A version of this story appeared in our The Decentralised newsletter on April 2. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- April is set to be a big month for airdrops

- Why you should pay attention to Pendle’s recent surge

- Uniswap DAO plans to sell some of its $5 billion UNI stash

Swell expects April token launch

Ethereum staking and restaking protocol Swell has long planned to launch a governance token.

Head of marketing Kieran Smith told DL News that the protocol’s token genesis event is expected in April.

Swell first confirmed it would launch a token in early 2023. That promise has helped push Swell’s deposits to $781 million. Those who stake Ether on Swell can earn points, which the protocol says will convert into a Swell token airdrop.

The move will likely put pressure on Swell’s competitors in the liquid restaking space — such as Renzo and Puffer Finance — to launch their own tokens.

And it’s not just Swell looking to airdrop its token. Cross-chain bridge Wormhole, real estate futures market Parcl, lending protocol Kamino and NFT marketplace Tensor have all confirmed token airdrops this month, too.

W

— Wormhole (@wormhole) March 28, 2024

Wormhole Wednesday

3-April-2024

11:30AM UTC pic.twitter.com/CjdmT1i8PE

Wormhole, Parcl, Kamino and Tesnor will all launch their tokens on Solana. Judging by recent Solana token launches such as Jito and Jupiter, it’s likely these airdrops will boost activity on the blockchain.

Disclosure: The author of this newsletter holds Swell staked Ether.

Pendle is now a top 10 DeFi protocol

Pendle, a DeFi protocol that lets traders bet on the yields of different tokens, just entered the top 10 DeFi protocols with almost $3.5 billion of deposits.

It’s the first protocol of its kind to gain traction. Its success shows that there is significant demand for more complex yield products in Ethereum DeFi.

Pendle lets traders take yield-bearing tokens, like Ether liquid staking and restaking tokens, and split them into two parts.

The first part, known as the principal token — or PT — represents the initial investment’s value after deducting anticipated future earnings, which are represented by the second part, the yield token — or YT.

Once a token is deposited to Pendle, a trader receives a principal token that reflects the base value of their investment minus the value assigned to the expected interest or yield, and a yield token that captures the potential earnings or returns their investment might generate over time.

These potential returns include points given out to token holders by protocols like EigenLayer.

The dual token structure lets those who want to accumulate as many points as possible purchase other users’ yield tokens. Those who just want to lock in staking yields can accumulate principal tokens.

Uniswap DAO forms working group for treasury diversification

Uniswap DAO has voted to form a working group to decide how the cooperative will diversify its more than $5 billion worth of treasury holdings.

The reason? Almost all the the DAO’s holdings are denominated in the UNI token. This is a problem because the DAO’s funds are overly tied to the price of UNI, and because the DAO isn’t growing the treasury by generating yield on its holdings.

According to the proposal, the working group will conduct eight weeks worth of research into the types of treasury management initiatives that the DAO could pursue.

The group will be composed of four members, including DAO governance solutions provider StableLab and professional governance group Arana Digital.

But diversifying the treasury could prove difficult. The proposal stresses that “before moving any UNI to and from the treasury, we must have clarity around the legal implications of administering this programme.”

This means the DAO may need to adopt a new legal structure.

Uniswap DAO has yet to formalize its opinions on how to set up legal entities, which could delay the planned treasury diversification.

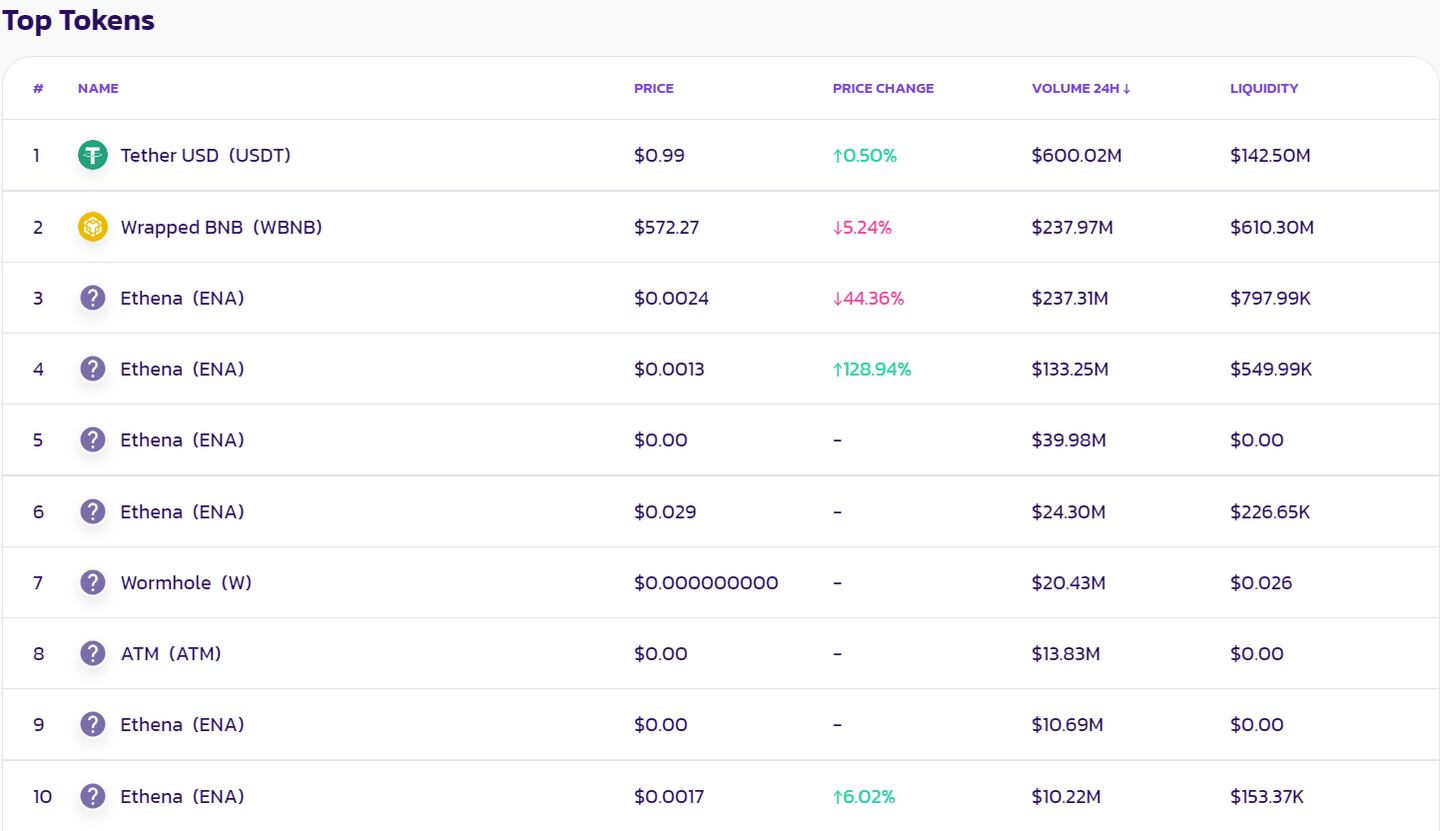

Data of the week: Fake tokens push up BNB Chain trading volume

BNB Chain hit $1.8 billion worth of trading volume on Monday, surpassing both Ethereum and Solana.

But scratching the surface, a lot of the new trading volume appears to be inorganic. PancakeSwap, the biggest decentralised exchange on BNB Chain, shows that seven of its top traded tokens are fakes imitating the Ethena and Wormhole tokens.

Cumulatively, these fake tokens account for almost $500 million of trading volume.

This week in DeFi governance

VOTE: GMX will let users provide liquidity in just Wrapped Bitcoin or Ether

PROPOSAL: Should Uniswap deploy Uniswap v3 on Sei after its parallelisation upgrade?

Post of the week

Players of Blast-based crypto game Munchables almost lost $63 million after a developer working on the project stole the funds.

To the relief of both players and the game’s creators, the rogue developer decided to return the funds soon after. The name of the game and its “Schnibbles” token add a certain absurdity to the situation, despite the serious nature of the theft.

you’re laughing? a bunch of 30 yr old men lost millions in Munchables trying to earn “Schnibbles” and you’re laughing?? pic.twitter.com/wGXANKHRjt

— Steezy (@steezysloth) March 27, 2024

What we’re watching...

Lido about to drop under 30% for the first time in years. Anyone know why? Is it just because of native restaking + LRTs on EigenLayer? https://t.co/wqWia8ojHC

— Viktor Bunin 🛡️🇺🇸 (@ViktorBunin) March 31, 2024

Lido’s dominance is falling.

The liquid staking protocol, which accounts for the largest share of all Ether staked on Ethereum, has dropped below 30% for the first time in over a year.

Correction, April 8: A previous version of this article said Swell’s token airdrop was confirmed to take place in April. It has been updated to say that the airdrop is expected in April.

Got a tip about DeFi? Reach out at tim@dlnews.com.