GM, Tim here.

Welcome back to The Decentralised, the DeFi newsletter that doesn’t skimp on all the extras.

Here’s what you’ll find in this week’s edition:

- DYdX loses $9 million in YFI trading attack

- Solana DEX trading hits weekly all-time high — again

- One of the biggest names in DeFi rebrands

Plus our hand-picked data of the week, top three governance updates, post of the week, and a peek at a developing story we’re keeping an eye on.

No, YFI didn’t rug investors

On November 17, Yearn Finance’s YFI token nosedived over 40% for seemingly no reason.

Upon observing the striking red candle on the YFI chart, numerous traders quickly attributed the unexpected price fluctuation to a potential rug pull by insiders at Yearn Finance.

Rest assured, the dramatic drop in YFI’s value wasn’t a case of its largest holders offloading their tokens. Instead, it appears to have been the result of a calculated attack aimed at depleting the insurance pool of the trading protocol dYdX.

An attacker exploited the low margin requirements on dYdX’s YFI trading market to pump and dump the token, extracting around $9 million from the protocol.

DYdX has since increased margin requirements on less liquid markets. According to dYdX founder Antonio Juliano, the protocol is reporting the incident to the FBI.

The dYdX exploit is similar to Avraham Eisenberg’s attack on Solana trading protocol Mango Markets last year, and highlights how low liquidity on markets for long-tail assets like YFI is still a serious problem for DeFi protocols.

Solana traders have no chill

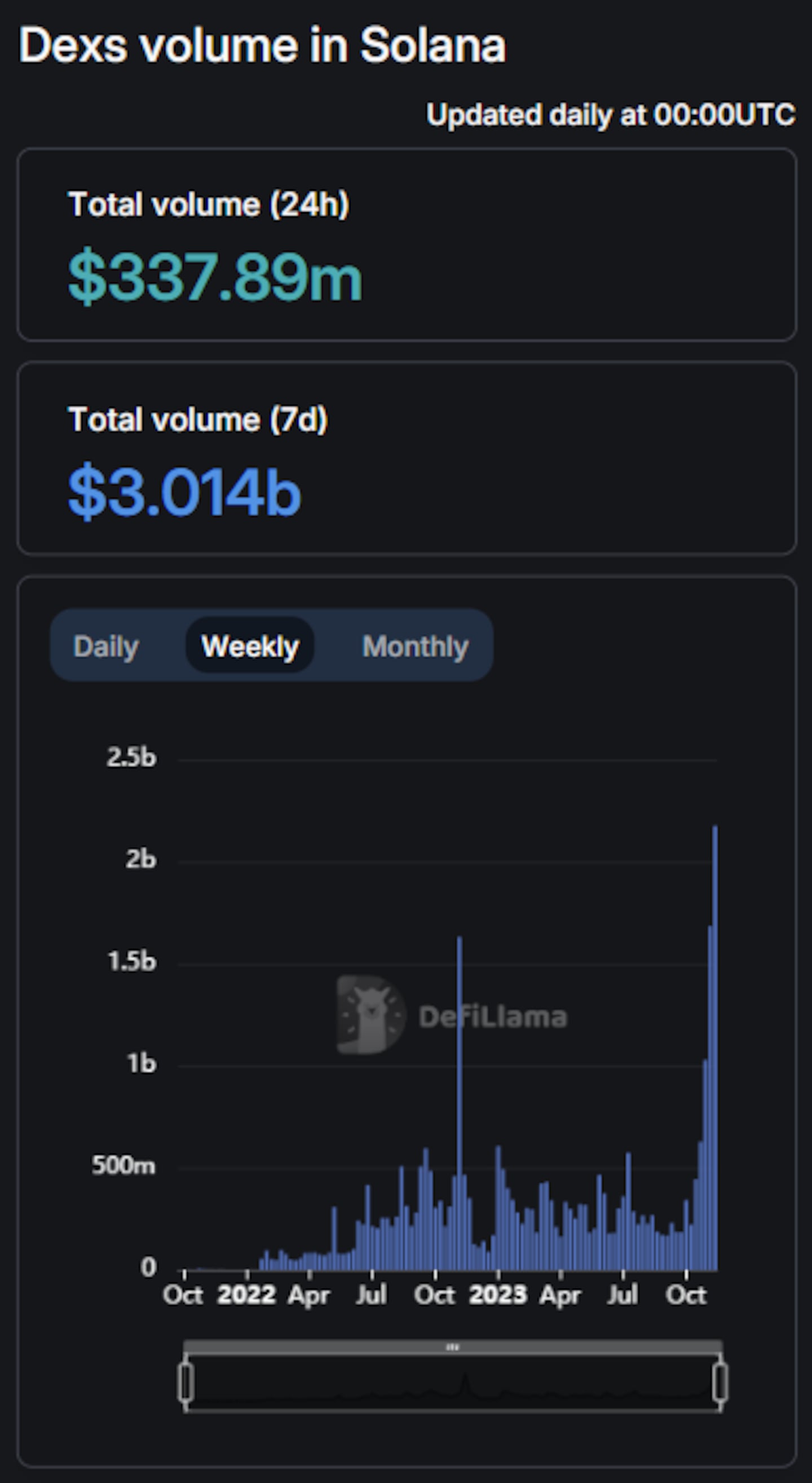

Traders on Solana have continued to push up the blockchain’s decentralised exchange volume, surpassing last week’s high of $1.7 billion to hit a new high just under $2.2 billion.

By now it has become pretty clear why Solana’s DEX volume is soaring — the promise of token airdrops from the blockchain’s top exchange aggregator, Jupiter.

As we discussed in a previous newsletter, Jupiter plans to launch a governance token and airdrop 10% to Solana users who stayed active during the crypto winter.

But that’s just the first of four planned airdrops. Jupiter has signalled that those who use the aggregator now will likely qualify for airdrop number two.

A recent X post from Jupiter team member Ming Ng detailing how users who previously traded more will get more tokens has only added fuel to the fire. Now Solana users are trading tokens back and forth to maximise the potential rewards from Jupiter’s subsequent airdrops.

It’s likely Solana’s onchain trading volume will stay high for this reason, at least until airdrop farmers find a more lucrative use for their time.

Avara?! What’s that?

Aave Companies, the London-based firm behind DeFi lender Aave and social protocol Lens, has rebranded.

It’s now called Avara, which, in CEO Stani Kulechov’s native Finnish, colloquially means “seeing more than you see.”

With the company expanding beyond Aave with Lens, and more recently GHO, the rebrand certainly make sense. The name also feels more mature, and perhaps wouldn’t look out of place side by side with Silicon Valley’s top start-ups.

But if Avara wants to continue growing, it would do well to put its house in order first.

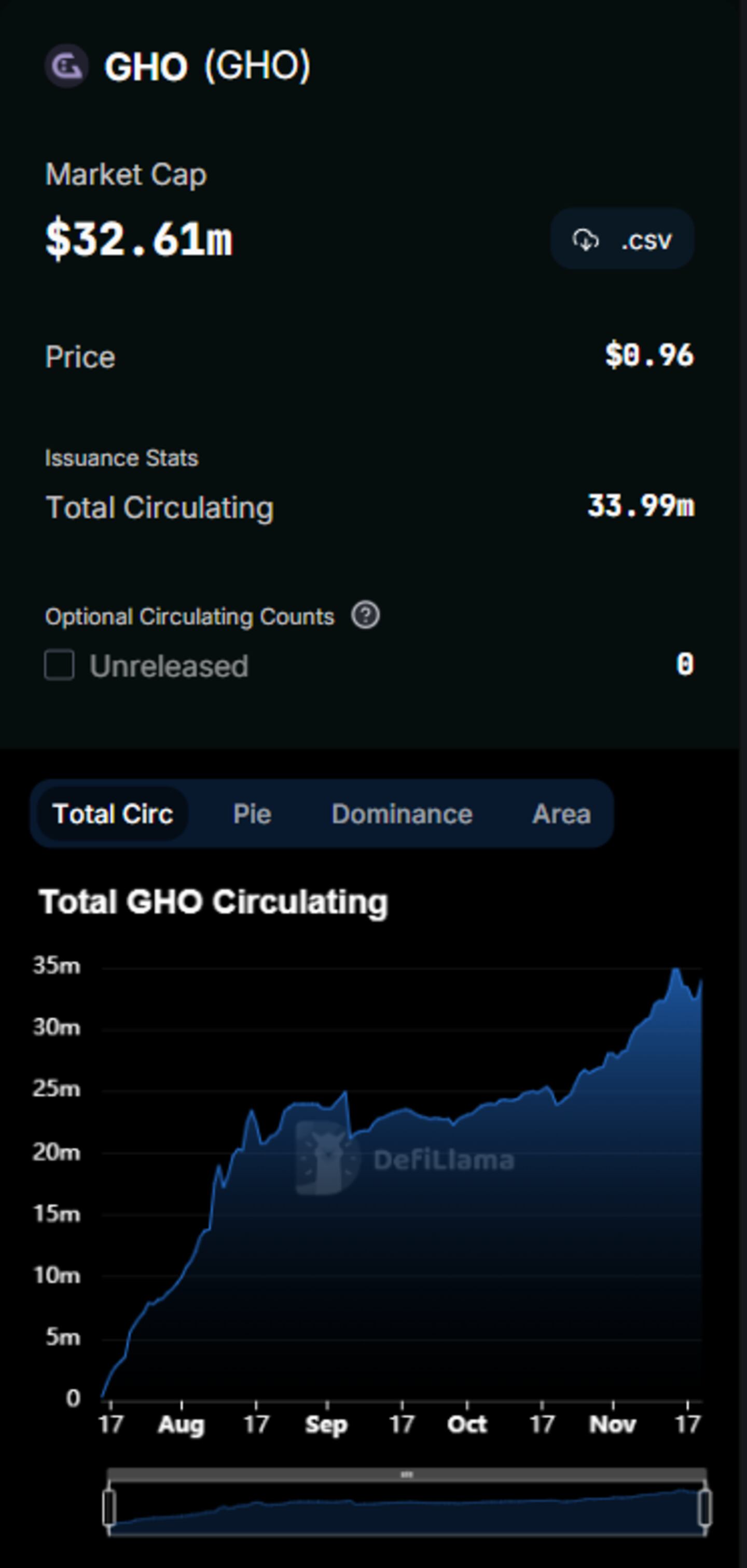

As DL News’ Aleks Gilbert recently reported, Avara’s GHO stablecoin is still trading below its targeted dollar peg.

Kuchelov told DL News that after initially focusing on growing GHO’s market share, the time has come to prioritise its peg.

In a renewed bid to shore up GHO, it has put DeFi veteran Brice Berdah temporarily in charge of a new committee to raise the stablecoin’s price to $0.985 by November 30.

GHO currently trades at around $0.957.

Data of the week

Avara’s GHO stablecoin has registered steady growth since its summer launch, despite trading below its targeted dollar peg.

This week in DeFi governance

VOTE: Aave to convert Ether held in DAO treasury to Rocket Pool staked Ether

PROPOSAL: Wintermute wants dYdX Chain to activate trading

VOTE: Arbitrum DAO considers backfunding successful STIP proposals

Post of the week

NFT artist Degen Alfie contrasts The Leveraged, one of his artworks commemorating the 2021 bull run, with his latest, The Survival Game.

gud mornin ct ⚡️

— ɅLFIE (@Degen_Alfie) November 16, 2023

how its started vs how its going pic.twitter.com/EJZjJEEU9O

What we’re watching

Don't get @cobie's take on arbitrum staking proposal and comparison to ape staking.

— Bullshi (@hovanvonhovan) November 18, 2023

As a holder of $arb you would get 15% apr worst case scenario in expense of 1.5% inflation or so

Pretty good trade if you ask me

Arbitrum DAO quietly voted yes on a poll to introduce ARB token staking at the start of the month. Two weeks on, and debate around the controversial decision is still raging on social media.

Have you joined our Telegram channel yet? Check out our News Feed for the latest breaking stories, community polls, and of course — the memes. https://t.me/dlnewsinfo

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out to him with tips at tim@dlnews.com.