A version of this article appeared in our The Decentralised newsletter on January 21. Sign up here.

GM, Tim here.

- Ethereum stakeholders are calling for change.

- Coinbase launches DeFi-backed Bitcoin loans.

- Decentralised exchange volume is at an all-time high.

Ethereum needs change?

Ethereum stakeholders are calling for change at the blockchain’s non-profit foundation, accusing its leaders of being ineffectual and out of touch with its community.

Many complained on X that the Ethereum Foundation has a bloated budget and headcount, doesn’t support developers on the network enough, and has failed to put to use the $900 million worth of Ether tokens it controls.

“We are indeed currently in the process of large changes to EF leadership structure, which has been ongoing for close to a year,” Ethereum co-founder Vitalik Buterin said in response to the criticism.

We are indeed currently in the process of large changes to EF leadership structure, which has been ongoing for close to a year. Some of this has already been executed on and made public, and some is still in progress.

— vitalik.eth (@VitalikButerin) January 18, 2025

What we're trying to achieve is primarily the following…

Buterin listed several goals the foundation is working towards. These include upping the level of technical expertise among its leadership, improving communication, recruiting new talent, and actively supporting developers on the network.

The frustrations come as leaders at other rival blockchain projects curry favour with the pro-crypto Trump administration, leading to increased speculation on their associated crypto assets.

For example, XRP, the token issued by crypto payments firm Ripple, soared some 37% after its CEO Brad Garlinghouse met with Trump last week. Ethereum rival Solana also jumped over the weekend as Trump chose the blockchain to launch an official memecoin.

Ethereum, on the other hand, appears left out.

Despite Ethereum being the most popular blockchain for DeFi apps — and home to the Trump-backed World Liberty Financial — the Ether token has lagged behind rivals.

The non-profit Ethereum Foundation isn’t intended to control or lead Ethereum, but fund development of Ethereum-related technologies.

Many other blockchain foundations play a more active role in promoting and marketing their associated blockchains, leading some in the Ethereum community to urge the Ethereum Foundation to do more.

Coinbase’s Bitcoin loans

Coinbase users can once again borrow against their Bitcoin directly through the exchange.

The new crypto-backed loans are available to US customers, excluding New York state, and will be made available in additional jurisdictions over time.

This time, the exchange itself isn’t facilitating the loans — it’s just the middleman. The operation is instead powered by Morpho, a DeFi lending protocol with $3.7 billion in deposits.

The development marks a major integration between a consumer-facing platform like Coinbase and the often complex world of decentralised finance.

DeFi protocols, code running on decentralised blockchains like Ethereum, offer a range of financial services. But their poor user experience makes them difficult for most to navigate.

Through Coinbase, users can now access one of the most popular DeFi services — overcollateralised lending — without having to custody their crypto assets themselves or interact directly with the protocols.

Coinbase axed its previous crypto-backed loans programme in 2023.

DEX volume explodes

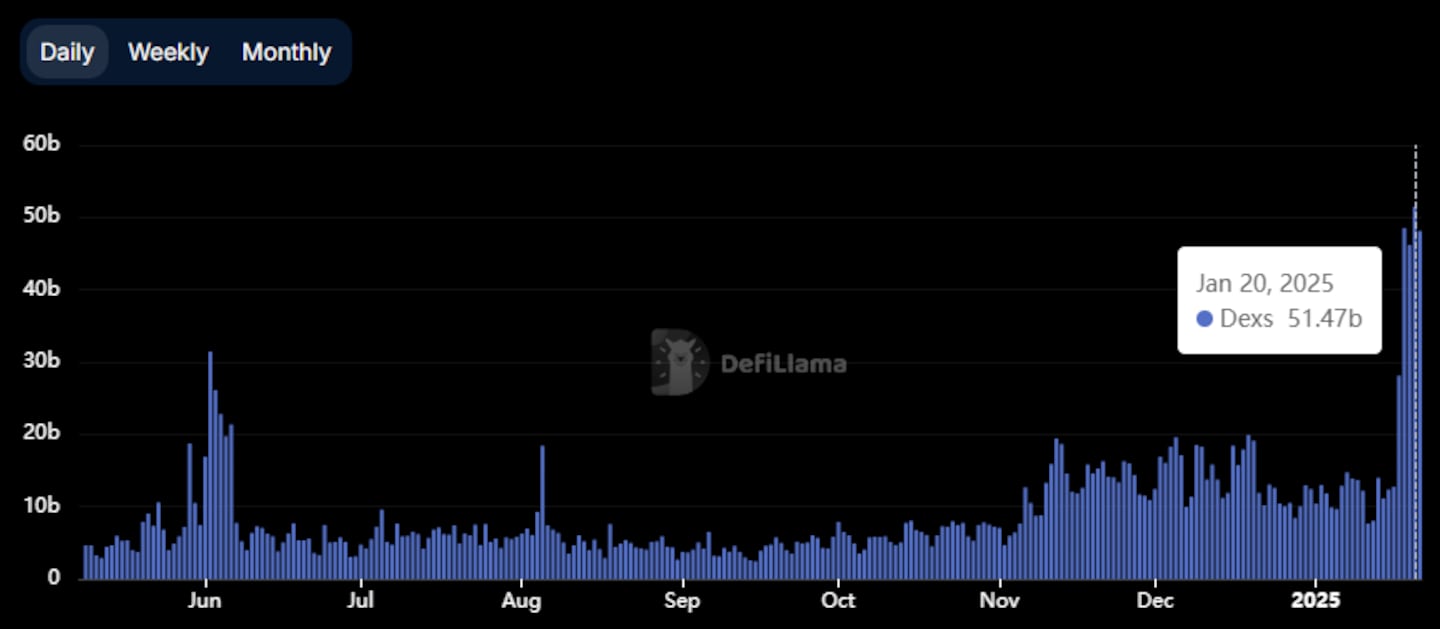

Decentralised exchange volume has soared to a new all-time high amid the Trump memecoin trading frenzy.

On January 20, DeFi traders exchange a gargantuan $51 billion worth of tokens, almost doubling the previous 24 hour record.

Of this amount, the majority of trading — $28 billion — came from Solana, where memecoins launched by the president, his wife, and other prominent figures reside.

However, the surge in trading exposes a weakness.

Although Solana has a bigger capacity for transactions than, say, Ethereum, it’s not infinite.

The huge numbers of Trump memecoin traders pushed the transaction fees on Solana to their highest level ever.During the latest two day period traders spent $53 million in tips to validators in order to get their transactions processed.

As the number of people onchain increases and Solana gets more expensive, users may look to a new generation of even bigger and faster blockchains.

This week in DeFi governance

VOTE: Arbitrum DAO supports grant misuse bounty programme

TALK: Eigen Foundation hosts first token-holder townhall meeting

VOTE: Aave to drive $300 million in user deposits with supply cap update

Post of the week

Traders of Donald Trump’s new memecoin noticed something peculiar on the price chart.

simulation. or illuminati having a laugh pic.twitter.com/awYsX4BHGt

— Auri (@Auri_0x) January 19, 2025

Got a tip about DeFi? Reach out at tim@dlnews.com.