GM, Tim here.

- Market rout liquidates Aave borrowers.

- A MicroStrategy-inspired Ethereum fund flops.

- Wallets linked to Ross Ulbricht lose $12 million.

DeFi users lose $200m

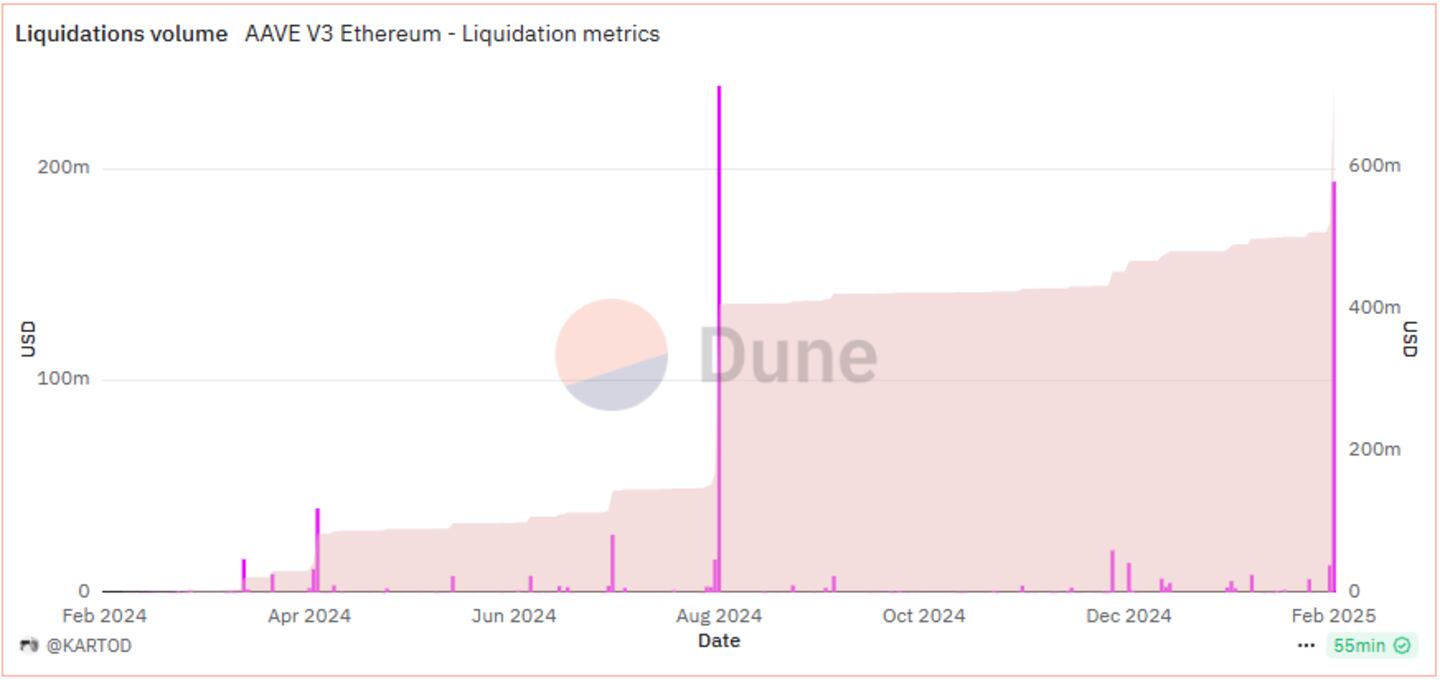

Borrowers on top DeFi lending protocol Aave are dropping like flies as falling asset prices trigger mass liquidations.

On Monday, more than 700 users of Aave V3, the protocol’s most popular instance, lost a combined $198 million — the biggest single-day loss in over five months. Borrowers on other lending protocols like Compound and Morpho also registered losses in the millions of dollars.

The crypto rout preceded a rollercoaster day in markets as President Donald Trump on Sunday threatened tariffs on goods from Canada and Mexico, then postponed the levies for a month on Monday.

The trade war jitters sent Bitcoin down 4%, while Ether plummeted 17%. Around 50% of liquidated assets on Aave were staked or wrapped versions of Ether.

DeFi lender liquidations occur when a user borrows other crypto assets against volatile collateral like Bitcoin or Ether. If the value of a user’s collateral decreases and nears the value of their borrowed crypto, lending protocols like Aave automatically put up the collateral for sale to ensure the protocol doesn’t accrue bad debt.

Aave borrowers weren’t the worst hit. Those placing leveraged bets on centralised crypto exchanges lost over $2.3 billion.

DeFi users may not be out of the woods yet.

Aave will put up another $16 million for liquidation if the price of Ether drops to around $2,355 and borrowers don’t top-up their collateral, according to onchain data compiled by DefiLlama.

The amount liquidated is still below that of last August. Market jitters caused by The Bank of Japan raising interest rates spread through the crypto market, causing $239 million worth of liquidations on Aave.

EtherStrategy flops

EtherStrategy, a DeFi project attempting to copy Bitcoin bull MicroStrategy but with Ethereum, has refunded depositors after a lacklustre launch.

“There was not enough interest or demand to justify launching the DAO in the current state,” EtherStrategy’s co-founders said in a post on X.

The project appeared to attract significant interest before launch, with some 5,000 people pledging to deposit about 40,000 Ether, according to co-founder Justin Bram.

But EtherStrategy launched on Thursday without having undergone a third-party audit, which may have deterred investors given crypto’s history of exploits. Moreover, a website bug caused deposits to initially go to the wrong onchain address.

EtherStrategy’s goal was to accumulate as much Ether as possible. It planned to issue convertible notes and sell its own ETHSR tokens to fund purchases, similar to MicroStrategy.

MicroStrategy has been one of the world’s hottest stocks since Donald Trump’s US election win in November. Founder Michael Saylor is a Bitcoin evangelist, and his company has repeatedly issued new stock and taken on new debt to fund the purchase of more Bitcoin.

A $12 million mistake

A wallet associated with freshly-pardoned Silk Road founder Ross Ulbricht lost $12 million in a memecoin trading blunder.

The error came while trying to use ROSS — a token created by fans to celebrate his release from prison on January 21 — to provide trading liquidity on Solana decentralised exchange Raydium.

The Ulbricht-linked wallet accidentally used the wrong settings, setting the price of ROSS much lower than the market rate.

Trading bots immediately capitalised on the error, picking up $1.4 million in ROSS and selling it. The wallet then made the same mistake again, letting bots pick up and sell a further $10.5 million worth of the token.

ROSS’s market valuation plunged more than 90% to $641,000 from $40 million.

The incident brings a bizarre twist, if the wallets associated with him are actually controlled by him. That one of Bitcoin’s most savvy figures would fall victim to a technical error — after building one of the largest Bitcoin marketplaces — shows how much trading has changed in the past 10 years of his absence.

The Free Ross campaign didn’t respond to a request for comment.

This week in DeFi governance

VOTE: Aave DAO to deploy v3 instance on Fantom relaunch Sonic

VOTE: CoW DAO renews the CoW grants programme

VOTE: Arbitrum DAO to invest another 35m ARB via treasury endowment programme

Post of the week

BoldLeonidas sums up President Trump’s recent impact on the crypto market with a meme.

— Bold (@boldleonidas) February 3, 2025

Got a tip about DeFi? Reach out at tim@dlnews.com.