- New non-profit Bluechip will grade stablecoins from A+ to F.

- In its inaugural report, no stablecoin earned the top A+ grade, but four got an A.

- Tether, the largest stablecoin by market cap, received a D due to its lack of an audit.

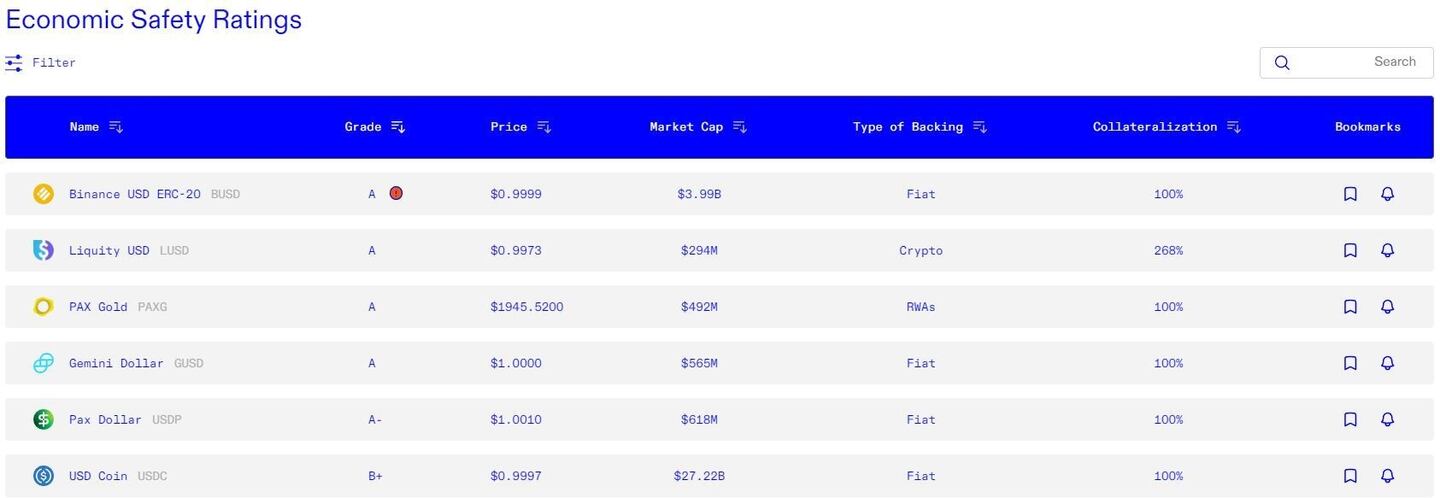

A new stablecoin rating agency just released a ranking of top 15 stablecoins. But no stablecoin got full marks.

The agency — a non-profit called Bluechip — wants to offer a reliable resource for crypto investors to understand the relative safety of the different pegged assets that power much of the crypto industry.

Bluechip works similarly to Wall Street rating agencies such as Standard & Poor’s and Moody’s, which provide ratings for various investment products. But Bluechip uses more familiar US school grading instead of bond ratings — assigning letter grades to stablecoins ranging from A+, the highest possible grade, to a failing grade of F.

NOW READ: Investors pull $4bn from Binance as regulators and rivals close in

No stablecoin earned the top A+ indicating it is “highly stable.” However, four stablecoins — Binance USD, Liquity USD, Pax Gold, and Gemini Dollar — received an A, the second-best grade.

On the other end of the spectrum, Bluechip gave USDD, a stablecoin with connections to the Tron blockchain and its founder Justin Sun, a failing F grade.

Explaining the grade, Bluechip said it believes that “USDD’s reserves are commingled with assets of Huobi,” and strongly recommend users not to use it.

Tether gets a D

“One of the hallmarks of our rating system is that we favour transparency. And if claims are opaque, we’re erring on the side of caution and distrust,” Garett Jones, Bluechip’s chief economist, told DL News in an interview. “It’s really the audit that’s the most important single factor holding back Tether.”

Tether, currently the biggest stablecoin by market cap and deployed across 14 different blockchains, as well as TrueUSD and Frax, all received a D grade, indicating that they are “unsafe.”

“When it comes to Tether, what ends up holding the rating down to a fairly low level is the lack of an audit — the fact that people can’t be credibly convinced of its reserve plans,” Jones said.

NOW READ: ‘Tether is next’ says short seller who bet against Silvergate and Signature Bank

Tether has long struggled to convince the crypto community it holds reserves one-to-one for its $83 billion tokens. In 2021, the US Commodities and Futures Trading Commission fined Tether $41 million for making untrue or misleading statements about the reserves backing its flagship dollar-pegged stablecoin.

Although Tether has since started releasing quarterly attestations, it has failed to conduct a comprehensive third-party audit of its reserves.

But it’s not just audits that can make or break a stablecoin’s rating. Bluechip looks at numerous factors, including how well a stablecoin has historically held its peg, how transparent its governance is, and the quality of its management, among other things.

“We’re not just looking at whether there are deep liquidity pools for each coin, although those are important traits,” Jones said. “We’re looking behind that to questions of governance.”

“It’s not just some sort of gut feeling about whether you like the team or not.”

That approach stems from Jones’ background.

He’s a professor for the Study of Capitalism at George Mason University’s Mercatus Center. He also helped bring together an advisory group of other economists, including Tyler Cowen, Robin Hanson, Alex Tabarrok and Lawrence H. White, to work on Bluechip.

Other advisers include Nic Carter, general partner at VC firm Castle Island Ventures, and Ameen Soleimani, co-founder of Reflexer Labs that develops stablecoin Rai.

Jones is one of the three team members behind the agency — the others are Austria-based CEO Benjamin Levit, and India-based ratings director Vaidya Pallasena, an accountant by training.

Bluechip has received donations from Rune Christensen, co-founder of MakerDAO behind stablecoin Dai; stablecoin issuance platform Reserve’s co-founder Nevin Freeman; Ethereum scaling solution Starkware’s co-founder Eli Ben-Sasson; InnovaticGroup and others.

NOW READ: Binance controls 90% of TrueUSD’s supply amid increased pressure on the stablecoin

Bluechip’s inaugural report offers ratings for the top 15 stablecoins by market cap, including Binance USD, Liquidity USD, USD Coin, Pax Dollar, Gemeni Dollar, Tether and more, with plans to expand the list in the future.

Jones realises stablecoin rating is a contentious practice. Others in the industry may disagree with Bluechip’s results, which are subject to change if a stablecoin’s fundamentals improve or deteriorate.

“We look forward to people disagreeing with us or agreeing with us, coming up with their own way of saying, ‘we wish you had rated this a little bit differently,’” Jones said.

“Ultimately, one of our goals is to encourage stablecoin projects to feel like they will benefit if they just share more information.”