Bitcoin developer Satoshi Nakamoto attached a powerful news headline in the blockchain’s Genesis block: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Many interpret this message, published in the first ever open-source financial ledger, as an attack on the traditional financial system — which, conveniently for Nakamoto’s new project, had just endured its hardest crash in decades — the 2008 Financial Crisis.

Over the following 14 years, central banks worldwide printed an estimated $25 trillion to prop up economies.

Unlike central banks, which can create new money out of thin air, Nakamoto had the network issue new Bitcoin according to a rigid algorithm.

As such, while fiat currencies like the dollar or the euro are at the mercy of central banks and governments, Bitcoin’s issuance schedule is predictable, stable, and transparent.

Bitcoin’s idea caught on, and by the late 2010s developers had created thousands of cryptocurrencies, often with issuance schedules far more complicated than Bitcoin.

In many cases, crypto projects set aside portions of their tokens for team members, similar to how companies dish out stock options. Others initially sell large tranches of tokens to investors or venture capital firms to fund future growth.

In both cases, tokens are usually locked up — meaning their owners cannot sell them on the market — and are unlocked at a later date.

Fortunately for the crypto-curious, DefiLlama tracks all these token unlock schedules.

With a few clicks, it’s possible to see all the upcoming token unlocks in DeFi, get a sense of how projects’ issuance models will affect their token supplies, and compare issuance between protocols.

How do token unlocks work?

In DeFi, tokens are issued by protocols through smart contracts, and generally have a set issuance schedule governed by immutable code.

Protocols may choose to give out locked tokens to help better align the incentives of investors, team members, and the existing token holders.

For example, If a venture capital firm buys some tokens that are locked for three years after purchase, they are incentivised to stick around and add value to the project. If the tokens weren’t locked, the firm could dump them on the market at the earliest opportunity, profiting at the expense of both the project and secondary investors.

There are many ways tokens are unlocked and enter circulation. And there are many potential beneficiaries of token unlocks, which can include:

- Early Investors. Locked tokens bought early on in a project’s development by speculative investors later unlock, meaning they can be traded or sold on the open market.

- Airdrops. Protocols sometimes set aside a chunk of their token supply to airdrop to early or frequent users. When these windfalls are announced ahead of time, DefiLlama can track them.

- The protocol team. Protocols often pay developers, employees, and contributors in the protocol’s native token, or give employees locked tokens as part of a compensation package. In the latter case, these tokens unlock at a later date.

- Foundation or DAO allocation. Many protocols have adjacent foundations or DAOs that help direct future protocol changes and proposals.These organisations often receive locked tokens that they can use in governance votes, or allocate via grants and incentives programmes once the tokens unlock.

Protocols can use smart contracts to enforce a variety of issuance schedules, such as scheduled mass unlocks, linear emissions that issue tokens steadily over time, or burn mechanisms that periodically destroy tokens. These methods help reduce the circulating supply.

Using these methods, DeFi protocols are capable of addressing the same economic problems TradFi does, albeit through automated means. Of course, DeFi protocols are not always designed successfully.

Most DeFi protocols outline their tokenomic structure in documents called whitepapers. Smart contracts are built such that a savvy researcher can determine the issuance schedule of a project by looking at the underlying code.

Data aggregators such as DefiLlama take much of the guesswork out of this process, however, by distilling unlock data in an easy-to-digest format.

What are token supply metrics?

Before we delve into the intricacies of token unlocks, it’s essential to first grasp the foundational concepts of supply metrics.

These metrics shed light on the availability, distribution, and potential quantity of tokens, serving as key indicators for investors and market participants.

Circulating supply refers to the number of coins or tokens that are publicly available and actively circulating in the market.

This metric is key in calculating the market capitalisation, or market cap for short, of a given token.

Market cap represents the total worth of all tokens currently in circulation, and it’s calculated by multiplying the circulating supply by the current price of the token.

Another metric closely related to market cap is Fully Diluted Valuation, or FDV for short. FDV calculates the potential market value at the current token price if all tokens were in circulation, which brings us to the next metric.

Total supply accounts for all tokens that have been created or mined, minus those that have been burnt, or removed from circulation forever. Total supply includes not just the circulating tokens but also those that may be locked, reserved, or even held back by the project’s team.

If you multiply the current price of the token by the total supply, you’ll get a valuation that’s somewhere between the current market cap and the fully diluted valuation. This is because it accounts for all tokens minted, but not necessarily those that can or will be minted in the future.

Total supply isn’t the final frontier. There’s also maximum total supply, which represents the absolute ceiling or the maximum number of tokens that will ever be created for the project, defining its ultimate scarcity.

If you multiply max total supply by the current token price, then you will get the FDV.

FDV gives potential investors an idea of what the market cap could be if the total supply of tokens were fully realised and if the current price remained unchanged.

Although these metrics are useful, they aren’t as clear-cut as they may seem.

Bitcoin has a maximum supply of 21 million coins, with about 19 million coins circulating at the time of writing. But not all cryptocurrencies have capped token supplies like Bitcoin.

Ethereum has about 120 million tokens in circulation with an uncapped total supply. However, since the introduction of a change called EIP 1559 in August 2021, the Ethereum network now burns a portion of transaction gas fees, potentially reducing new Ether supply and adding a deflationary element to the cryptocurrency if the network’s in high demand.

Another important caveat to remember is the enforceability of the maximum total supply.

There have been instances where project teams have the ability to modify the supply rules or where the underlying code of a project doesn’t strictly enforce the advertised cap. It’s helpful to differentiate between a token’s hard-coded, immutable maximum supply and promises made in whitepapers or by project spokespeople. While the former is a technical constraint, the latter relies on the trustworthiness and credibility of the team behind the project.

Why follow token unlocks?

Token unlocks provide insight into a DeFi project and its team. Prospective investors in a token may draw conclusions about the attractiveness of a project based on unlock details.

For example, if a token is about to unlock 20% of its supply all at once, it’s possible that holders of the locked tokens will sell them the moment the unlock occurs. That could drive down the price of the token.

If the team allocation does not begin until the protocol reaches a certain age, an investor may choose to wait until the allocation begins to determine the team’s resolve in their own project.

If the team holds the token or sells a small amount of it following the unlock, perhaps the team believes that the project has more merit. Conversely, if the team immediately begins to sell in large quantities, some investors may consider that a red flag.

How to track token unlocks on DefiLlama

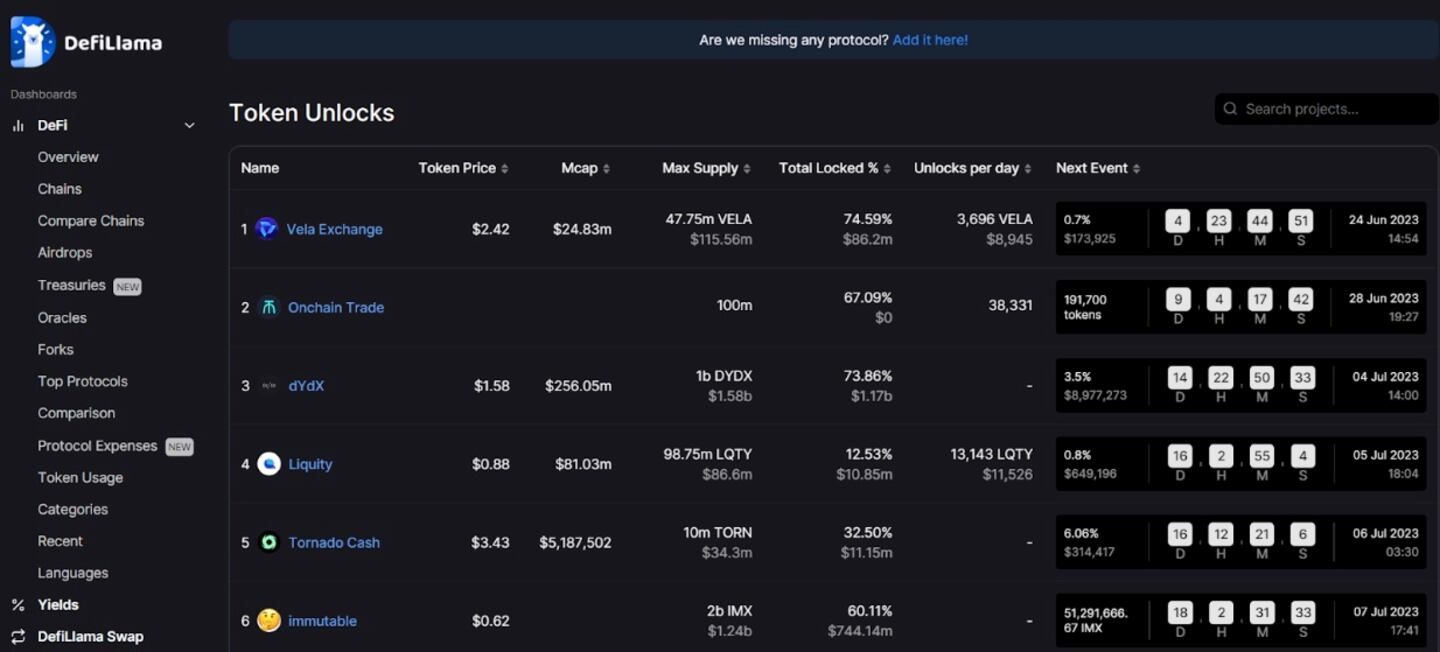

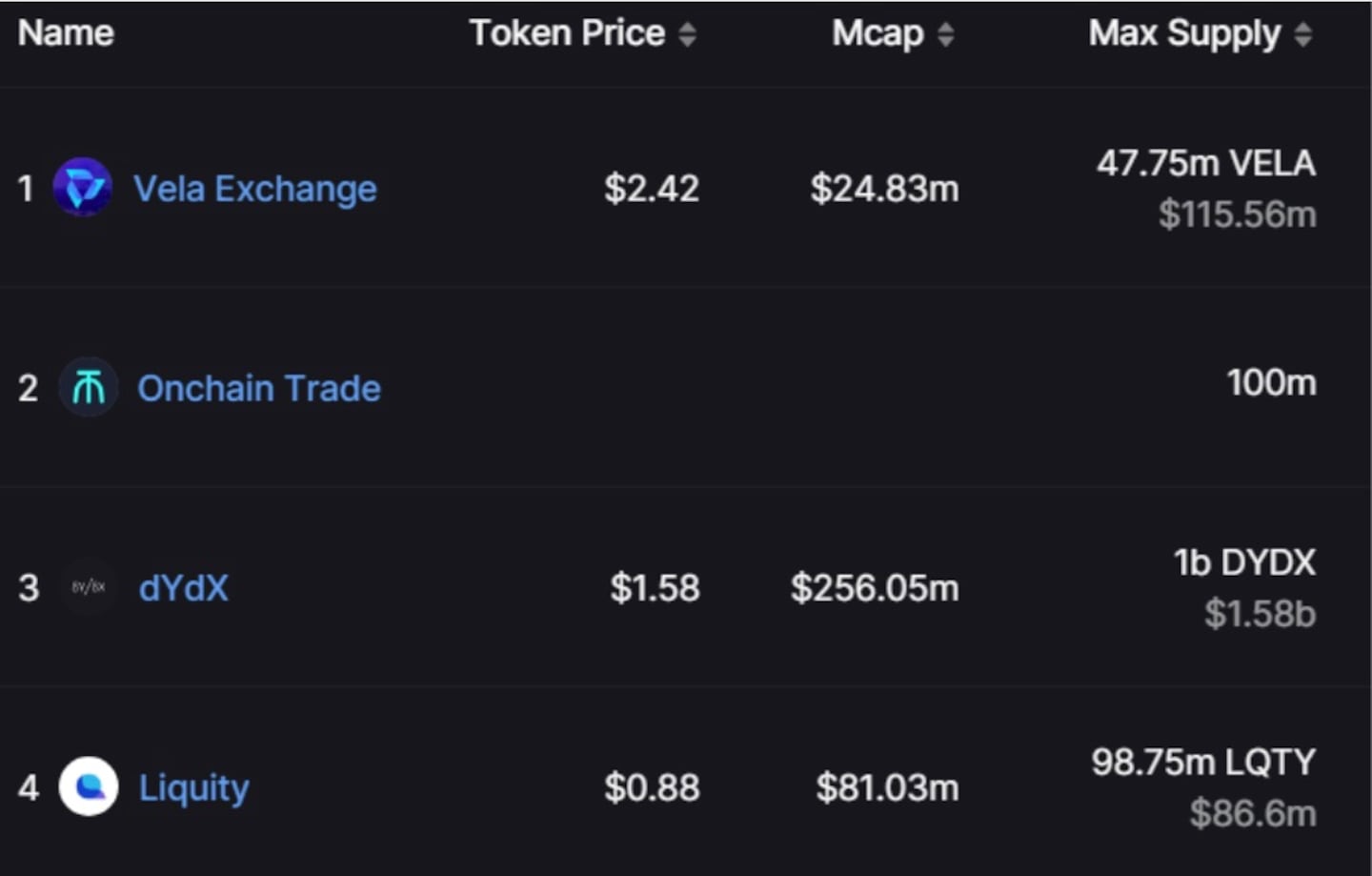

DefiLlama orders its Token Unlocks section by date. The protocol next to unlock tokens sits at the top of the list. Each row displays the current token price, along with the token’s market cap. This data helps calculate the other available metrics.

The max supply metric states the number of tokens that can ever be issued, and is supplemented with the token’s FDV. Recall that FDV calculates the potential market value at the current token price if all tokens were in circulation.

These metrics are important because they reflect the issuance phase of the token’s life span — once all tokens are issued and in circulation, the behaviour of the token’s price will no longer be affected by issuance.

So, if Aptos’s APT token has a price of $5, with a market cap of $5 billion, that means 1 billion tokens are currently circulating. The max supply metric shows APT as having a max supply of two billion, which means that one billion tokens remain locked. Thus, the Fully Diluted Value (FDV) of APT is $10 billion.

The FDV of a token is displayed in grey letters below the max supply metric.

The FDV of a token is a simple projection. It does not take into account fluctuations in price that are likely to occur once unlocks take place.

Although the FDV serves as a valuable metric for assessing token valuation, it shouldn’t be construed as definitive proof of the token’s inherent value. It’s also crucial to remember that there may never be enough exit liquidity to truly realise the FDV.

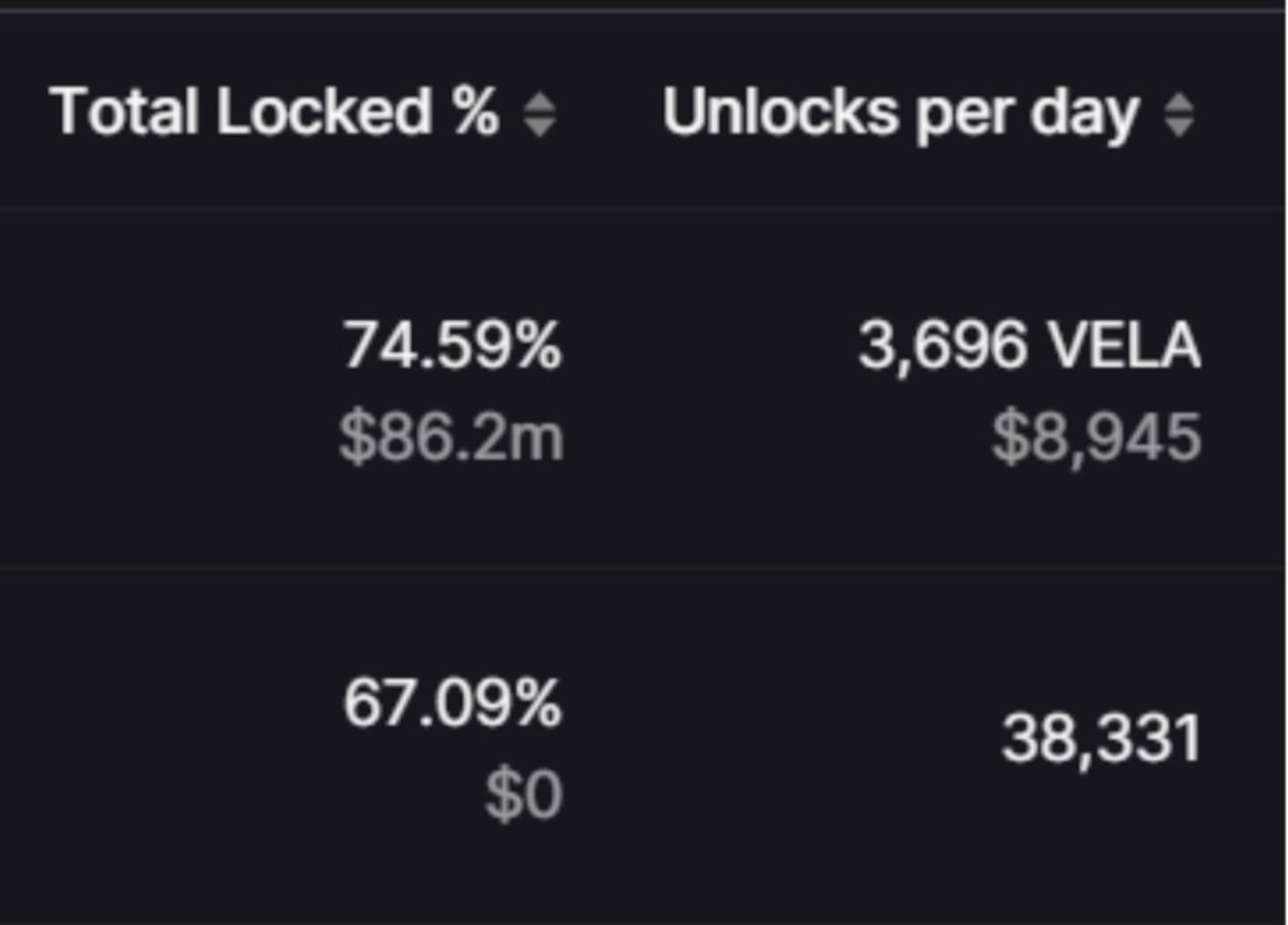

Protocols may issue tokens using long-term release schedules, vesting periods, or burning mechanisms that will alter the circulating supply over time. An example of this is the next metric, unlocks per day, which tracks the daily distribution of a token with a constant release schedule.

Unlocks per day is calculated based on the amount of tokens issued and their USD value.

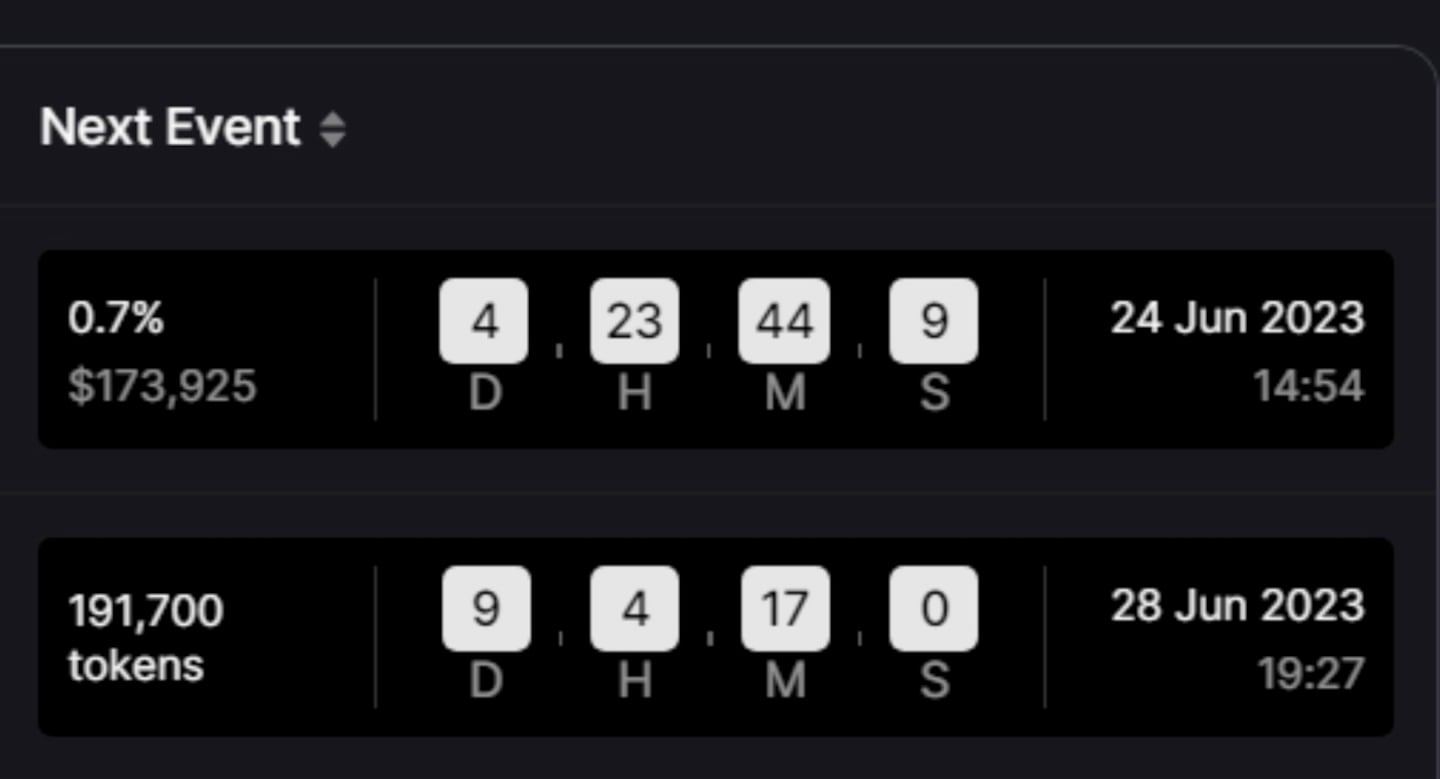

The final columns show information about a protocol’s next unlock event. The percentage represents the number of tokens that will be released from the total supply.

The total supply is the complete count of a cryptocurrency’s coins or tokens, whether they’re being traded, locked away, saved, or kept by the creators.

Above is a dollar amount for the entire unlock, calculated using the current price of the token. A countdown clock gives a live, up-to-the-second deadline for the unlock. The final column displays the actual time and date of the unlock.

Token unlocks are but one piece of the puzzle when evaluating a DeFi project. Issuance schedules reveal information about a token’s lifespan, its developer team, and possible selling pressure down the road.

While DefiLlama TVL charts help users see how a project has performed in the past, the token unlock section is one of the best ways to peer into a token’s future.

Next steps

- Read through the DefiLlama token unlocks page and try to find disparities between different unlock schedules. Are some unlocks riskier than others for investors?

- Compare the past token unlock of a project with its consequent price action. Does an unlock translate to a drop or rise in price?