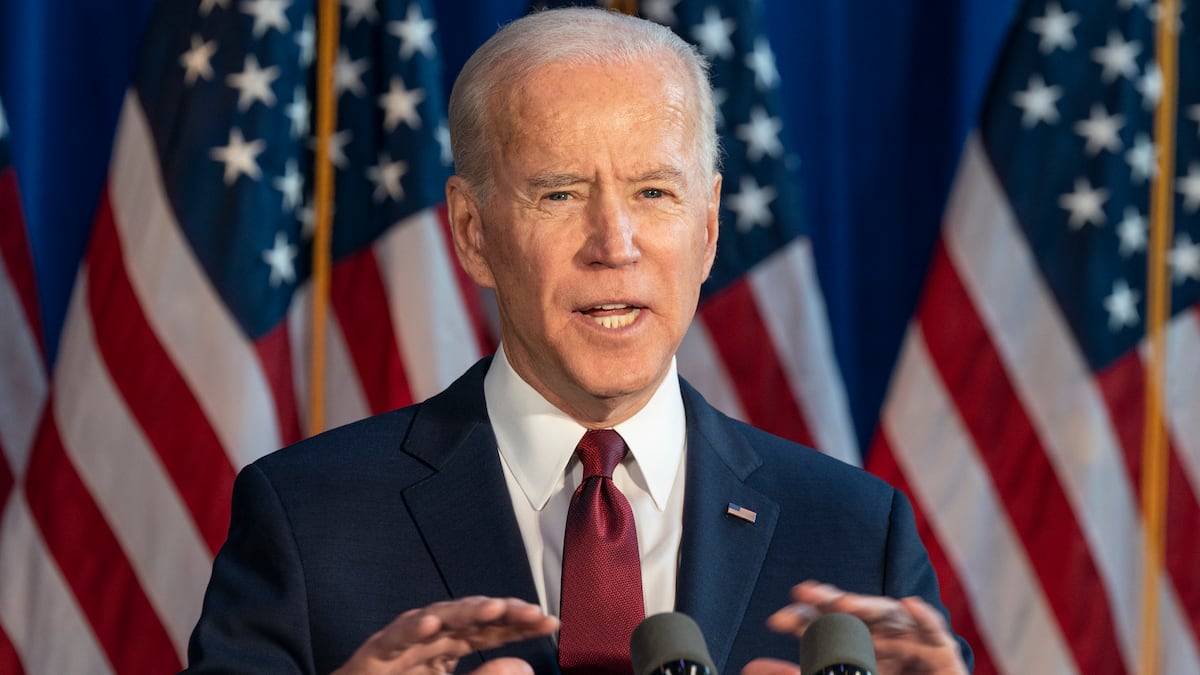

Biden’s new mining tax slammed

Crypto Twitter has lashed out against the White House’s proposal to tax crypto miners for their environmental impact.

The uproar came after the Biden administration announced plans on Tuesday to tax crypto miners " for costs they impose on others.”

The Digital Asset Mining Energy tax would see miners pay an amount equal to 30% of their electricity costs to the government. The White House expects that the tax will raise $3.5 billion in revenue over the next decade.

“The DAME tax encourages firms to start taking better account of the harms they impose on society,” the White House’s Council of Economic Advisers wrote.

However, several crypto industry representatives have publicly criticised the bill.

“So, apparently it doesn’t matter where the electricity comes from — coal, gas, 100% renewable, etc,” Brian Quintenz, Head of Policy at investment giant a16z crypto, tweeted. “If the government doesn’t like how you use the energy, you’ll be penalised. Oh, and just wait until they add a CBDC.”

Central bank digital currencies are increasingly becoming a decisive issue in the industry, as DL News has reported in the past.

Others argued that crypto mining is not as bad for the environment as is often said.

Today the CEA released a blog highlighting a new tax in the President’s budget, the Digital Asset Mining Excise Tax (“DAME Tax”), a tax equal to 30 percent of the cost of the electricity cryptominers use once fully phased in. 1/ https://t.co/944x0wVVB5

— Council of Economic Advisers Archived (@WHCEA46Archive) May 2, 2023

NOW READ: Secretive trading firms that pile into crypto are ‘first sign’ of mainstream adoption

Coinbase goes international amid US regulatory chaos

Major US exchange Coinbase launched a new service for users outside of the US Tuesday, as enforcement actions in the country continue to place pressure on the crypto industry.

The Coinbase International service will initially offer perpetual swap derivatives to institutional investors outside of the US at up to five times leverage.

Coinbase’s move follows similar actions by a slew of other US-based crypto companies — such as Gemini and Kraken — in the face of what Coinbase calls “regulation by enforcement” on the part of American regulators.

NOW READ: Congress clashes over plumbing of crypto markets

Former Coinbase CTO closes ‘$1m in 90 days’ Bitcoin bet, pays out $1.5m

Former Coinbase official Balaji Srinivasan has announced the closure of his much-publicised bet that Bitcoin would reach $1 million in 90 days.

Srinivasan tweeted and posted a short video Tuesday in which he reiterated his March statement that the US dollar and other fiat currencies are in jeopardy of hyperinflation, but conceded that his timeline of 90 days was a failure.

The terms of Srinivasan’s wager are not public, but the former Coinbase CTO paid out $1 million to two crypto organisations, as well as $500,000 to James Medlock, the Twitter user who posed the bet that the US would not enter hyperinflation.

I will take that bet.

— Balaji (@balajis) March 17, 2023

You buy 1 BTC.

I will send $1M USD.

This is ~40:1 odds as 1 BTC is worth ~$26k.

The term is 90 days.

All we need is a mutually agreed custodian who will still be there to settle this in the event of digital dollar devaluation.

If someone knows how to do this… https://t.co/hhPr522PQu pic.twitter.com/6Aav9KeJpe

Binance and Circle engage with UK government on crypto regulations

Major crypto firms Binance and Circle engaged with UK regulators in regards to His Majesty’s Treasury closing its consultation into new crypto laws.

While the proposals focused on centralised finance, it also asked for input about DeFi. Binance zeroed in not this part. While the exchange ceded the need for robust regulations with an emphasis on consumer protection, it argued that DeFi as an area of crypto that needs specific definition.

Similar argument were made by other industry players responding to the consultation, including the investment firm a16z.

Stablecoin issuer Circle encouraged the government to set “simple and transparent” rules so firms could reach compliance effectively. Both firms have come to blows with regulators in the US recently.

NOW READ: A16z warns UK on lumping DeFi into broader crypto laws

US and international authorities arrest 288 and seize crypto in dark-web bust

US and international authorities announced the execution of Operation SpecTor on Tuesday, which saw 288 arrested and $53 million in cash and crypto seized as part of a dark-web drug enforcement action.

The bust — which took place across three continents — also saw dozens of firearms and over 850 kilograms of drugs seized, alongside dark-web marketplace Monopoly Market. Operation

SpecTor began in October 2021 and included law enforcement agencies from nine countries.

More web3 news from around the web…

Ron Desantis renews attack on CBDCs as part of ‘woke politics’ — Decrypt

Digital Currency Group revenue up from fourth quarter, lags year earlier as CFO steps down — The Block