- Three Telegram bots rank in the top 20 protocols for fees generated in the past 24 hours.

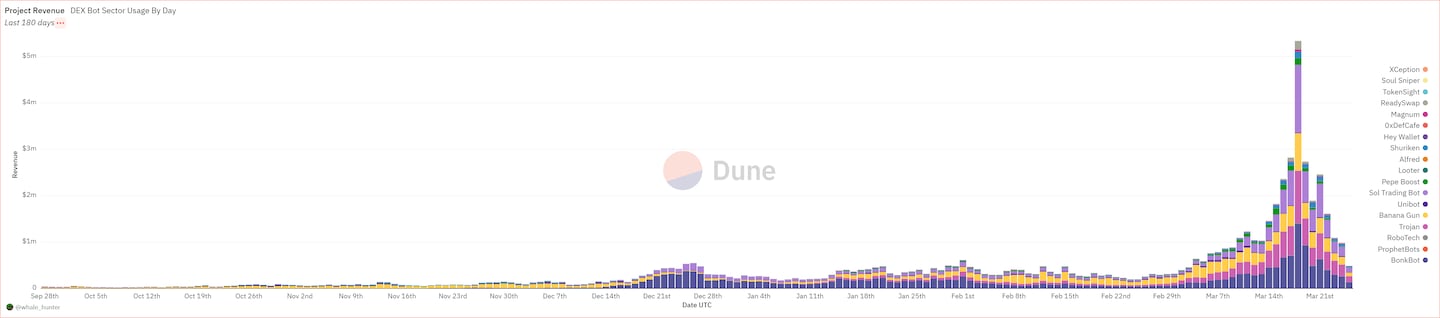

- Telegram bots peaked at over $700 million in trading volume and $5 million in revenue on March 18.

- An initiative by the Avalanche Foundation and a proposal on the Arbitrum DAO forum to support memecoin development signal continued interest in the memecoin ecosystem.

With memecoin trading taking centre stage, three out of the top 20 protocols by fees generated in the last 24 hours are Telegram trading bots, according to data from DefiLlama.

Telegram trading bots allow users to trade cryptocurrencies on the popular messaging app, streamlining the process with various features.

A user can buy cryptocurrencies simply by sending a message containing the contract address of the desired currency to the bot, which then executes the purchase in the specified amount.

This approach is especially favoured by memecoin traders, because it provides a faster option than using a decentralised exchange’s front end.

Given that memecoins can experience double-digit percentage swings in price within mere minutes, the importance of speed cannot be overstated.

Three bots — Trojan, BONKbot, and Banana Gun — collectively generated over $725,000 in fees in the last 24 hours.

The sector as a whole has surged in the last month. It had over $153 million in trading volume in the last 24 hours, and the trading bots generated over $700 million in trading volume and over $5 million in revenue on March 18.

Telegram bots often have native tokens that unlock additional features or provide access to revenue sharing. Revenue comes from fees charged on trades and range from 0.5% to 1% of the total trade amount.

These Telegram bots manage their revenues differently.

Trojan, previously associated with Unibot before a team split, distributes 50% of its generated revenue to Unibot holders, determined by a snapshot taken before the split was announced. The remaining 50% is allocated to future holders of the Trojan token.

BONKbot distributes fees across a number of avenues with the largest portion, 30%, going to the team behind BONKbot.

Banana Gun distributes 40% of its revenue back to token holders, with the remaining 60% going to the team and further bot development. The token now provides an annual percentage yield of over 68%.

The Solana blockchain dominates with 85.8% of the total user base. Base captures the next largest group of users at 6.6%, while Ethereum mainnet trails with 5.9%.

The memecoin trend doesn’t appear to be stopping anytime soon. Realising how big this trend has become, blockchain developers are now dedicating resources to encourage memecoin development.

The Avalanche Foundation recently announced that it will hold five different memecoins, dubbed community coins, in its treasury.

A similar proposal was put forth on the Arbitrum DAO forum from a community member, outlining a plan to initiate a memecoin fund. The fund would invest in memecoins and cultivate a memecoin-friendly community on Arbitrum.

Ryan Celaj is a data correspondent at DL News. Got a tip? Email him at ryan@dlnews.com.