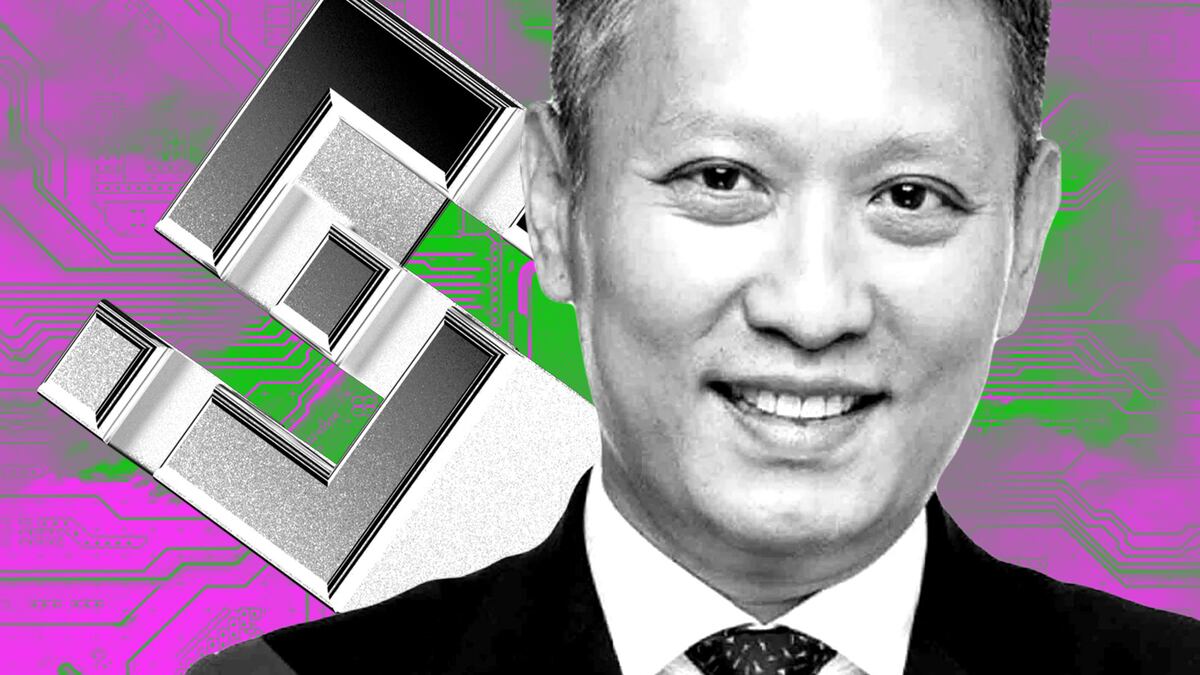

Binance’s new CEO, Richard Teng, seems to have pulled the firm back from the brink of destruction — only for it to plunge back into chaos in at least one jurisdiction.

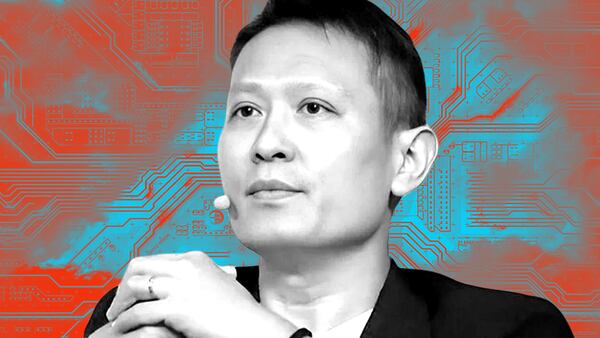

In November, the world’s largest exchange lost its mercurial co-founder, Changpeng Zhao, who stepped down as CEO and pled guilty to money-laundering charges in the US.

Binance was fined $4.3 billion, and the week of Zhao’s exit, the exchange saw outflows in the billions.

Some wondered if the exchange would survive.

Teng, the company’s former head of regional markets and a businessman with decades of regulatory experience, came in with the gargantuan task of reshaping the company.

Read on for a timeline of Binance’s first 100 days under Teng.

November 8:

- As Binance’s head of regional markets, Teng opens Binance Blockchain Week in Istanbul.

November 20:

- DL News reports the departure of Binance institutional client manager Marcus Bacchi-Howard, one of several executives who left the firm in 2023.

November 21:

- Zhao agrees to step down as CEO and plead guilty to violating the Bank Secrecy Act. He names Teng as his successor.

- As part of the settlement, Binance agrees to pay $4.3 billion in fines and restitution and report to a court-appointed compliance monitor for five years.

- Teng announces his new position as CEO in an X post. He states his goals are to restore investor confidence, work with regulators, and drive web3 growth and adoption.

November 23:

- Binance’s share of Ethereum trading volume drops from 40% on November 20 before Zhao’s exit, to 30%, according to Kaiko data.

November 26:

- Teng posts selfies with soccer legend Ronaldo and MMA star Khabib Nurmagomedov at an F1 event in Abu Dhabi.

November 29:

- In an interview with Bloomberg TV, Teng says he will not shuffle Binance’s top leadership. ”Our core leadership remains intact,” Teng says.

December 5

- Teng debuts as CEO at a Financial Times Live conference in London, where he answers for Zhao and Binance’s recent legal woes in the US. “There were mistakes made,” Teng tells the Financial Times Live audience, “and we acknowledge those mistakes. We have now moved past them; we resolved those issues with US agencies.”

- When asked about Binance Global’s elusive headquarters, Teng says the company will announce its location “in due course.”

December 6:

- In an X post critical of bankers, Teng references an academic paper that says traditional fiat currencies are responsible for trillions of dollars worth of illegal activities annually, compared to roughly $20 billion in annual crypto crime. ”Loved this analysis,” writes Teng.

December 7:

- A federal judge rules Zhao may not leave the US until his sentencing. In the ruling, Judge Richard A. Jones cites the lack of an extradition treaty with the United Arab Emirates, where Zhao resides, and the vast overseas wealth that could render his bail package “inadequate to ensure his return” to the US. Zhao’s lawyers follow up with a second request to allow him to travel.

- Binance subsidiary BV Investment Management withdraws an application for a licence in Abu Dhabi. According to Reuters, the licence would have allowed the firm to operate a collective investment fund in the city. ”When assessing our global licensing needs, we decided this application was not necessary,” a spokesperson for the firm says.

December 12:

- In a joint filing, Binance, Binance.US, and Zhao request a hearing to argue for a dismissal of charges before the SEC trial.

December 18:

- In a press release, the Commodity Futures Trading Commission confirms court approval for fines levied against Binance and Zhao. The court orders Zhao to personally pay $150 million to the agency, while Binance must pay $2.7 billion.

December 19:

- Teng appears at Taipei Blockchain Week, where he lauds Binance’s growing user base. ”We now have over 167 million users globally, and that number continues to grow at a rapid pace,” Teng says.

December 28:

- India’s Financial Intelligence Unit announces the issuance of “Show Cause” notices to nine digital asset service providers, including Binance. The announcement petitions the Indian Ministry of Electronics and Information Technology to block the providers’ URL addresses.

December 29:

- Judge Jones denies Zhao’s second request for travel permission and orders the court to seal his reasons for travel.

January 2:

- Speaking to EL PAíS, Teng says the future is bright for Binance and cites “very robust inflows” in December as positive for the company’s outlook. From December 31, 2023 to January 2, 2024, Binance sees $130 million in investor funds enter the exchange.

January 4:

- Binance announces the addition of its “Monitoring Tag” to several assets, including Monero and Zcash. The company tags tokens it deems to have higher risk and volatility with the user warnings. The tokens see liquidity dry up following the announcement.

January 7:

- A Kaiko report says Binance removed the TrueUSD stablecoin from its Launchpool staking program. The removal occurs after the company axes its zero-fee structure for the asset. According to Kaiko, the changes likely caused the stablecoin to experience a price depeg.

January 18:

- Bloomberg reports Binance’s inflows have grown to $4.6 billion since Zhao’s exit. Company inflows continue to increase in February, according to DefiLlama data.

January 22:

- In a public hearing, Binance argues for Judge Amy Berman Jackson to toss out the SEC’s lawsuit against the firm. The SEC previously called Binance’s appeal “absurd.” A January 25 status report shows several outstanding points of contention following the hearing.

January 29:

- Teng thanks Ethereum co-founder Vitalik Buterin for a visit to one of Binance’s offices in an X post.

January 31:

- Families of victims of the October 7 Gaza attack sue Binance over its alleged role in facilitating terrorist financing to Hamas.

- Binance confirms to DL News that the company will sell its majority stake in the South Korean crypto exchange Gopax. Binance purchased the stake in February 2023 — its first activity in South Korea since 2021. A sale may signal Binance’s second exit from the South Korean market.

February 1:

- In an X post, Teng announces that Binance froze $4.2 million worth of XRP tokens stolen in an exploit. Teng urges hack victims to reach out to Binance in the case of further hacks.

After finding out early on about the exploit that occurred at @Ripple, we’re happy to say that the #Binance team has managed to freeze $4.2 Million worth of $XRP stolen by the exploiter.

— Richard Teng (@_RichardTeng) February 1, 2024

We appreciate both the communities efforts in flagging it to exchanges - as always @zachxbt…

February 2:

- Binance announces the re-hiring of Steve Christie as deputy chief compliance officer. Christie formerly served the company as senior vice president of compliance. He was among several executives who left the firm in mid-2023.

I'm pleased to welcome Steve Christie back to #Binance as Deputy Chief Compliance Officer!

— Richard Teng (@_RichardTeng) February 2, 2024

Having the best compliance talent is vital - it ensures better user protection and builds the foundations for stronger sustainable growth.https://t.co/NBdYcjIahH

February 5:

- Binance co-founder Yi He announces a $5 million bounty on any employees trading on insider information after Ronin’s RON token rose 17% and fell 25% shortly after being listed on Binance. Teng does not reference the post or acknowledge plans to root out corruption.

February 6:

- Binance announces it will delist the market’s largest privacy coin, Monero, and several other coins. ”When a coin or token no longer meets these standards or the industry landscape changes, we conduct a more in-depth review and potentially delist it,” writes the Binance team. Monero’s token plummets 32% on the news.

February 12:

- Judge Jones reschedules Zhao’s sentencing date to April 30. The court had initially set the sentencing for February 23.

February 21:

- Binance defends itself in a blog post amid calls for a ban on the exchange in Nigeria by a presidential spokesman who says currency speculation and market manipulation on Binance are out of control. A source tells DL News of an ongoing investigation into an alleged “coordinated effort to manipulate the country’s forex market via crypto trading on Binance.”

February 23:

- Judge Jones approves Binance’s $4.3 billion payment in its November plea deal, Reuters reports. Afterwards, Binance makes a statement saying the company accepts responsibility and is making “significant progress” towards reaching compliance.

February 26:

- DL News reports Nigerian authorities detain two Binance executives, an American and a British citizen, as part of its probe into the exchange for alleged currency manipulation.

February 29:

- In a report, Binance says it has recovered $4.4 billion of mishandled funds for customers, resolving hundreds of thousands of cases in which users deposited cryptocurrency but were not credited in 2022 and 2023.

Tyler Pearson is a junior markets correspondent at DL News. He is based out of Alberta, Canada. Got a tip? Reach out to him at ty@dlnews.com.