- Revolut has launched a new feature to let users buy and deposit crypto into their MetaMask wallets.

- The move comes as Wall Street giants and fintech firms increasingly move into crypto.

Revolut is diving deeper into crypto with a new MetaMask collaboration in a bid to give more people access to digital assets.

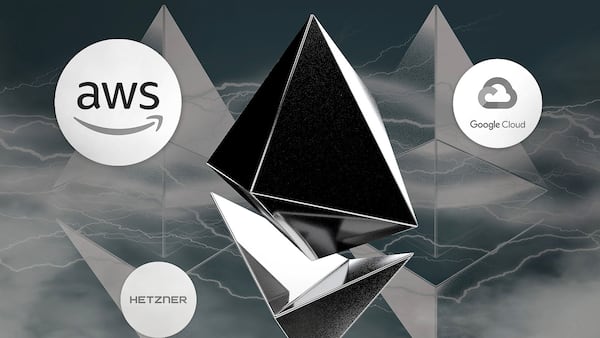

The challenger bank unveiled a new feature on Wednesday. Dubbed Revolut Ramp, it will allow its 40 million users to buy cryptocurrencies and deposit them directly into MetaMask wallets.

“This partnership is really about giving our users what they want — more control over their crypto, in a straightforward way,” Lorenzo Santos, senior product manager at Consensys, the company behind MetaMask, said in a statement on Wednesday.

“It also plays a crucial role in fostering broader crypto adoption, opening up the world of crypto to more people.”

MetaMask has 30 million users, the company said.

The Revolut Ramp launch comes as traditional finance firms increasingly muscle into crypto.

Most noticeably, Wall Street giants like BlackRock and Fidelity have powered the spot Bitcoin exchange-traded fund boom this year, a key driver behind why the cryptocurrency reached a new all-time high on Tuesday.

However, smaller firms, like stock-trading app Robinhood, payments behemoth PayPal, and mobile payments firm Venmo have also grown their cryptocurrency services lately.

Revolut’s crypto push

Revolut Ramp is available through MetaMask’s app, browser extension, and its Portfolio platform. Users can purchase up to 20 cryptocurrencies, including Ethereum, USDC, and Shiba Inu.

Ramp is designed to skip additional verification for existing Revolut customers by leveraging know-your-customer processes already conducted via the Revolut app.

New customers can still use Revolut Ramp, but must undergo the same KYC process that the neobank’s users are subjected to.

A “small fee” for purchasing crypto with Revolut Ramp on MetaMask will apply, which will be displayed before the purchase, typical of all services through the wallet app.

MetaMask and Revolut did not specify their exact fee structure and did not return requests for comment.

Revolut first launched its crypto trading business across Europe in 2017. During the 2021 bull run, it contributed to its £39.8 million profit.

Crypto contributed “up to 30%, 35% in revenues in 2021,” CEO Nikolay Storonsky told Bloomberg TV in 2022.

Those tailwinds ceased in 2022 when Revolut went back in the red, revealing a £25.4 million loss in its 2022 financial results, published in December.

Despite the headwinds and scandals like the collapse of FTX, Storonsky told fDi Intelligence in 2022 that Revolut was “doubling down on crypto products.”

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.