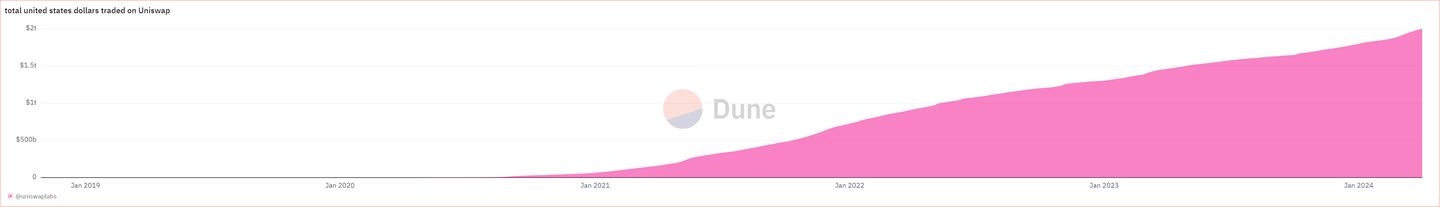

- Uniswap has achieved a milestone of $2 trillion in total volume since its launch in 2018.

- The exchange is expanding its technology with Uniswap V4, aiming for increased efficiency and reduced costs.

- Discussions around revenue include a proposed "fee switch" and a new staking initiative, alongside a 0.15% interface fee for funding development.

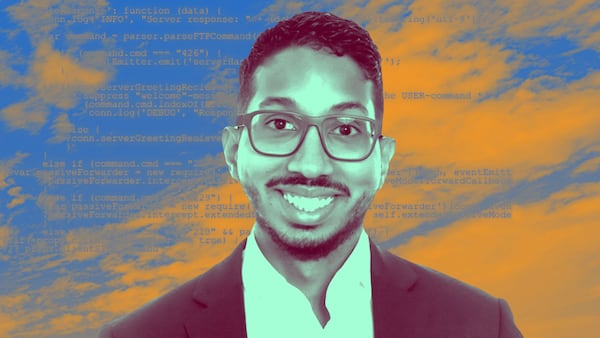

Uniswap, a decentralised exchange, reached $2 trillion in total cumulative trading volume today at around 1 pm London time, and Devin Walsh, executive director of the Uniswap Foundation said that Uniswap’s finest days are yet to come.

This optimism, according to Walsh, is in part due to the efforts of the Uniswap Foundation, which is building a community of developers and researchers who are dedicated to creating more integrations for Uniswap.

Additionally, the wider Uniswap delegate community is contributing to the platform’s growth, most recently through the initiation of a cross-chain deployment program.

DeFi pioneer

Launched in November 2018, Uniswap held one of DeFi’s first airdrops in September 2020, distributing 150 million UNI tokens, which are used primarily for governance, to traders and liquidity providers.

The practice of rewarding early users and cultivating a decentralised community continues today, as protocols still employ airdrops as a key strategy for growth.

At the time of the airdrop, Uniswap had just over $15 billion in cumulative volume and was live only on the Ethereum mainnet.

Now, Uniswap is live on nine different blockchains. It generated $2.4 billion in volume in the last 24 hours alone, accounting for 32% of total decentralised exchange volume according to data from DefiLlama.

Walsh said the platform’s immutable code and minimised governance ensure that the “rules” remain constant for developers, swappers, and liquidity providers.

Building on the principle of decentralisation, Uniswap is preparing for the rollout of Uniswap V4, which is tentatively set for the third quarter.

The upcoming version will introduce customizable “hooks” for enhanced smart contract functionalities, a Singleton contract framework to cut gas costs, and a “flash accounting” system for streamlined transactions.

Alongside features like unlimited fee tiers for how much a trader spends per trade and native ETH support, V4 is designed to refine efficiency, reduce costs, and support different trading strategies, while continuing to empower the community’s role in shaping the future of decentralised exchanges.

Uniswap fees

Depending on the liquidity pool, fees to trade on Uniswap range anywhere from 0.01% to 1%, with all of the revenue generated by the fees going to liquidity providers.

Multiple discussions have taken place in Uniswap’s governance forum about enabling a “fee switch,” which would direct a portion of these fees elsewhere.

Last month, the Uniswap Foundation, which was founded in 2022 to foster Uniswap’s growth, proposed a new initiative that would allow users to stake their UNI tokens, delegate their governance rights, and earn a portion of the protocol’s revenue. UNI token holders are expected to vote on the proposal this month.

In January, Uniswap Labs, a company that develops software that works on top of Uniswap, implemented a 0.15% interface fee to fund further development.

That fee is in addition to swap fees and is charged to users on select markets when they swap through the Uniswap interface. The fee has generated just under $5 million in revenue so far.

Ryan Celaj is a data correspondent at DL News. Got a tip? Email him at ryan@dlnews.com.