- Renzo’s ezETH token added 30%, or $730 million, to its total supply in the last seven days.

- The total ezETH supply on layer 2 blockchains is $680 million, compared with the $428 million eETH from competitor Ether.fi.

- The battle for market share will only heat up as EigenLayer recently launched its mainnet as further leveraged farming integrations are on the horizon.

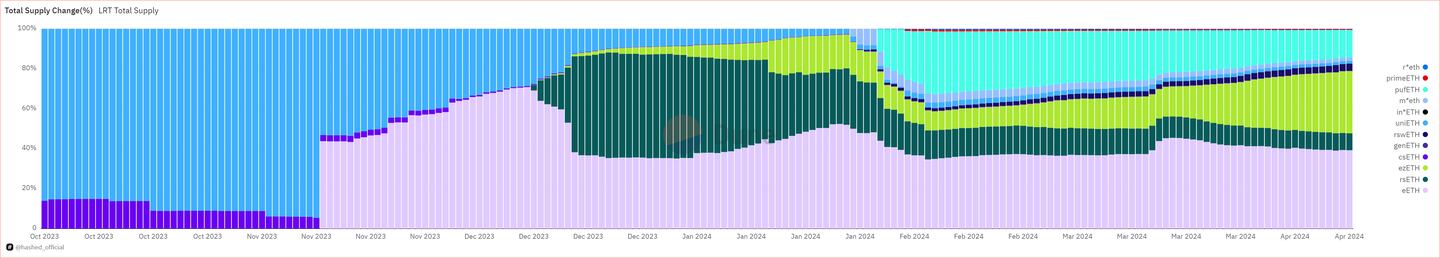

Renzo’s ezETH, a liquid restaking, or LRT, token, added 30% to its total supply in the last seven days to gain market share in the competitive LRT sector.

Restaking is a novel concept introduced by the Ethereum-based protocol EigenLayer that extends the security of Ethereum validators to other protocols.

Renzo, and other restaking protocols, let users deposit their staked Ether into EigenLayer. In return, users receive a receipt token, known as an LRT, that can be used elsewhere in DeFi.

According to data from DefiLlama, while Renzo added $460 million in deposits on Ethereum’s mainnet, an additional $270 million was added to Ethereum’s layer 2s in the last seven days.

Consequently, layer 2s now account for $680 million of the ezETH, within a broader total supply of $2.96 billion across all blockchains.

Renzo’s main competitor, Ether.fi’s eETH, leads in total value deposited, with a current total supply of $3.8 billion, but only around $428 million of that is on layer 2 networks.

Layer 2 networks offer users the benefit of reduced transaction fees, as well as opportunities to earn additional points.

Points are a tool designed to incentivize people to use a protocol. For example, Renzo gives users points each day if they hold ezETH. Similar strategies are used by other DeFi protocols.

Typically, these points convert to tokens at a later date.

For Ether.fi the first conversion of points to tokens happened on March 15. Renzo still hasn’t converted points to tokens.

Both Ether.fi and Renzo have a big presence on Arbitrum, the largest Ethereum layer 2 by total value of crypto assets deposited, with 120,136 eETH and 75,257 ezETH on the blockchain.

Mode, an Ethereum layer 2 built using the Optimism SDK, is another popular choice for LRT holders, but here, ezETH outweighs eETH, with 38,743 ezETH and 2,232 eETH.

Mode offers ezETH depositors double the Mode points, playing a role in the outsized deposits.

Still, Renzo’s most important integration may be with Blast, an Ethereum layer 2 that offers a native yield on deposits. On Blast, ezETH users can deposit in Juice, a “leverage farming” protocol that allows users to leverage their deposits to earn more points through Juice’s vaults.

Vaults are smart contracts that perform specific DeFi strategies.

A handful of vaults on Juice use ezETH, but the largest is the wETH/ezETH V3 LP vault, which currently has about $144 million deposited in it.

This specific strategy provides liquidity on Thruster, a decentralised exchange on Blast, and then stakes that position on Hyperlock, a yield optimiser.

In doing so, users can expect to earn points from Renzo, EigenLayer, Hyperlock, Thruster, Juice, and Blast. Still, it should be noted, this daisy chain of points involves significant risks, as deposits are routed through multiple protocols, in addition to the risk of liquidation.

The battle for market share will only continue to heat up, as EigenLayer launched its highly anticipated mainnet on Tuesday.

Also, this week, Juice announced that it will be integrating eETH into its vaults, and Gearbox, a leverage farming protocol on Ethereum mainnet, announced it will integrate ezETH on Arbitrum for leveraged point farming, the first such market on Arbitrum.

Ryan Celaj is a data correspondent at DL News. Got a tip? Email him at ryan@dlnews.com.