- Deposits in Pendle surged to $3 billion and trading volumes hit a record $324 million.

- PENDLE's price soared to $4.36 against the backdrop of underperforming DeFi tokens.

- The protocol lets users split yield-bearing tokens into two parts, a principal token and a yield token, which traders can then speculate on.

Pendle, a DeFi platform that lets traders bet on the yields of different tokens, hit an all-time high of over $3 billion deposited, an increase of 31% in the last seven days.

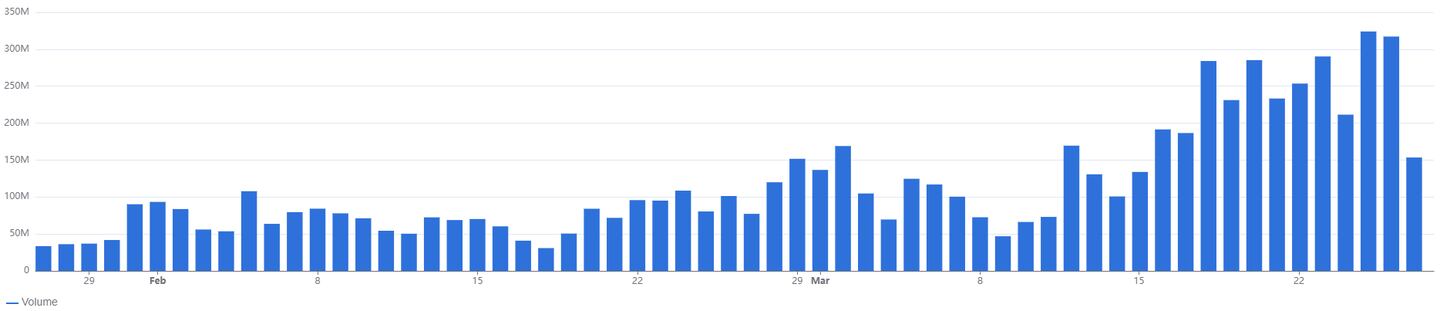

Trading volumes on the protocol reached an all-time high of $324 million on March 25, which was more than the majority of decentralised exchanges on that day.

All of this activity has propelled the native token, PENDLE, to an all-time high today of $4.36, on a day when decentralised-finance tokens have largely underperformed the market.

PENDLE stakers can now earn up to a 47% annual percentage yield from fees generated by the protocol.

Pendle lets traders take yield-bearing tokens, like weETH, Pendle’s largest market, and splits it into two parts.

weETH is a liquid restaking token issued by Ether.fi. Restaking, which was introduced by Ethereum-based protocol EigenLayer, makes it possible to use the same capital to simultaneously secure Ethereum and other protocols.

The first part, known as the principal token, PT, represents the initial investment’s value after deducting the anticipated future earnings, which are represented by the second part, the yield token, YT.

Essentially, once a token is deposited in the protocol, a trader receives a principal token that reflects the base value of their investment minus the value assigned to the expected interest or yield, and a yield token that captures the potential earnings or returns their investment might generate over time.

These tokens can then be traded on Pendle’s exchange.

Ether.fi is running a point program that distributes EigenLayer and Ether.fi points to Pendle depositors.

Points generally convert to tokens at a later date. Ether.fi has already distributed 6% of its native token, ETHfi’s supply, to participants via their points program.

ETHfi is trading at $7.20, implying a fully diluted value of $7.2 billion.

The dual nature of markets on Pendle give traders two main strategies to speculate with.

Those who want to accumulate as many points as possible purchase yield tokens, and those who want to lock in yields, like the 39% annual percentage yield for the eETH market, accumulate principal tokens.

This trend shows no signs of slowing down, especially because EigenLayer has yet to announce an official date for converting points to tokens. Although there was mention about a possible conversion in the second quarter, nothing official has been confirmed yet.

EigenLayer is the second-largest DeFi protocol by the total value of crypto assets deposited, rising 29% in the last month.

Some 3.3 billion EigenLayer points are in circulation, with prices on secondary markets between $0.14 and $0.18, which would imply a value of between $462 million and $594 million for these points.

Ryan Celaj is a data correspondent at DL News. Got a tip? Email him at ryan@dlnews.com.