3 billion supply of USDe as part of Ethena’s mission to become a major player in the stablecoin market.

Ethena founder Guy Young told DL News the move could facilitate an additional $600 to $900 million of USDe creation.

Expanding USDe to another backing asset should also help spread out the risk of something unforeseen happening to one asset, Young said.

It’s not without risk.

Ethena chose the LayerZero crypto bridge to facilitate cross-chain USDe transactions to and from Solana.

Bridges between Ethereum and Solana have been attacked before.

In 2022, the Wormhole crypto bridge connecting Ethereum and Solana was hacked for $326 million, contributing to $1.8 billion of bridge hacks that year.

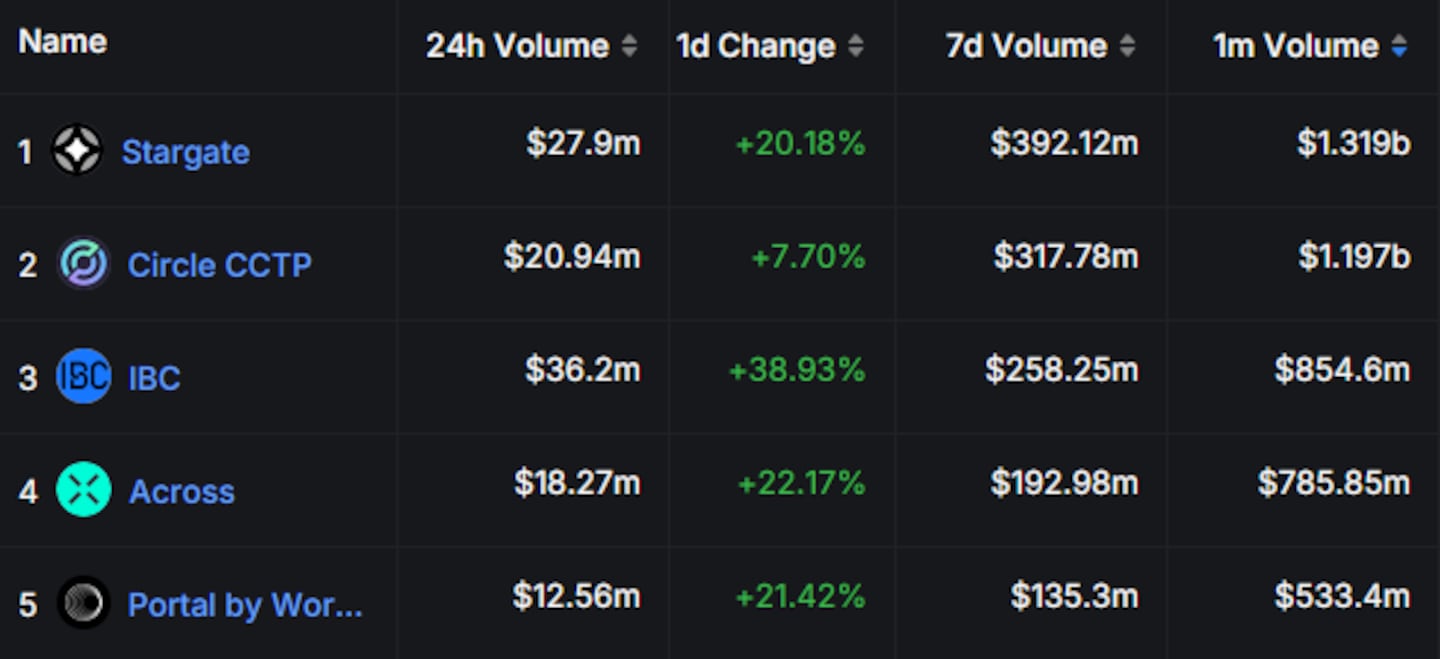

Data of the week

LayerZero’s Stargate crypto bridge processed $1.3 billion worth of transactions over the past month amid a surge in bridging activity.

USDC stablecoin issuer Circle’s Cross-Chain Transfer Protocol came in second with just under $1.2 billion.

Cosmos’s Inter-Blockchain Communication Protocol processed about $850 million.

This week in DeFi governance

VOTE: ARB holders could soon be able to stake their tokens

VOTE: Jupiter reduces JUP token supply by 30%

VOTE: Uniswap votes on $250,000 onboarding package for Gnosis Chain

Post of the week

It’s official: Betting on newly-created Solana memecoins has terrible odds.

Only 1.4% of those created on pump.fun make it to a decentralised exchange. Of those, 0.6% last long enough to get listed on CoinGecko.

Pumpfun gambling is legit the WORST odds out of ANY gambling game.

— Bastille (@BastilleBtc) August 11, 2024

Better to just go to the casino lol.

1.4% of tokens go to ray. pic.twitter.com/kCf9rUOJhb

What we’re watching

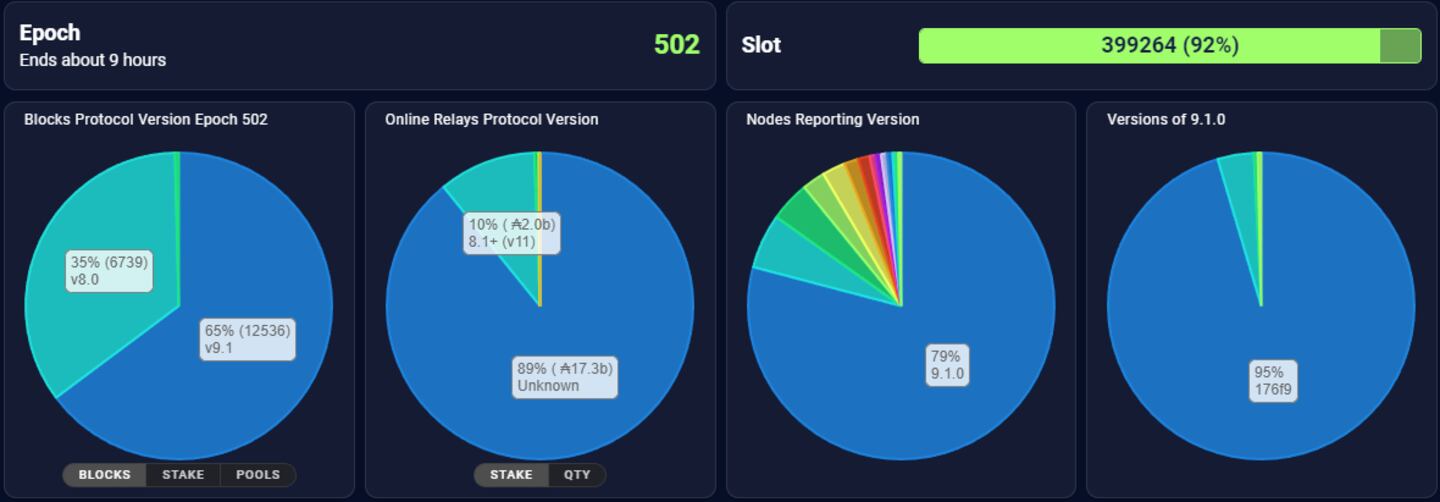

Over 70% of Cardano nodes have upgraded to the latest software version, meaning the network is ready to commence its Chang hark fork.

Chang will transfer control of the $11 billion blockchain to ADA holders.

Got a tip about DeFi? Reach out at tim@dlnews.com.