- Pump.fun is accused of running an unregistered securities exchange.

- The accusations comes on the back of a $2 million exploit.

- That and much more in this week's Decentralised newsletter.

A version of this article appeared in our The Decentralised newsletter on May 21. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- The pump.fun exploiter is out for blood.

- US prosecutors bring first-of-its-kind MEV case.

- TVL on Telegram’s TON blockchain jumps.

Is Solana’s pump.fun in trouble?

Pump.fun, a Solana-based platform for memecoin launches, is back after a temporary shutdown following a $2 million exploit.

But the exploit could just be the beginning of the protocol’s troubles.

Accused exploiter Jarret Reginald S Dunn posted a confirmation that he had been arrested and released on bail by UK police over the weekend.

Now he’s hitting back with accusations of his own against the pump.fun team.

Dunn, who other pump.fun developers say previously worked on the project, accused it of running the UK equivalent of an unregistered securities exchange, or a gambling site with no license.

Pump.fun is currently one of Solana’s most successful projects. Days before the exploit, it generated over $1.2 million in fees in 24 hours — more than the Solana blockchain did in the same period.

If pump.fun faces legal issues and shuts off again, it could kneecap activity on Solana.

But Dunn’s case against pump may be weak.

He’s already appeared to take credit for the exploit, and later said he’s been accused of stealing the $2 million with conspiracy to steal another $80 million.

In the UK, the legality of pump.fun is unclear. But still, its developers likely won’t want to have to defend themselves in court.

Pump.fun did not respond to a request for comment.

US prosecutors bring $25m MEV case

US prosecutors allege a pair of MIT-educated brothers made off with $25 million by targeting crypto trading bots on the Ethereum.

Such trading bots, which rearrange transactions on blockchains for profit, have long existed in a legal grey area. While some trading bots do exploit users, others help maintain efficient markets.

Some say the first-of-its-kind case could signal that more actions against those operating crypto trading bots are coming.

But as always, the devil is in the details.

It appears that the point of contention for prosecutors is that the alleged perpetrators targeted private transactions to extract the funds.

Normally, trading bots can only target publicly-broadcast transactions. However, in this case, the brothers are accused of gaining access to private transactions to trick other trading bots into buying $25 million worth of illiquid tokens.

Those targeting publicly-broadcast transactions for MEV strategies appear to be safe — for now.

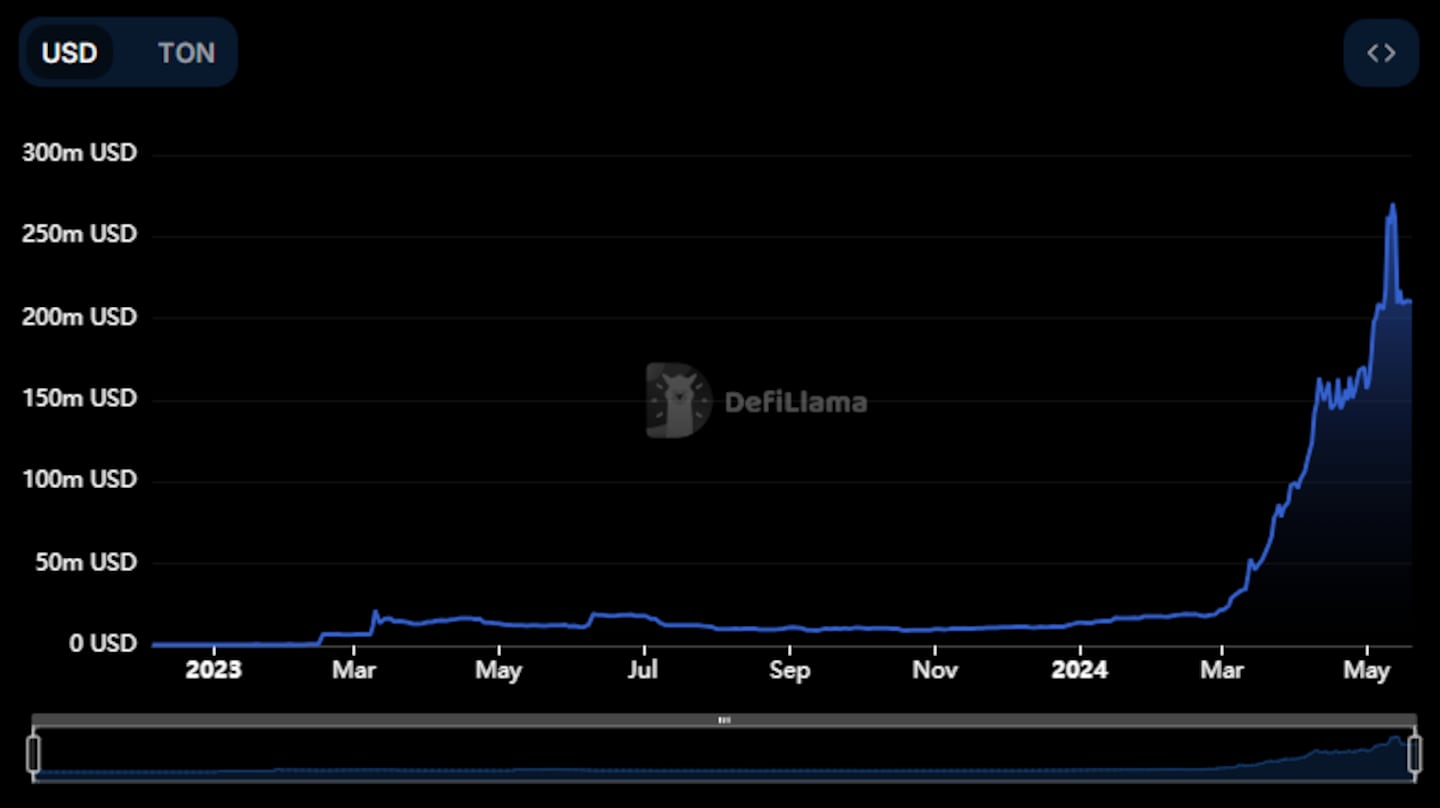

TON hits TVL all-time high

Assets deposited to DeFi protocols on Telegram’s TON blockchain briefly hit an all-time high of $270 million.

The boost could be the start of the messaging app converting its 800 million monthly active users into crypto degens.

Helping fuel the rise is Tether’s deployment of its USDT stablecoin on the TON blockchain in April. USDT is the biggest crypto stablecoin with over $111 billion in circulation.

TON has a crypto wallet integrated into the Telegram app, allowing users to send USDT to their contacts worldwide directly from the app.

Users can also earn an annual yield of up to 50% on USDT stored in their TON wallet, paid in TON, the blockchain’s native token.

The TON token rallied some 31% after venture firm Pantera Capital announced an investment in the blockchain on May 8.

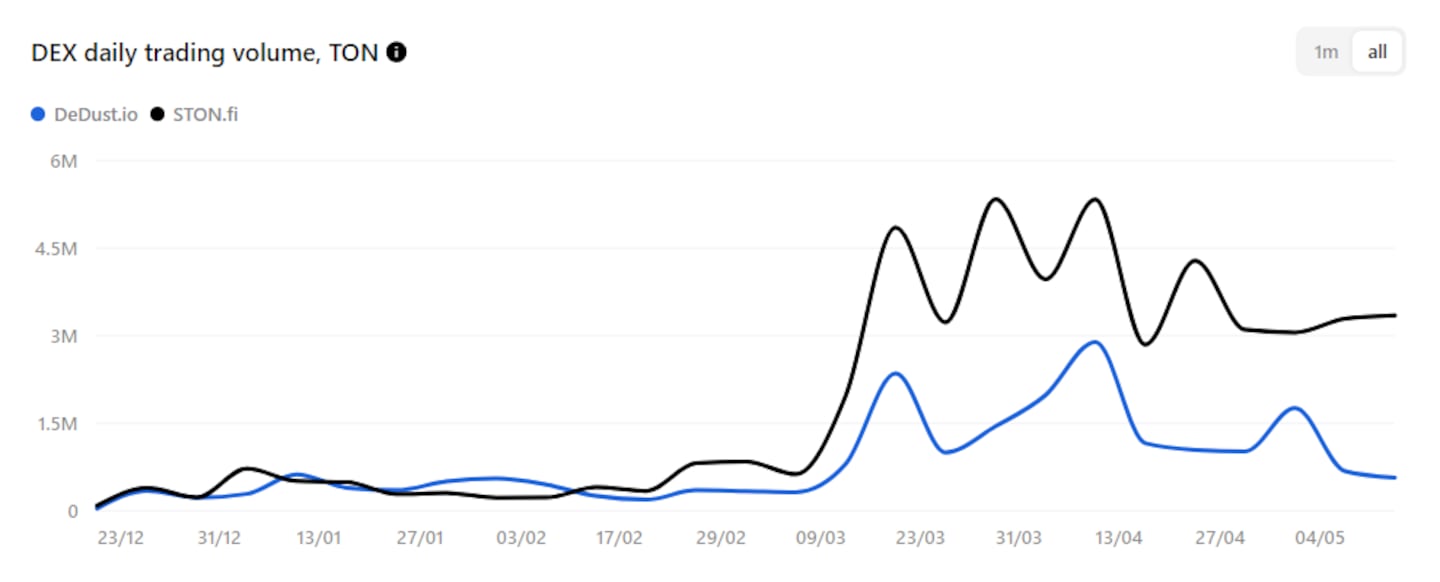

While TVL is up, it’s unclear if this recent increase is translating into increased activity.

Data of the week — what’s happening on TON?

The TON blockchain’s TVL spiked again at the start of May, pushing the metric briefly to over $270 million.

But at the same time, other metrics, like trading volume, didn’t show a similar increase.

Historically, increases in blockchain TVL usually result in increases in trading activity.

This week in DeFi governance

VOTE: Arbitrum DAO supports 8-week mergers and acquisitions pilot

VOTE: Aave DAO looks to onboard Ethena’s USDe on Ethereum

VOTE: Lido DAO polls new Lido Alliance framework

Post of the week

Crypto personality Jordan Fish — AKA cobie — has penned another blog post after a nearly-two-year hiatus.

In it he discusses the growing trend of how more and more of a crypto project’s value is captured privately before it launches a token.

Cobie’s previous posts proved highly-influential across the crypto industry — and this one looks to be no different.

What we’re watching...

zkSync firmly stands by its commitment to decentralize.

— ZKsync (∎, ∆) (@zksync) May 17, 2024

Since rolling out support for EIP4844 in March, this has been the sole focus. The upcoming release of v24 is the final planned protocol upgrade needed before handing over network governance to the community. The remaining…

Ethereum layer 2 zkSync teases that its token launch could be close.

The project has previously said it plans to decentralise governance of the blockchain through a token.

It now says this transfer will take place after the upcoming v24 upgrade, scheduled for the end of June.

Got a tip about DeFi? Reach out at tim@dlnews.com.