- Bitcoin breached $91,000 on Tuesday.

- The cryptocurrency was as low as $84,000 on Sunday.

- Global uncertainty and regulatory clarity in the US may be driving the price increase.

Bitcoin’s sharp rise past $91,000 on Tuesday has jolted markets, signaling what some analysts believe could be the beginning of a broader crypto resurgence.

Behind the breakout lies a potent mix of political turbulence, shifting monetary sentiment and growing institutional appetite for Bitcoin, according to analysts.

“There is high short-term uncertainty, but we see solid foundations for a further rally in Bitcoin’s price over the coming months — $90,000 was just the first domino; in our view, Bitcoin is likely to move well beyond previous highs later this year,” Zach Pandl, head of research at Grayscale, told DL News.

“Bitcoin’s price performance since April 2 validates its role as a portfolio diversifier.”

As global investors hedge against fiat instability and uncertain central bank policy, Bitcoin’s reputation as “digital gold” is gaining traction as it continues to move from what was once considered a fringe investment to a serious financial contender in the flight to safety.

“Bitcoin’s recent climb to over $90,000 is a direct response to escalating global trade tensions as well as renewed institutional interest in digital assets,” David Siemer, co-founder and CEO of Wave Digital Assets, told DL News.

Those tensions include Trump’s escalating trade war with China as well as a recent one-sided spat with Jerome Powell, the chair of the Federal Reserve whom Trump called “a major loser” on Monday.

Speculation that Trump may attempt to interfere with the Fed and remove Powell has spooked investors, Pat Zhang, head of research at WOO X crypto exchange, told DL News.

The dollar dropped sharply on Monday before recovering Tuesday. But it was still down almost 9% this year according to data from TradingView.

While regularly throwing diplomatic haymakers, President Donald Trump has pushed for crypto-specific legislation, providing investors further confidence in the top cryptocurrency and digital assets in general.

The pro-crypto Paul Atkins was sworn in as the new head of the SEC on Monday, one of several pro-crypto members of the administration. A rule that disallowed banks from holding crypto was rescinded by the SEC even prior to Atkins’ arrival. Trump has said he wants the US to be the crypto capital of the world.

Bitcoin, worth a total $1.8 trillion, was up 5% over the past 24 hours, trading at $91,675 as of this writing. The Nasdaq, which Bitcoin often follows, was up 3% over the day and the S&P 500 was up 2.63%.

Bitcoin spent most of March bouncing between $79,000 and $88,000 before dipping as low as $74,800 on April 7.

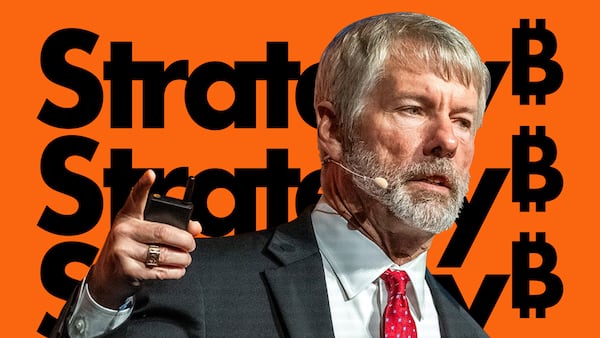

According to Dune Analytics, Bitcoin ETFs hold more than $93 billion in their coffers, and account for more than 5.5% of Bitcoin’s total supply. Another large player is Michael Saylor’s Strategy, which holds 538,200 Bitcoin worth $49 billion.

Andrew Flanagan is a markets correspondent for DL News. Have a tip? Reach out to aflanagan@dlnews.com.