A version of this article appeared in our The Decentralised newsletter on September 10. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Trump’s DeFi project values itself at $1.8 billion.

- Does blockchain choice matter for a DeFi protocol’s success?

- DeFi degens profit off a new Ethereum exchange.

Trump’s new cash cow?

The Trump family’s World Liberty Financial could provide the former president with hundreds of millions of dollars from token sales.

That’s according to code tests that reveal the project plans to sell 30% of its WFLI token at a $1.8 billion valuation.

The sale, if it finds buyers for all 30 billion tokens on offer, would put $537 million into its coffers.

The project’s white paper specifies that although the platform is not owned, managed, operated, or sold by Trump, he and other members of his family may still receive compensation from it.

The outsized allocation of 70% of the project’s tokens to insiders, as well as other concerns, have split opinions.

Onchain sleuths have been quick to highlight the project’s connection to Dough Finance, a previous DeFi protocol that was hacked for $2.1 million in July.

A spokesperson for World Liberty Financial declined to comment.

DeFi’s biggest question

Blockchains often style themselves as being the best for different use cases, whether that’s preserving privacy or offering lightning-fast transactions.

But is one statistically the best for launching new DeFi protocols on?

A new analysis from euro stablecoin EUROe’s Juuso John Roinevirta attempts to get to the bottom of this enduring question.

Assuming you choose sensibly, does the blockchain on which you deploy actually matter?https://t.co/uZoPum9NJa

— roinevirta.eth🦞🦢🔴🟢 (@roinevirta) September 4, 2024

Roinevirta looked at launches of the largest protocols across several categories, including decentralised exchanges and lending protocols, on six blockchains:

- Ethereum

- Solana

- BNB Chain

- Arbitrum

- Base

- Blast

He found that after one year, BNB Chain protocols attracted the most deposits, while Arbitrum protocols attracted the least.

The differences between the chains closed as the protocols on them matured, however.

But there are other factors that might be even more important.

Arbitrum, Roinevirta noted, launched during the crypto winter, while BNB Chain launched close to the peak of crypto’s 2021 bull run.

It may be that when a protocol launches is more important to its success than where.

“I’d love to see a more robust analysis on what role timing plays over other factors,” Roinevirta said.

Degens pile into Ethervista

Savvy DeFi traders have been busy making millions on a buzzy new Ethereum exchange called Ethervista.

In its first five days live, the top 10 traders of the exchange’s VISTA token made a combined $5.4 million.

Launched on August 31, Ethervista is a decentralised exchange similar to Uniswap, where users launch their own tokens and create liquidity pools, letting other users swap tokens without the need to trust a custodian.

The excitement around Ethervista has led many to compare the new exchange to memecoin creation platforms like pump.fun on Solana.

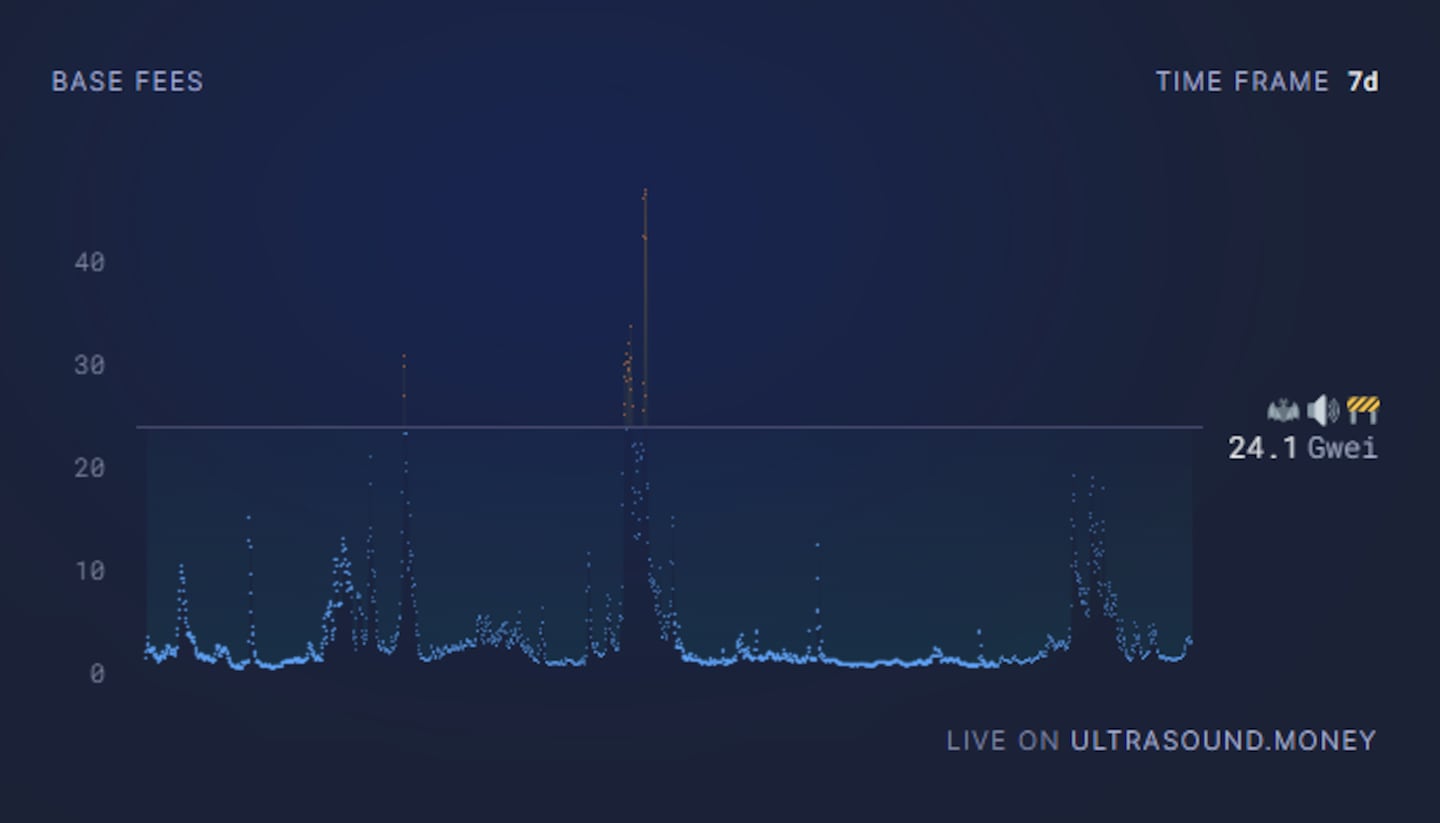

The flurry of trading activity has pushed Ethereum transaction fees to their highest level in weeks.

gwei at 17@ethervista top consumer

— 0xRamen (@0xRamenUmai) September 2, 2024

we are so back pic.twitter.com/TY2TedYNkK

The subsequent increase in fees hasn’t been enough to sustainably make Ethereum deflationary again, however.

Data of the week

Increased Ethereum activity over the past week briefly pushed fees over the 24.1 gwei threshold where the network burns — or destroys — more Ether than is creates.

Gwei is a denomination of Ether used to price transactions. A gwei is one-billionth of one Ether.

This week in DeFi governance

VOTE: Uniswap’s DAO votes on new fee tiers for its Base deployment

PROPOSAL: Aave Chan Initiative puts forward Crypto.com Earn product partnership

VOTE: Jupiter DAO decides on the future of the Jup and Juice Podcast

Post of the week

Check out LlamaFeed, the latest product from our friends at DefiLlama.

Excited to share our latest product with you: LlamaFeed

— slasher125 (@takeoffXY) September 9, 2024

It's designed to be your go-to landing page for up-to-date info across crypto.

LlamaFeed updates every minute and lets you organise and select the sections that matter most to you.

Try it out at: https://t.co/DPRL9upWeT

What we’re watching

Proposed code that makes Uniswap’s v2 version resistant to sandwich attacks has generated buzz in DeFi circles.

Sandwich attacks are a malicious form of maximal extractable value. Such attacks, similar to front-running in traditional finance, can cost users millions.

I made Uniswap V2 resistant to sandwich attacks with only 19 lines of code.

— diego (@0xfuturistic) September 3, 2024

This solution preserves atomic composability, has zero dependencies, and requires no additional infra or off-chain computation.

Here's how it works 👇 pic.twitter.com/1QxfyS3Ops

Got a tip about DeFi? Reach out at tim@dlnews.com.