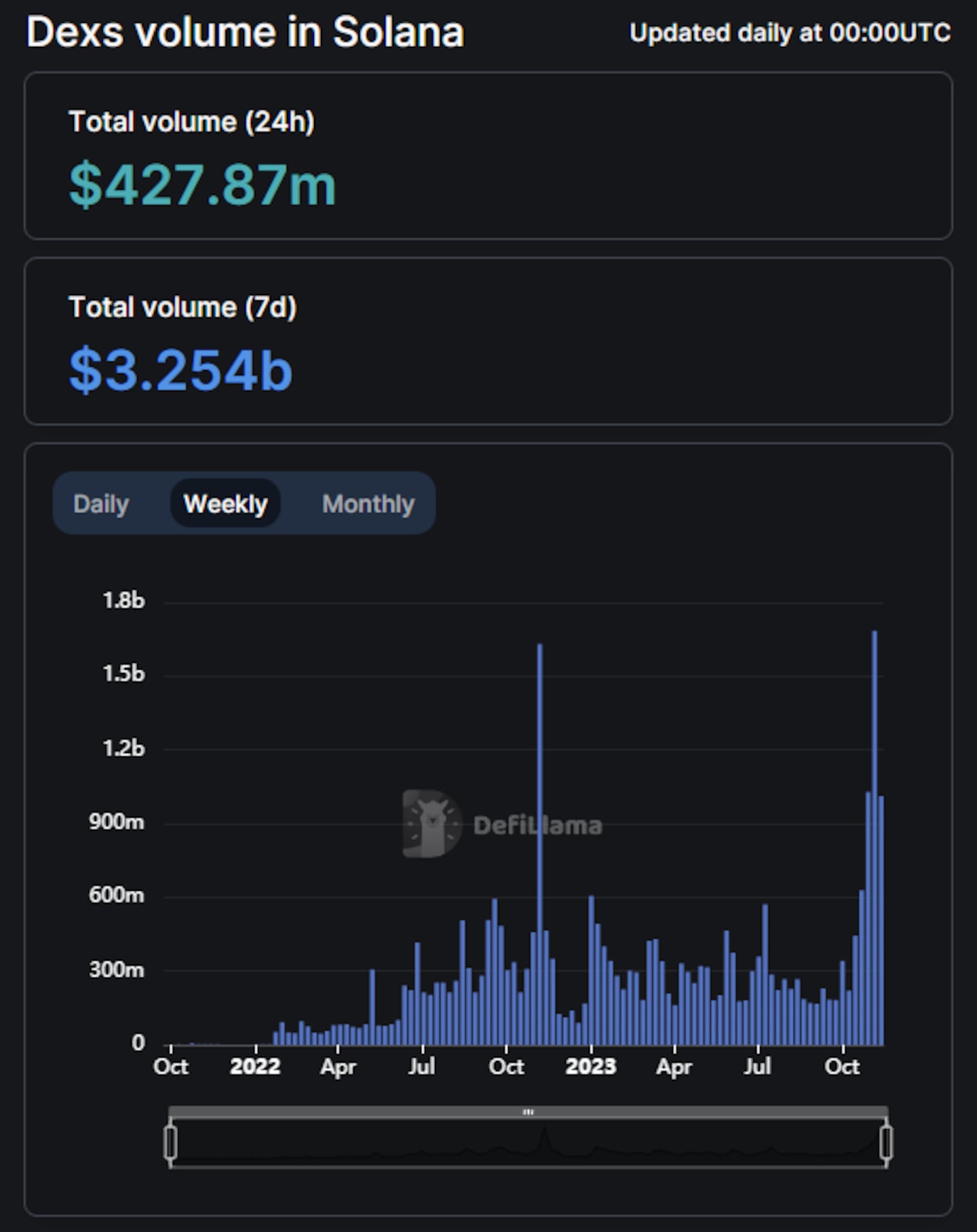

- Over the past two weeks, trading volume on Solana has experienced a notable spike, and the upward trend continues.

- The surge in trading activity coincides with the announcements of two upcoming airdrops, along with the increasing price of Solana.

Excitement is once again the prevailing sentiment on Solana after a difficult couple of years.

Decentralised exchanges on the network are seeing more activity than ever before amid a massive price spike in the blockchain’s eponymous cryptocurrency.

Weekly trading volume on Solana decentralised exchanges set a new record last week, reaching $1.7 billion, beating the November 2022 record of $1.6 billion, according to data from DefiLlama. The current week is also off to a promising start with a trading volume of $1 billion so far, signalling a continuation of the upward trend.

The cause, according to some, could be a new cohort of Solana users hoping to qualify for token airdrops.

That’s because the recent trading volume increase coincided with two major airdrop announcements from Pyth and Jupiter.

These projects say they are rewarding the Solana faithful who stuck with the blockchain despite a turbulent period that saw on-chain investments, as measured by total value locked, crash by 97% from peak levels in dollar terms.

“It’s pretty clear users are expecting and positioning for retroactive airdrops,” Anders Jorgensen, growth executive at Solana lending protocol MarginFi told DL News.

Jorgensen said some of the recent trading volume can be attributed to attempts to qualify for future airdrops from DeFi protocols like exchange aggregator Jupiter.

Reward for the Solana faithful

Crypto airdrops can be a significant windfall for those who qualify for them. Some users who attempt to qualify for airdrop on multiple wallets — a practice called Sybil attacking — claim to have made over $10 million doing so.

In a presentation at the Solana Breakpoint conference in Amsterdam, Jupiter announced it would airdrop tokens to users over four rounds, prioritising users who have been “consistent through these difficult two years.”

Breakpoint is Solana’s major annual crypto conference which took place between October 30 and November 3.

Such is the hype around Jupiter that the aggregator has recently broken into the top 10 decentralised exchanges across all blockchains, according to crypto analytics website CoinGecko. As an aggregator, Jupiter routes token swaps through several supported decentralised exchanges on Solana including Orca and Lifinity.

Although airdrop farming is part of the recent Solana volume uptick, it is not the only catalyst.

“We’ve also seen excitement around some older tokens,” Jorgensen said, pointing to popular Solana tokens, like BONK, which is up 13-fold in the last month.

Rooter, the pseudonymous founder of Solana lending protocol Solend, told DL News that he believes airdrops are only a “small driver” of the activity spike, with Solana’s price movement driving the momentum.

“The main driver right now is simply a surge in the price of Solana around the time of Breakpoint, which has caused a huge number of curious users to come back to speculate.”

The price of Solana has more than doubled in the last month and is now at its highest level since May last year.

Solana’s 145% price rally puts it as one of the best performers among all the crypto majors in the last month. Only FTT, FTX’s native token, and RUNE, the native coin of the ThorChain network, have performed better than Solana among the cryptocurrencies with market capitalisations north of $1 billion.

Orca’s Whirlpool

Most trading activity on the Solana blockchain is happening through Whirlpool — a concentrated liquidity protocol offered by Solana-native decentralised exchange Orca.

Concentrated liquidity protocols, otherwise known as CLAMMs are so named because they offer liquidity for token swaps at tight price ranges, which allows for greater price efficiency for both traders and liquidity providers.

“The fact that you can actively manage CLAMMs on Solana — as opposed to Ethereum where fees make this impossible — allows liquidity providers to use narrower ranges and thus use their capital more efficiently,” Will Thieme, software engineer at Orca told DL News.

Orca’s dominance of the Solana decentralised exchange market has been building since last year.

In February, DL News reported that Orca had emerged from the FTX collapse as Solana’s biggest decentralised exchange.

Orca’s capital-efficient liquidity pools have given it an edge over other exchanges, Orca co-founder Grace Kwan told DL News at the time.

Orca’s pools allow liquidity providers to concentrate liquidity across specific price ranges, similar to popular decentralised exchange Uniswap V3 on Ethereum. “This is why they drive the majority of trading volume on Solana and capture the majority of volume from aggregators,” Kwan said at the time.

But Orca’s success has become even more apparent in recent weeks. Of the $1.7 billion in trading activity recorded last week, $674 million used Orca’s Whirlpool.

While Solana’s TVL still lags its peak by 95% in US dollar terms, there has been some significant recovery with TVL growing about $200 million in the last month, DefiLlama data shows.

However, according to Jorgensen, much of this growth is due to the increase in SOL price in US dollar terms.

“What really matters is SOL-denominated TVL increasing,” Jorgensen added.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.

Tim Craig contributed to the story.