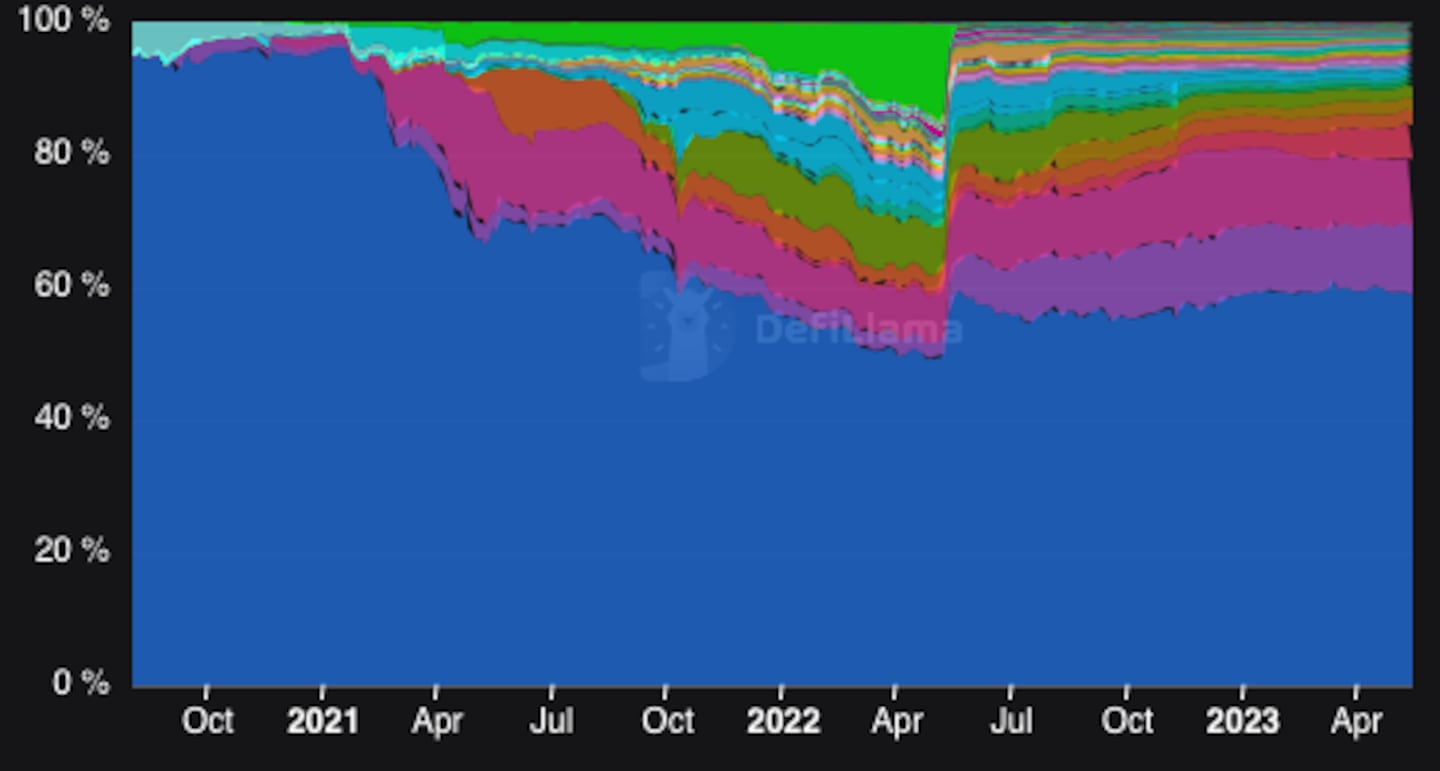

- Ethereum’s share of value locked in DeFi protocols plunged from 90% in January 2021 to 49% in April 2022

- Since the collapse of Terra and the growth of “layer 2″ protocols, it now accounts for two-thirds of value locked in DeFi

- Experts say interest in alternative blockchains has dimmed amid rising rates, regulation, and improvements to Ethereum

As crypto took off, Ethereum became a victim of its own success.

In 2021, retail investors crowded into crypto, sending the global value of all cryptocurrencies to a whopping $3 trillion.

Transactions soared on Ethereum, the first and most popular smart contract blockchain. But it became congested and expensive to use — the average trade cost about $20 in the first three months of the year; in May 2021, it almost topped $70.

Several so-called “Ethereum killers” sprouted up in response. These independent blockchains — layer 1 blockchains in industry-speak — traded Ethereum’s decentralisation for speed and affordability. For a while, their bet paid off.

NOW READ: Bitcoin fee surge spurs calls for changes to treat NFTs and meme coins as spam

Now, things have changed. As Ethereum improves, and as the crypto industry girds for a war of attrition against rising interest rates and regulators emboldened by scandals, users and investors are choosing a faster, cheaper Ethereum over a multi-blockchain future.

“I question why you would be building an L1 at all, when it’s going to be so hard to bridge customers from the Ethereum ecosystem,” an analyst at a crypto fund told DL News. The analyst asked for anonymity citing company media policy.

Consolidation of DeFi

Although the total value locked in Ethereum DeFi protocols grew more than sevenfold in 2021 to more than $110 billion, its share of the crypto market plummeted, from more than 90% to 55%. New, cheaper-to-use blockchains Terra, Binance Smart Chain, and Avalanche together accounted for one out of every five dollars locked in a DeFi protocol.

But multibillion-dollar scandals have destroyed or weakened competing blockchains in the years since. The poor design of Terra’s dollar-pegged stablecoin led to its spectacular collapse in May 2022.

FTX was a prominent backer of Solana, which has yet to fully recover from the exchange’s bankruptcy. Harmony and Waves have also suffered from accusations of mismanagement and fraud.

NOW READ: Waves founder Ivanov threatens investors burned in $530m DeFi debacle — ‘I’ll find you if I want to’

Perhaps most importantly, Ethereum is getting better.

Instead of seeking solutions elsewhere, some developers built separate Ethereum-based blockchains that batch and compress user transactions before appending them to the main Ethereum chain. These so-called “rollups,” or layer 2 blockchains, such as Arbitrum and Optimism, let users access Ethereum’s security and decentralisation at a fraction of the price.

‘There’s a huge liquidity problem, because everyone’s money is still locked up in Ethereum’

— Tze Donn Ng, Tioga Capital

Layer 2 blockchains built on top of Ethereum now handle more transactions than Ethereum itself.

There has been a “consolidation of DeFi onto Ethereum, where there’s the most liquidity,” according to Sebastien Guillemot co-founder and director at Paima Studios.

When accounting for its rollups, Ethereum’s share of TVL has grown since April 2022, to more than two-thirds of the DeFi market.

Move over

Venture funds last year poured hundreds of millions into a pair of blockchains built using Move, a programming language developed by Meta’s Facebook during its attempt to create its own cryptocurrency. As many before them had, Aptos and Sui promised faster transactions at lower cost, luring funding from venture capital giant Andreessen Horowitz, among others.

“Aptos and Sui got a lot of fanfare a while ago when they announced all the funding rounds,” Tze Donn Ng, an investment associate at Tioga Capital, told DL News.

The reason is multifaceted.

First, there’s less innovation than meets the eye.

During the bull market, tokens for newly launched protocols would surge in value the moment they began trading, Guillemot said.

In an attempt to ride this wave, developers launched clones of popular Ethereum applications on new blockchains, Guillemot said.

“But now that we’re in a bear market and that’s not really an option, there’s not so much appetite for this, which has caused everyone to consolidate on platforms that do have active users,” he said.

The result? Fewer applications on new blockchains, and fewer reasons to go to those blockchains.

“These new blockchains don’t have anything fundamentally interesting for users at the moment,” Tom Dunleavy, a former analyst at Messari, told DL News.

The ‘liquidity problem’

There’s another, deeper issue facing alternative smart contract blockchains. Network effects mean that, as Ethereum grows in popularity, it becomes an even more attractive place for new users. More users means more assets, which means deeper liquidity and an easier experience trading.

“There’s a huge liquidity problem, because everyone’s money is still locked up in Ethereum,” Ng said.

Creating a bridge between Ethereum and competing blockchains in order to allow Ethereum users to move their assets elsewhere likely won’t help the matter — not after a year in which bridges became prime targets for hackers.

NOW READ: DeFi hackers stole $3.2bn last year amid 35% surge in ‘bridge’ exploits

Said Ng: “No one likes to bridge assets. They want native assets.”

And as Ethereum transaction fees surge amid a craze in meme coin trading, rollups stand to benefit — enjoying tight integration with Ethereum but offering a cheaper and faster user experience.

But why did alternative blockchains succeed in the first place?

That success “was very much a function of the times,” the anonymous analyst told DL News.

“It’s probably the same reason why loss-making businesses were able to SPAC for the last two-and-a-half years,” he said, referring to companies that went public via a merger with special-purpose acquisition companies.

“All these terrible businesses that will never make a profit, they were able to SPAC because we were in such a low interest rate environment, money was flowing everywhere.”