A version of this story appeared in our The Decentralised newsletter. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Starkware proposes an inflation schedule for STRK

- All 154,000 Wrapped TAO on Ethereum are controlled by a single person

- Bitcoin holders will soon be able to stake their coins on Cosmos

Starknet’s STRK airdrop could be just around the corner

Starknet, an Ethereum layer 2 network created by Starkware, is preparing to launch its long-awaited STRK token airdrop.

Ahead of the airdrop, Starkware just put forth a proposal for the token’s inflation — the number of new STRK that will be created each year.

To decentralise Starknet, Starkware plans to transition transaction sequencing and proving on the network to a proof-of-stake protocol. STRK token holders will be able to stake their tokens to help secure Starknet, and receive newly-minted STRK in return.

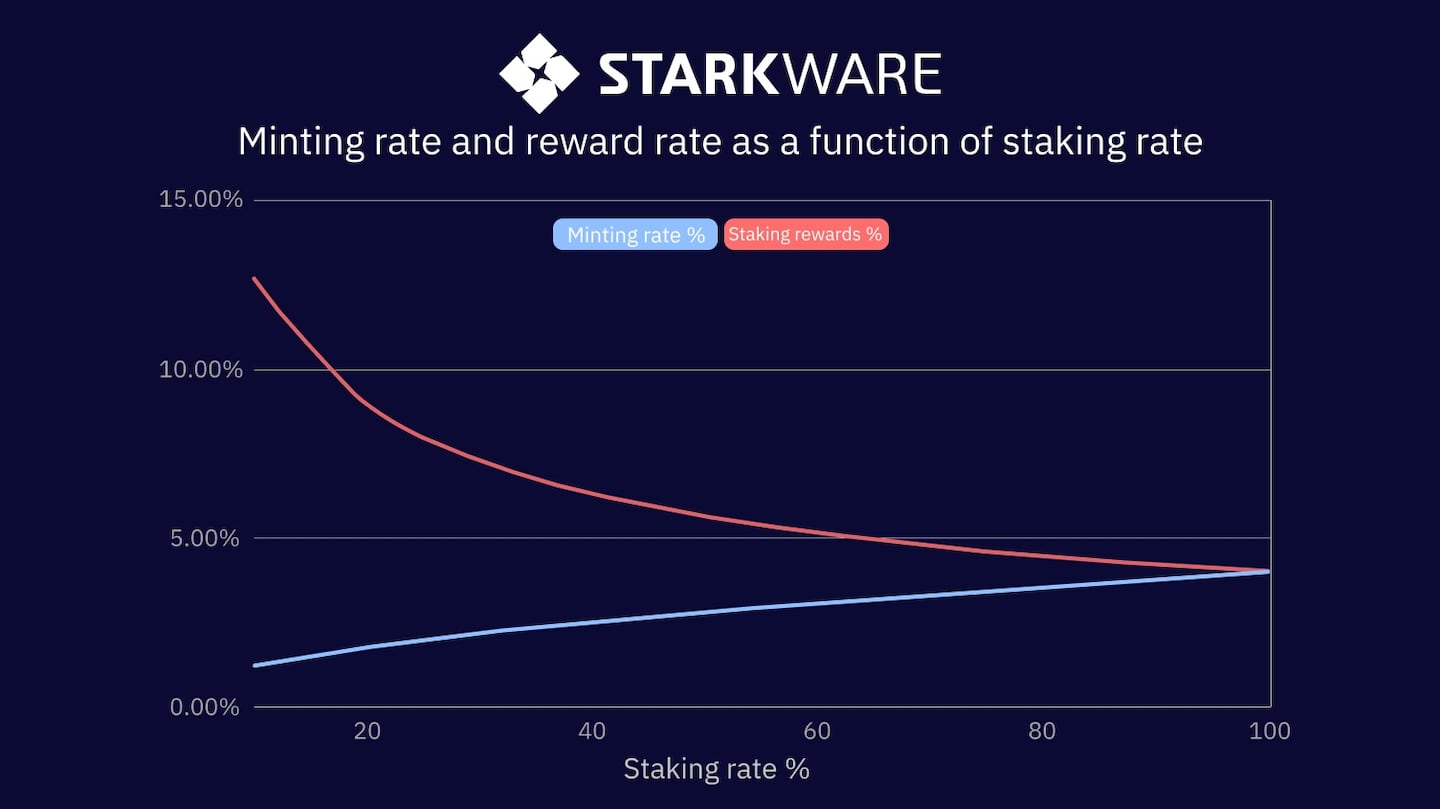

Such a system requires balancing. Stakers need to be rewarded enough to make it worth their while, but reward them too much and token inflation could get out of control.

Starkware’s proposed reward algorithm puts the maximum STRK inflation at 4% per year. Individual stakers could earn over 12% annually, depending on what percent of STRK’s 10 billion supply is staked.

The current figures are not set in stone, though. The proposal will undergo a community review process and then must pass a governance vote to be incorporated into Starknet.

The Wrapped TAO bridge is permissioned

Bittensor, the buzzy AI blockchain, has seen its TAO token rally some 990% in recent months.

With demand for TAO soaring, an enterprising member of the Bittensor community created a bridge allowing users to transfer TAO between the Bittensor and Ethereum networks.

So far, the bridge has minted more than 154,000 Wrapped TAO tokens on Ethereum — but there’s a catch.

CreativeBuilds, the bridge’s pseudonymous creator, has to personally sign off every time a user wants to redeem Wrapped TAO.

This set-up gives a single person complete control over more than $82 million worth of Wrapped TAO holders’ funds.

Such permissioned bridges are highly unusual in DeFi. It means one individual or entity has total control over funds deposited into the bridge.

Babylon proposes Bitcoin staking on Cosmos

Babylon, a platform developing a Bitcoin staking protocol, has partnered with Cosmos to let Bitcoin holders get involved in Cosmos staking.

It plans to integrate with Cosmos, allowing Bitcoin holders to stake their Bitcoins to secure Cosmos Hub consumer chains, such as Neutron and Stride.

Bitcoin staking is coming to Cosmos Hub. Together with @informalinc, we are bringing our Bitcoin staking protocol to @Cosmos, turning Cosmos Hub into a multi-asset security aggregator powered by $ATOM, $BTC, and ecosystem tokens. https://t.co/IQmjdncNf7

— Babylon (@babylonlabs_io) February 12, 2024

The hope is the integration will attract some of Bitcoin’s $976 billion market value to help secure the Cosmos ecosystem. In return, Bitcoin holders can earn staking rewards in the form of tokens from Cosmos and its consumer chains.

Babylon says the process of staking Bitcoin on Cosmos will be completely trustless and self-custodial.

The development comes amid a staking and restaking frenzy on Cosmos competitor Ethereum.

Data of the week

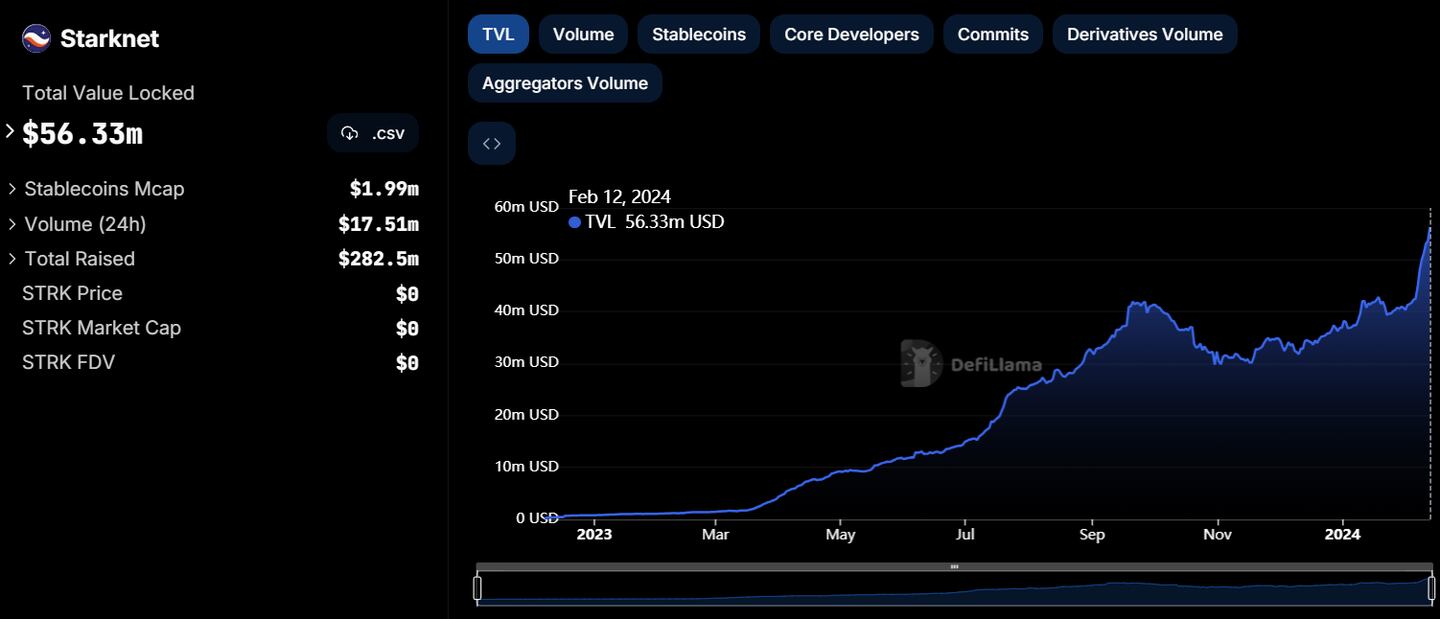

Starknet TVL just hit an all-time high above $56 million after a 30% increase this week.

The majority of the network’s TVL boost comes from three protocols: lending and trading market Nostra, decentralised exchange Ekubo, and money-market protocol zkLend.

Around 4% of Starknet’s TVL comes from stablecoins, compared to 74% at rival zkSync Era.

This week in DeFi governance

VOTE: Balancer to pay back hack victims in BAL

VOTE: Arbitrum DAO uncertain on rewarding Discord members with ARB tokens

VOTE: CoW Swap to increase liquidity for its native token

Post of the week

DL News is excited to partner with ETHDenver from February 29 to March 3.

I’ll be on the ground in Denver, so if you’ve got a DeFi scoop to share or just want to chat, come and say hi!

MEDIA PARTNER ALERT 🦙

— ETHDenver 🏔🦬🦄 (@EthereumDenver) February 10, 2024

We are BAAA-YONNND EXCITED to announce our media partnership with @DLNewsInfo, the news arm of @DefiLlama 🌈 🦄 pic.twitter.com/QH7HBx0Lub

What we’re watching

Sui and Aptos founders going at it is pretty bullish both chains tbh

— mert | helius.dev (@0xMert_) February 10, 2024

You gotta have that dawg in you in such an environment pic.twitter.com/wjulQ5D2qG

Competition between Move-based blockchains is heating up, as Helius Labs CEO Mert Mumtaz recently highlighted.

Currently, Sui is way out in front with more than $571 million in TVL compared to Aptos’ $175 million.

Got a tip about DeFi? Reach out at tim@dlnews.com.