A version of this article appeared in our The Decentralised newsletter on November 19. Sign up here.

GM, Tim here.

- Memecoins push trading volume on Solana over $40 billion.

- Why Manifold Finance is down 98% amid a raging bull market.

- Magic Eden prepares for its token airdrop.

Solana’s record week

A new wave of memecoin mania is driving Solana trading volume higher.

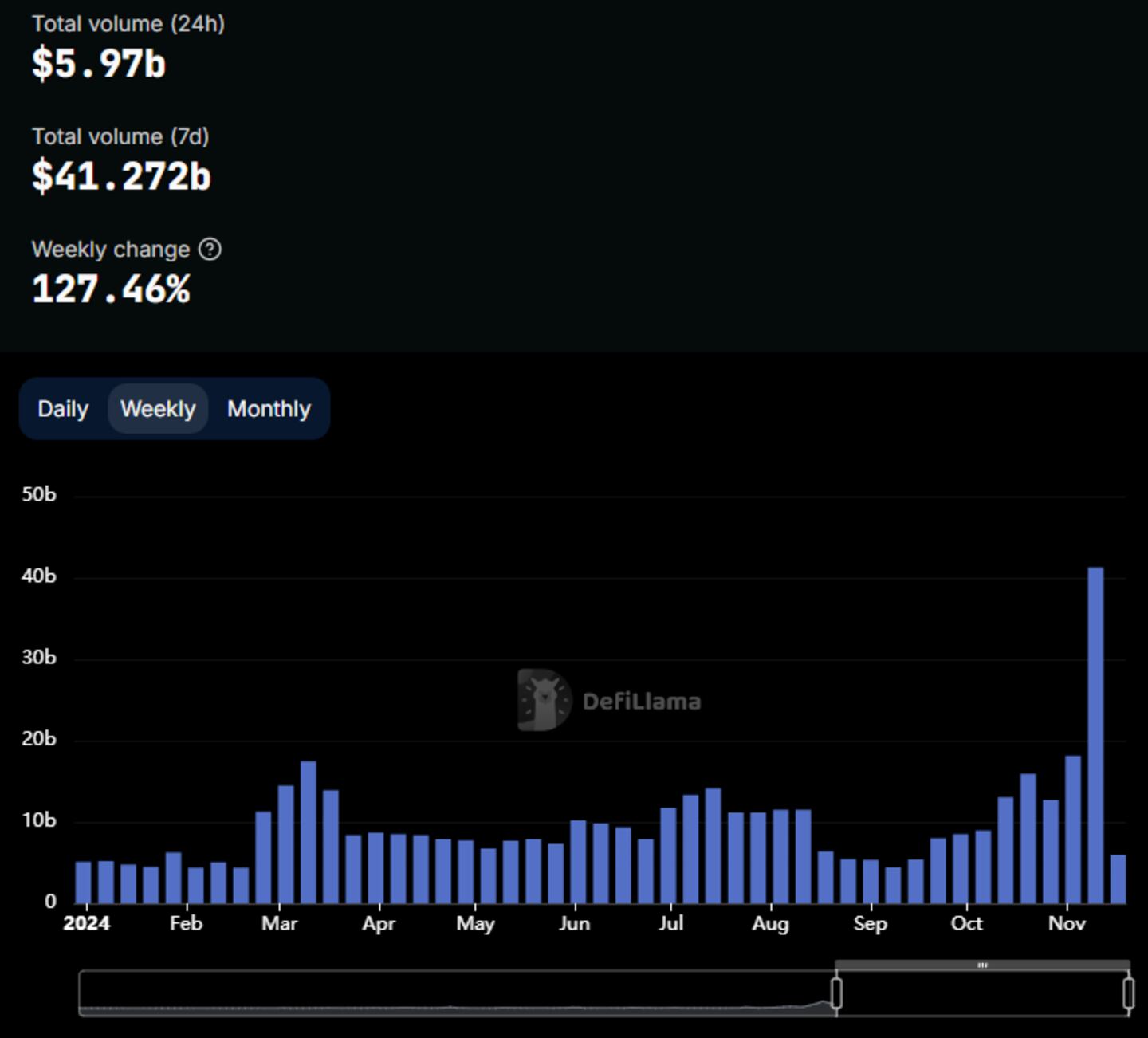

Solana handled over $40 billion worth of transactions over the previous week, more than doubling its previous weekly record of $17.5 billion set in March.

It’s a sign that traders are increasingly moving beyond centralised exchanges like Binance and Coinbase to trade crypto.

Traders looking to hit the jackpot on memecoins are fuelling the surge.

Unlike many other crypto tokens, which are ostensibly tied to something of value, most memecoins don’t advertise a use case, trading solely on popularity and hype.

One anonymous trader who bought $17 worth of Pnut, a memecoin named after a celebrity squirrel, recently sold their stash for over $3 million.

Trading volumes for popular memecoins Bonk and Dogwifhat are also surging. But for every winner, there are thousands of failed memecoins that go nowhere.

It’s not just lucky traders profiting either.

Users on Pump.fun, a memecoin creation platform, have launched over 47,000 new tokens over the past 24 hours, helping the platform hit its highest-ever daily revenue of $4.1 million.

Manifold’s 98% crash

Manifold Finance, a onetime buzzy DeFi project, has plunged into turmoil.

Its FOLD token hit an all-time low of $0.64 on November 8 — a 98% drop — even as crypto markets surged on the election of Donald Trump as the US president.

The fall coincides with founder Sam Bacha’s increasingly erratic behaviour.

He’s been absent from the project for weeks at a time, only returning to argue with supporters, share memes, and tell corny jokes.

The situation is the latest example of the pitfalls that come with crypto’s freewheeling culture.

“I invested in it in 2021, and at the top, it was worth like $5m and now it’s worth 0,” Crypto personality Jordan Fish, better known online as Cobie, told DL News. “I don’t know what to tell you, yeah, seems like it failed, crypto investments are risky, maybe I should’ve sold the top, it is what it is.”

Magic Eden’s airdrop

NFT marketplace Magic Eden is gearing up to airdrop its ME token.

Early users of Magic Eden’s apps on Bitcoin and Solana will share 12.5% of the token’s one billion supply, according to a Monday blog post.

The post said the token launch is “coming soon,” but didn’t provide an exact date.

It’s the latest in a string of highly-anticipated token launches in recent weeks.

The ME Foundation, the organisation issuing the ME token, will use a further 37.7% of the supply to pay for and incentivise ecosystem development. The remaining 49.8% will be split between the Magic Eden team and the project’s investors.

The insider allocation, while large, is similar to that of other recently-launched tokens such as SWELL, GRASS and SCR.

On Whales Market, a DeFi app that lets users trade airdrop allocations before a token launches, ME trades at around $1 per token, implying a $1 billion valuation.

This week in DeFi governance

VOTE: Aave DAO votes to add PAX Gold to the main Aave instance on Ethereum

PROPOSAL: Jupiter DAO discusses allocations for its second JUP token airdrop

VOTE: Compound DAO votes on Gauntlet’s supply cap increase recommendations

Post of the week

Boldleonidas captures Crypto Twitter’s feelings towards Ethereum and Solana this week.

Just checked SOL/ETH. pic.twitter.com/EDzWKM0QlP

— Bold (@boldleonidas) November 17, 2024

Got a tip about DeFi? Reach out at tim@dlnews.com.