Stablecoins are arguably one of the most important crypto inventions.

They let investors easily switch between volatile crypto assets — like Bitcoin and Ethereum — and more stable fiat currencies like the US dollar or the Euro, without having to reenter the traditional financial system.

Competition in the burgeoning stablecoin sector is hot. Currently, Tether’s dollar-pegged USDT is the top crypto stablecoin with a market capitalisation of over $88 billion.

Big Tech has also stepped up to the plate with payments giant PayPal launching its own crypto stablecoin PYUSD in August.

But the lack of a regulatory framework for cryptocurrencies in the US could spell uncertainty for dollar-denominated stablecoins.

In the name of global adoption, the crypto community is rooting for any genuine attempt at a trustworthy digital dollar – especially given all the fear, uncertainty and doubt weighing on existing stablecoin issuers over the past year.

So what’s the good and bad with blockchain bucks these days? DefiLlama has its own section dedicated to exploring the crypto market’s numerous stablecoins.

Tracking stablecoins on DefiLlama

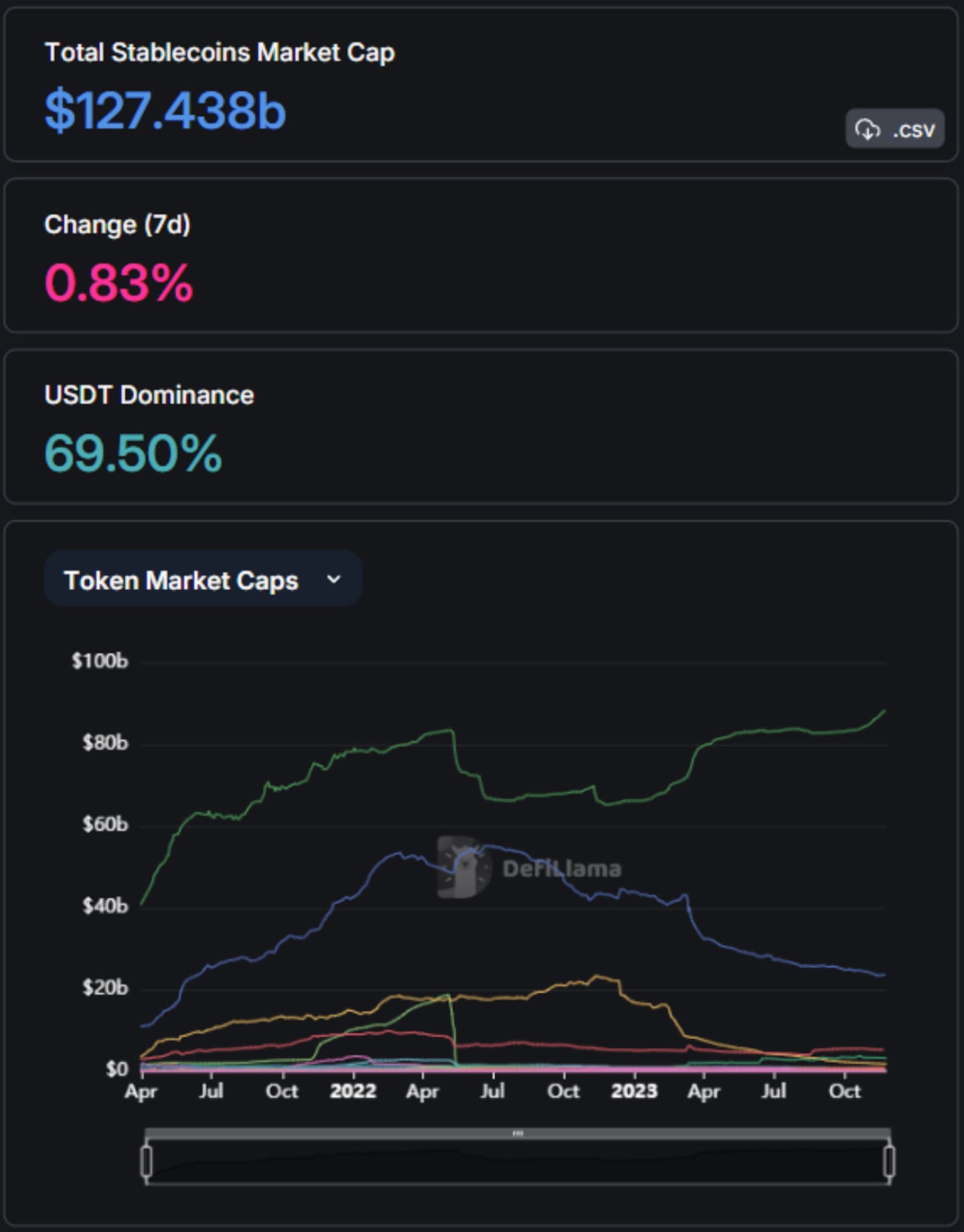

Over 120 stablecoin projects across more than 80 blockchains make up the $127 billion stablecoin market cap reported in DefiLlama’s “Stables” overview dashboard.

Users can filter tokens by a number of metrics such as market cap, type of backing, what asset they’re pegged to, what chains they’re available on, and more.

Upon entering the Stables overview dashboard, users are greeted with a historical timeline of the market capitalisation of all major stablecoins.

Here we can see Tether’s USDT (green) has stayed strong over the past year, while its biggest rival, Circle’s USDC, has fallen in popularity.

The chart also has the option to take a step back and look at the stablecoin market in its entirety. Let’s select “Total Market Cap” from the dropdown box in the upper left corner and see what it shows.

The red line shows the market capitalisation of all stablecoins. Since the collapse of the Terra blockchain’s algorithmic stablecoin in May 2022, dollars, in the form of stablecoins, have fled the market.

But, as the data shows, that trend could be changing.

In addition to stablecoin market cap data, the chart also has the option to show data for stablecoin dominance, US dollar inflows and token inflows.

Below the main chart is a table where you can find everything you need to know about a specific stablecoin. Like other DefiLlama dashboards, clicking the top of each column will filter stablecoins by that specific metric. Users can also click into each asset to get a more comprehensive view of its performance.

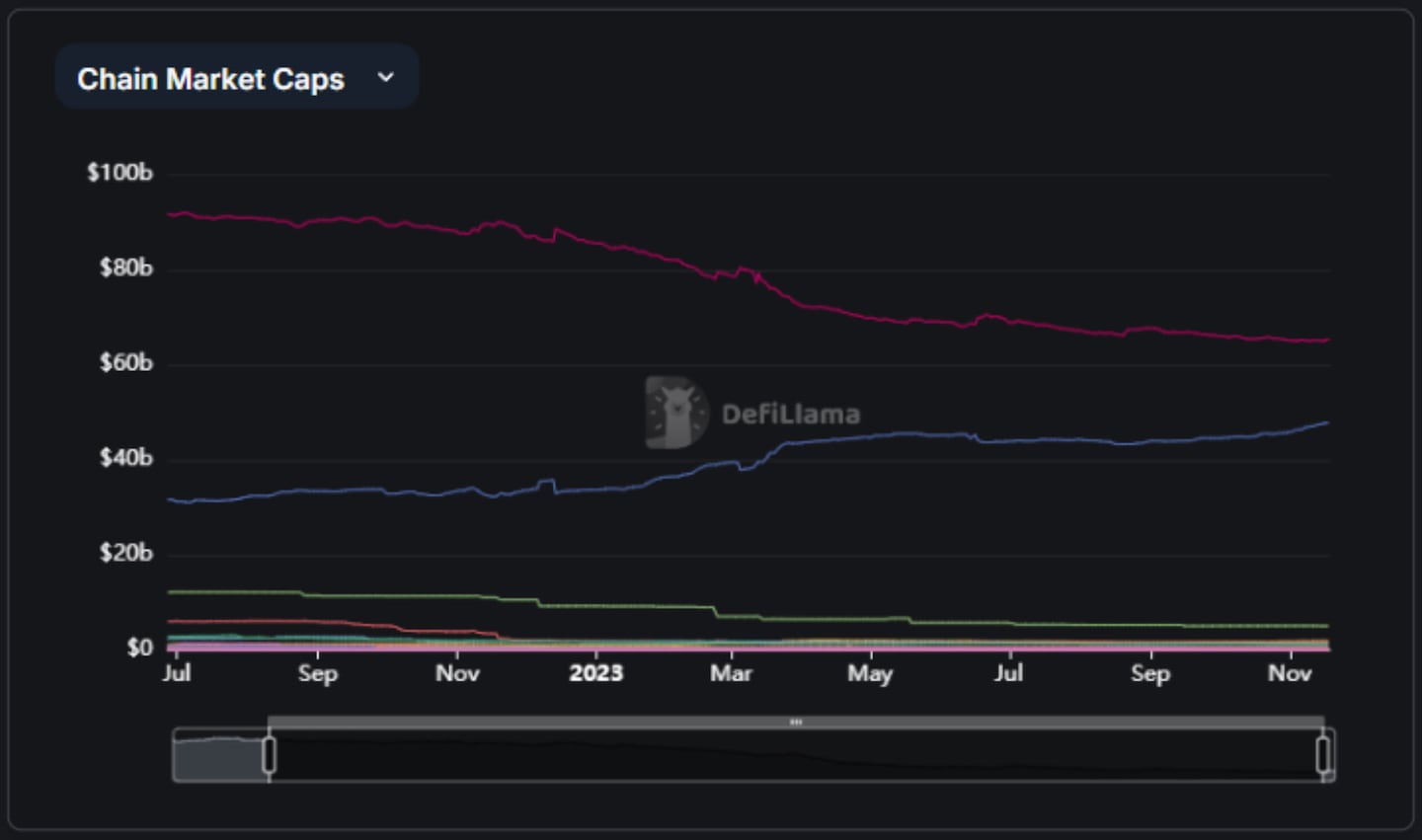

DefiLlama also provides a Stablecoin Chains dashboard. Here users can find out the dominant stablecoin on a specific blockchain, how many stablecoins are in circulation there, and several other helpful metrics.

A chart at the top of the page shows the number of stablecoins on all major blockchains.

Here we can see that Ethereum (red) holds the most stablecoins. But another gladiator has been battling in the arena as of late — TRON (blue).

After increasing its share of the stablecoin market throughout 2023, TRON is now the closest it has ever been to overtaking Ethereum as the dominant blockchain for stablecoins.

In all the examples we’ve looked at, dollar-backed stablecoins issued by a centralised custodian — like USDT and USDC — are the most dominant. But, as we’ll see, there are other ways to issue stablecoins.

Back that asset up

Stablecoins are designed to maintain a one-to-one peg with the asset they represent, and there are different ways of achieving this. The three main types of stablecoin are as follows:

- Asset-backed — These stablecoins are backed one-to-one with the asset they represent. For fiat stablecoins, these backing assets can include cash or cash equivalents like government-issued bonds.

Other stablecoins, such as those pegged to the price of gold, hold physical gold or gold derivatives in reserve. Circle’s USDC, or Tether’s XAUT are examples of dollar-backed and gold-backed stablecoins.

- Overcollateralised — These stablecoins are issued in exchange for locking up other assets, such as cryptocurrencies. Because the assets backing overcollateralised stablecoins are usually volatile, they must, in aggregate, always maintain a much higher market value than the stablecoin’s total market capitalisation.

MakerDAO’s DAI is an example of an overcollateralised stablecoin, and is issued in exchange for locking up Ether, wrapped Bitcoin, other asset-backed stablecoins, and more recently, real-world assets like bonds.

- Algorithmic — These stablecoins rely on an algorithm to help them maintain their peg. More specifically, most attempted algorithmic stablecoins are undercollateralized, meaning that the entity that issues them does not hold enough assets in reserve to allow holders to redeem them for their face value. Such a system can have disastrous consequences. The Terra USD algorithmic stablecoin collapsed in May last year, resulting in an estimated $40 billion of investor losses.

Without regulations ordering asset-backed stablecoin issuers to prove they hold adequate reserves, they usually try to reassure investors that their stablecoins are backed one-to-one in other ways. For example, USDC issuer Circle produces monthly attestations conducted by auditing firm Deloitte to prove that it holds more assets than liabilities and could redeem all USDC in circulation for US dollars, if it needed to.

Others, like USDT issuer Tether, are less transparent. Tether’s reserves have been a source of speculation since USDT launched in 2014. Although the company details the assets it holds to back USDT and produces quarterly attestations on its holdings, it has never undergone a formal audit. Because of this, Tether’s solvency has been a constant point of issue among crypto investors.

The reserves of overcollateralised offerings like MakerDAO’s DAI or Frax’s FRAX are verifiable 24/7 simply by looking at the onchain smart contracts which govern them.

Next steps

- Check out the independent stablecoin ratings agency Bluechip.

- Learn about the next generation of stablecoins, such as Ethena Labs’ USDe.